Celestica: Generative AI Boom Is Real – Prospects Remain Bright (NYSE:CLS)

wigglestick/iStock via Getty Images

We previously covered Celestica Inc. (NYSE:CLS) in March 2024, discussing how it had been a beneficiary of the ongoing generative AI boom, with the increased demand for ML/ AI-related products likely to trigger its accelerated top/ bottom line growth through FY2026.

Despite the inherently lower-margin manufacturing business model, we believed that there remained great long-term growth opportunities, attributed to the ramp-up in Thailand/ Malaysia operations, with us initiating a Buy rating then.

Since then, CLS has further rallied by +27.5% well outperforming the wider market at +1.6%. Even so, we are maintaining our Buy rating here, thanks to the promising demand commentaries from Nvidia’s (NVDA) and Super Micro Computer’s (SMCI) recent earnings calls.

This is further aided by the CLS management’s promising FQ2’24 guidance, growing return on invested capital, and finally, the guidance of growth acceleration on a YoY basis in the coming quarters.

CLS’ Investment Thesis Remains Robust, Thanks To NVDA’s Impressive Earning Results

For now, CLS has reported a double beat FQ1’24 earnings call, with overall revenues of $2.2B (+7.8% QoQ/ +20.2% YoY), overall operating margins of 6.2% (+0.2 points QoQ/ +1 YoY/ +3.5 from FY2019 levels of 2.7%), and adj EPS of $0.86 (+22.8% QoQ/ +82.9% YoY).

Much of the tailwinds are attributed to the robust performance observed in the Connectivity & Cloud Solutions segment, with accelerating revenues of $1.44B (+8.2% QoQ/ +38.4% YoY) and expanding operating margins of 7% (+0.3 points QoQ/ +1.2 YoY/ +3.4 from FY2019 levels of 2.6%).

This is not a surprising development indeed, thanks to the “continued demand strength for AI/ML compute and networking products from hyperscaler customers.”

This is especially since NVDA recently reported an impressive Q1’24 revenues of $26.04B (+17.8% QoQ/ +262.1% YoY) while guiding Q2’24 revenues of $28B (+7.5% QoQ/ +107.4% YoY), smashing consensus estimates of $22.03B and $26.8B, respectively.

The same has been reported by SMCI, a company offering complete server solutions, with Q1’24 revenues of $3.85B (+5.1% QoQ/ +200% YoY) while guiding Q2’24 revenues of $5.3B (+37.6% QoQ/ +143.1% YoY).

These developments continue to suggest the robust demand for generative AI infrastructures, thanks to their inherent leadership in data center chips and complete server solution markets.

At the same time, NVDA already guides new AI chips every year instead of the previous cadence of every two years, implying accelerated replacement rhythm, naturally triggering further tailwinds for Electronics Manufacturing Services [EMS] and Original Design Manufacturer [ODM] companies, such as CLS.

This is especially since CLS is involved across the broader technology market, with the generative AI boom already triggering notable expansion in the sales of cloud-related electronic components.

As a result, it is a given that CLS has raised its FY2024 guidance to revenues of $9.1B (+14.3% YoY), operating margins of 6.1% (+0.5 points YoY), adj EPS of $3.30 (+35.8% YoY), and adj Free Cash Flow of $250M (+28.9% YoY).

This is up drastically from the previous numbers of $8.5B (+6.7% YoY), 5.75% (+0.15 points YoY), $2.70 (+11.1% YoY), and $200M (+3.1% YoY) offered in the FQ4’23 earnings call, further implying its ability to capitalize on the generative AI infrastructure boom.

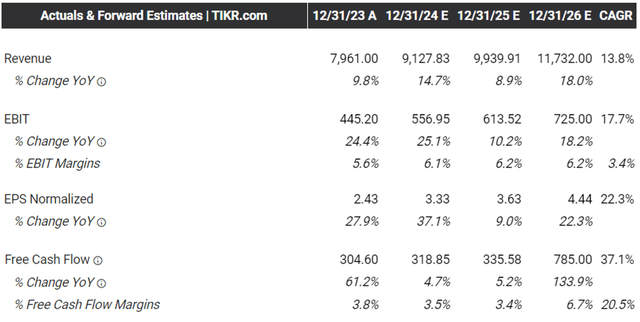

The Consensus Forward Estimates

As a result, it is unsurprising that the consensus forward estimates have been raised again, with CLS expected to generate an accelerated top/ bottom line growth at a CAGR of +11.6%/ +22.2% through FY2025. This is compared to the previous estimates of +9%/ +15.4%, respectively.

Most importantly, despite the higher capex related to the manufacturing ramp up in its expanded facilities in Thailand and Malaysia through 2025, the management continues to report robust Free Cash Flow generation of $65.2M (-22.1% QoQ/ +608.6% YoY) and expanding margins of 2.9% (-1 points QoQ/ +2.4 YoY/ -2.2 from FY2019 levels of 5.1%) in the latest quarter.

This suggests CLS’ ability to sustainably fund its growing operations while maintaining a healthy balance sheet with net-debt-to-EBITDA ratio of 0.72x in FQ1’24, compared to 0.76x in FQ4’23, 1.12x in FQ1’23, and 0.68x in FQ4’19.

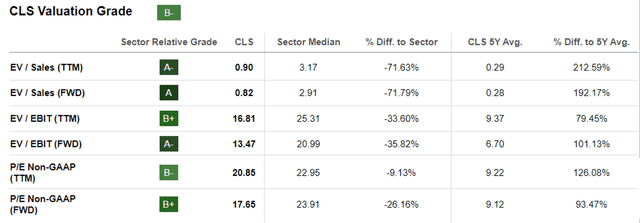

CLS Valuations

As a result, we can understand why the market has awarded CLS with the premium FWD P/E valuations of 17.65x, higher than the previous article at 16.08x and its 1Y mean of 10.86x.

It is undeniable that CLS may be relatively expensive compared to its EMS and ODM competitors, including Flex Ltd. (FLEX) at FWD P/E valuations of 13.87x, Hon Hai Precision Industry Co., Ltd. (OTCPK:HNHPF) [2317:TW] at 10.65x, and Quanta Computer (OTC:QUCCF) at 21.80x.

Then again, the premium appears to be justified for now, due to CLS’ accelerated profitable growth prospects over the next few years compared to FLEX at +2.7%/ +14.2% and HNHPF at +10.5%/ +15.1%, while nearing QUCCF at +34.6%/ +24.1%, respectively.

So, Is CLS Stock A Buy, Sell, or Hold?

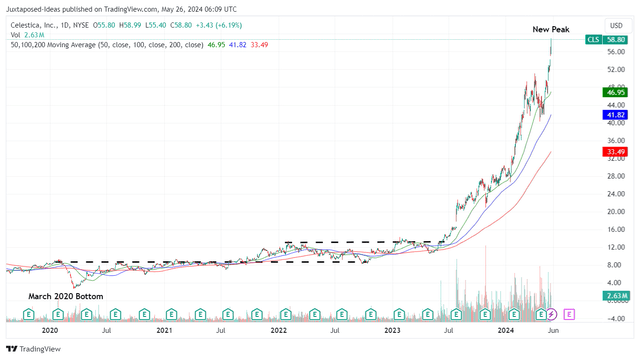

CLS 5Y Stock Price

For now, CLS has charted a new peak beyond the early 2024 heights, with it also running away from its 50/ 100/ 200 day moving averages.

Despite so, based on the annualized FQ1’24 adj EPS of $3.44 (+22.8% QoQ/ +82.9% YoY) and the raised FWD P/E valuations of 17.65x, the stock appears to be trading near to our fair value estimates of $60.70.

There remains an excellent upside potential of +21.2% to our long-term price target of $71.30 as well, as discussed in our previous article.

As a result, we are maintaining our Buy rating for the CLS stock, though with no specific recommended entry point since it depends on the individual investor’s dollar cost average and risk appetite.

With the stock currently buoyed by the highly promising NVDA and SMCI guidance thus far, we believe that interested investors may want to wait for a moderate retracement to its previous trading ranges of between $41s and $49s for an improved margin of safety.