Canoo Spent Twice As Much on CEO’s Jet As It Brought in Last Year

- Canoo spent $1.7 million on CEO Tony Aquila’s private jet bills, twice its 2023 revenue.

- The EV maker lost $302 million last year, struggling in an industry facing slowing demand.

- Investors often scrutinize private jet spending, especially when a company is in trouble.

Electric vehicle company Canoo spent twice as much on its CEO’s private jet trips as it brought in last year.

Canoo, which has never turned a profit as a public company, paid $1.7 million in “aircraft reimbursements” for its CEO last year. The company had $886,000 in revenue, according to its full-year earnings report, filed on Monday.

The CEO was “reimbursed for business expenses, including air travel expenses for either, at our option, first-class airfare or the business use of his private jet,” the company said in the filing.

CEO Tony Aquila, who is also Canoo’s chairman, owns about 14% of the company, per Monday’s filing. Canoo spent $1.3 million on Aquila’s air travel in 2022.

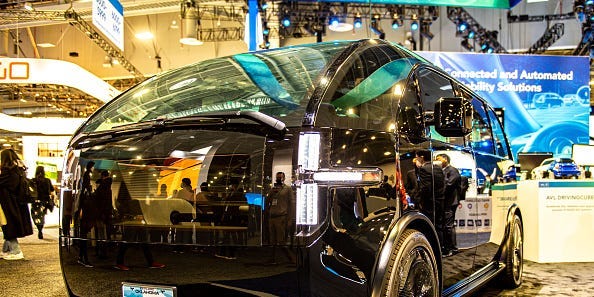

Canoo, which launched in 2017, manufactures passenger vehicles, delivery vans for Walmart, and crew transport vehicles for NASA. The Texas-based company reported an annual loss of $302 million as it bleeds cash while trying to ramp up production.

Canoo doesn’t have enough cash to get through the next year without raising more money, and a wave of executives quit in 2022. After it reported earnings on Monday, its stock fell 26% on Tuesday.

The company did not respond to Business Insider’s request for comment sent outside regular business hours.

Investors often scrutinize companies’ spending on private jets, particularly when the business is troubled.

When office provider WeWork tried to go public in 2019, it came under fire for, among other governance issues, buying a luxury jet that was used almost exclusively by Adam Neumann and his family. After Neumann’s exit, the company sold the plane.

Former General Electric CEO Jack Immelt had a second plane follow his private jet for 16 years of overseas trips, which GE’s board only learned about in 2017.