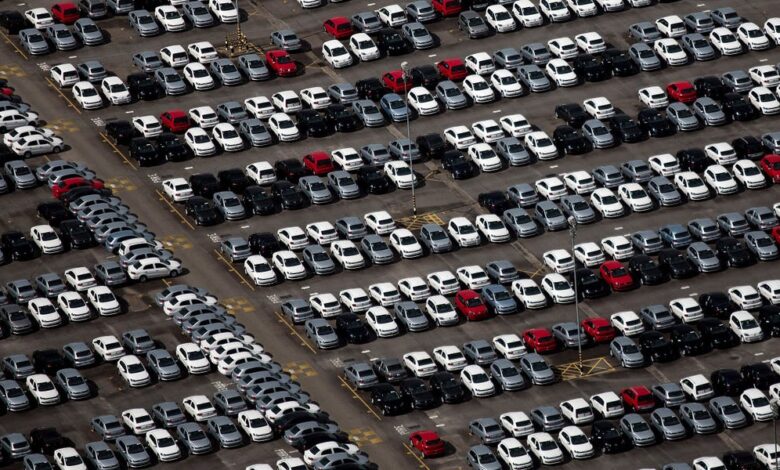

Car Prices Are Finally Falling. 2 Reasons Why People Still Aren’t Buying.

- Both new and used car prices are normalizing from pandemic peaks. But sales have flatlined, Bank of America says.

- Consumers are still priced out of the market due to rising interest and insurance costs.

- Some have turned to electric vehicles and hybrids, with EV loan originations rising steeply.

Car prices are falling back down to earth, in a steady decline from 2021 peaks. But that’s no relief to consumer wallets, as car affordability remains low.

According to Bank of America, overall car sales have flatlined, despite post-pandemic recoveries ing both pricing and supply.

During the COVID years, new car inventory slumped heavily, as stimulus-rich buyers looked for alternatives to public transport. Deepening the crunch were supply chain issues, which dented the availability of needed components for manufacturing.

Used car purchases picked up as an alternative; as a result, used vehicle prices swung past those of new models.

But supply has since bottomed out, and inventory is showing slow signs of recovery. Despite this, buyers are not coming back as expected, with both new and used vehicle loan originations tumbling through 2023. That suggests that sales have plateaued.

“One reason for this flattening, we believe, is that the total ‘all in’ cost of ownership — including elevated interest rates, insurance, and maintenance costs — has become more expensive even as auto prices are declining,” the bank wrote on Friday.

For instance, the note points out that car loan interest rates have jumped steeply since mid-2022. Citing a nearly four percentage point gain since then, it means that consumers would have to pay close to $100 more a month for the average new vehicle loan as of March.

And insurance costs are similarly trending upwards, having risen 22.6% year-over-year in April. According to the bank, premiums are likely to remain higher.

“In fact, Americans feel that vehicle maintenance and loans were two of the top five most difficult household expenses to afford as of April 2024,” the report said, citing a recent Bank of America proprietary Market Landscape Insights study. “Nearly 45% of respondents reported difficulty affording these items, while the share was even starker for Gen Z at nearly 60%.”

Owners are instead holding onto their vehicles longer, potentially as they wait out for affordability to improve. The average US vehicle age jumped 40% between 2001 and 2023, reaching 12.5 years.

For some consumers, this market has prompted interest in electric vehicles and hybrids, marked by a sharp rise in EV loan originations. But this trend has limits, Bank of America said, as buyers will need to face limited access to charging stations.