‘Car Wars’ begin as US, EU and Turkey impose duties on Chinese electric vehicles – Chemicals and the Economy

Autos are the world’s largest manufacturing industry. They employ tens of millions of people directly on the production line and in their vast number of related supply chains.

Today, 3 major changes are underway in the industry and as a result, many manufacturers, particularly in the West, are struggling to keep up:

- Electric Vehicles (EVs) are replacing gasoline and diesel cars (ICEs, Internal Combustion Engines)

- The end of zero interest rates means many consumers can no longer afford to buy premium cars

- China is aiming to become the big winner via its focus on selling cheap but well-made EVs

China’s car industry has only developed in recent years. Back in 2000, there were just 16m cars on China’s roads. But today, it is the world’s largest market and a major exporter.

So the scene is set to create Winners and Losers on a major scale, as noted here in April:

“The starting pistol is close to being fired for the start of a trade war. The immediate cause is China’s plan to ramp up Electric Vehicles (EV) exports. Its EVs are cheap and would support the achievement of Net Zero targets:

- Western automakers have forgotten how to make $25k cars, and are only now rushing to catch up

- The problem is that it will take them years, rather than months, to reorganise

- Whilst they are retooling, China’s imports might wipe out the US/European auto industries

- And these are responsible for 8.3% of all European jobs and support 4.5% of all US jobs”

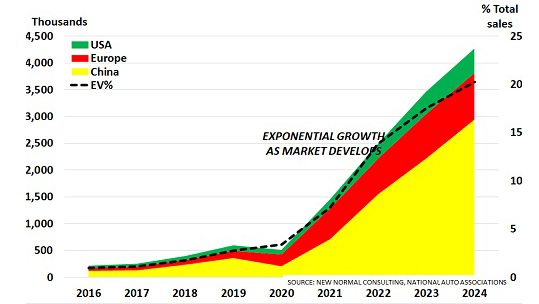

EV SALES ARE SEEING EXPONENTIAL GROWTH

‘TOP 3’ ELECTRIC VEHICLE SALES, Q1 2016 – APRIL 2024

VOLUME (MILLIONS) v % TOTAL PASSENGER SALES

The key issue is that EVs have now begun to see exponential growth, as the chart shows. These were less than 1% of sales in the 3 major markets of China, the US and Europe in 2016, and only 3.4% in 2020. But today, they are 18%:

- In April, EVs had a 42% market share in China, the world’s largest auto market

- In Europe and the US they had a 20% and 9% share respectively

WESTERN COMPANIES HAVE FORGOTTEN HOW TO MAKE $25K CARS

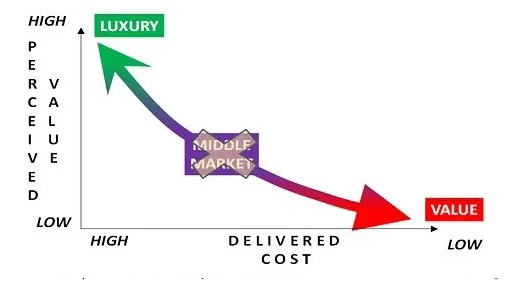

Markets are polarising as the Boomer SuperCycle ends

– The highly profitable Middle Market is disappearing

A second problem for Western automakers is that they have virtually stopped making Value cars to sell at the $25k/€25k price point.

The average US car currently costs $48k, compared to $30k at the start of the stimulus programmes. And today, the average loan payment for a new car has reached a record $735/month with a 68 month term. As the New York Federal Reserve warns:

“Auto Loan Delinquency Revs Up as Car Prices Stress Budgets”

The issue is simply that consumers can no longer afford to buy ‘Middle Market’ cars. Instead, the market is polarising again.

The ‘Middle Market’ is disappearing and consumers are back to choosing between low-cost Value and Luxury models, as the chart shows.

WESTERN GOVERNMENTS ARE IMPOSING TARIFF BARRIERS TO PROTECT THEIR INDUSTRY

Western governments can’t afford to see their auto markets taken over by Chinese exports. So they are being forced to try and ‘buy time’ for their own automakers to catch up:

- The US has announced a 100% tariff on Chinese-made EVs to protect the domestic industry

- Tariffs will also rise on lithium batteries and other key areas of the supply chain

- The EU has also announced tariffs – with a top rate of 38.1%

- Turkey has announced a 40% tariff on EV and ICE imports

And in a major reversal of the past 20 years, Western carmakers are forming alliances with top Chinese companies to learn how to reduce costs and time to market:

- VW is partnering with Xpeng to reduce costs, and reduce development time from 50 months to 36 months

- Renault is partnering with a Chinese engineering company to produce EVs in Europe for sale at €20k

- Stellantis has taken a €1.5bn stake in China’s Leapmotor to sell cars in Europe for €20k from September

THE ‘CAR WARS’ WILL SEE WINNERS AND LOSERS EMERGE

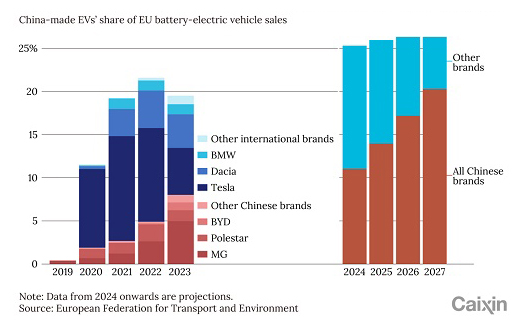

Nearly One-Fifth of EVs Sold in EU Last Year Came from China

Europe is in the line of fire today, as the chart confirms:

- The EV market is growing fast, and nearly 20% of last year’s European sales were Chinese exports

- This included major volumes from Tesla, Renault (Dacia) and BMW’s Chinese plants

And no doubt China will follow through on its threat to increase tariffs of Western exports of Luxury 2.5l cars. This creates a double threat for the German car industry as Caixin notes:

“German companies produced nearly 95% of the cars Europe exported to China”.

There are no easy answers to the Car Wars issue. Europe and the US are unlikely to hand over the EV market to China. And so today’s Car Wars may well lead to further tariffs on both sides.

The next few years could be a bumpy ride for anyone involved in the auto industry and its supply chains.