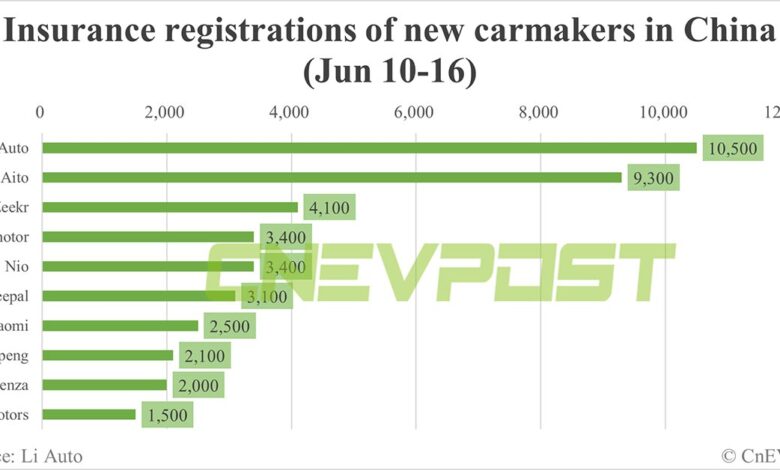

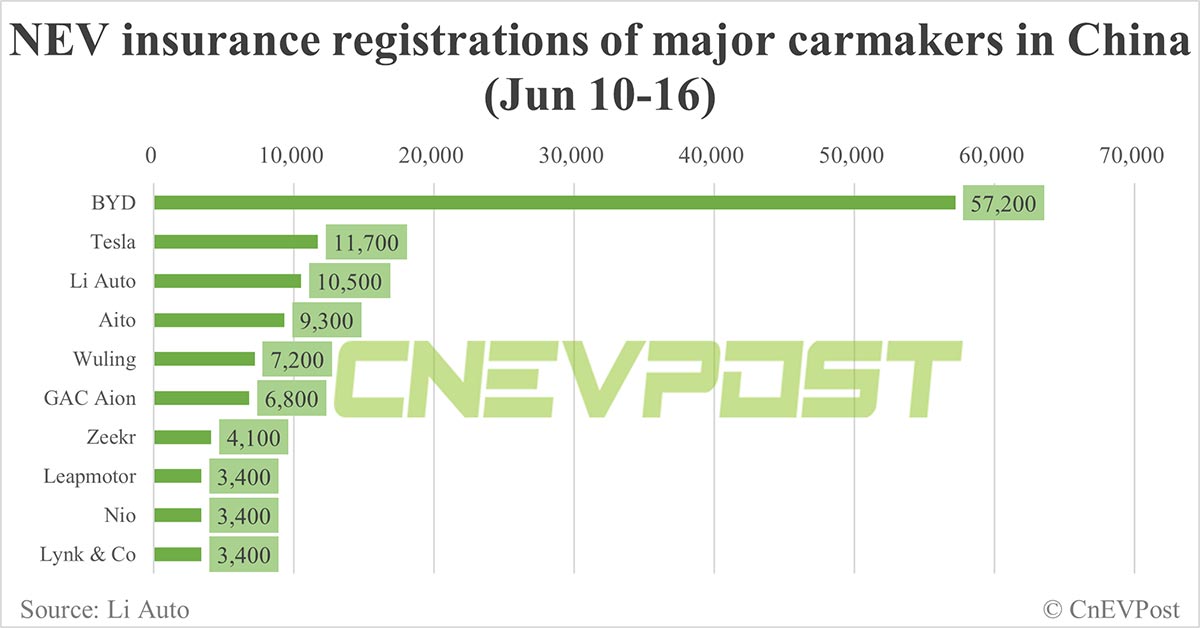

China EV insurance registrations for week ending Jun 16: Nio 3,400, Tesla 11,700, BYD 57,200, Xiaomi 2,500

This article is being updated, please refresh later for more content.

Xpeng had 2,100 insurance registrations last week, Zeekr 4,100 and Leapmotor 3,400.

Major electric vehicle (EV) makers saw mixed insurance registrations in China last week after seeing weak deliveries earlier in the month.

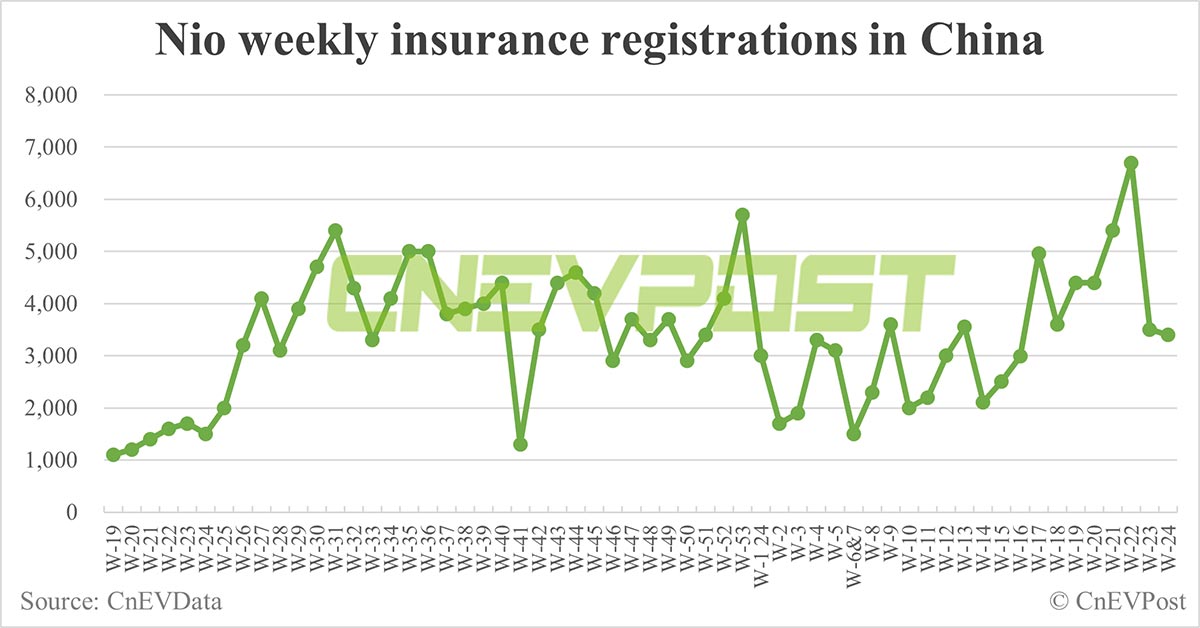

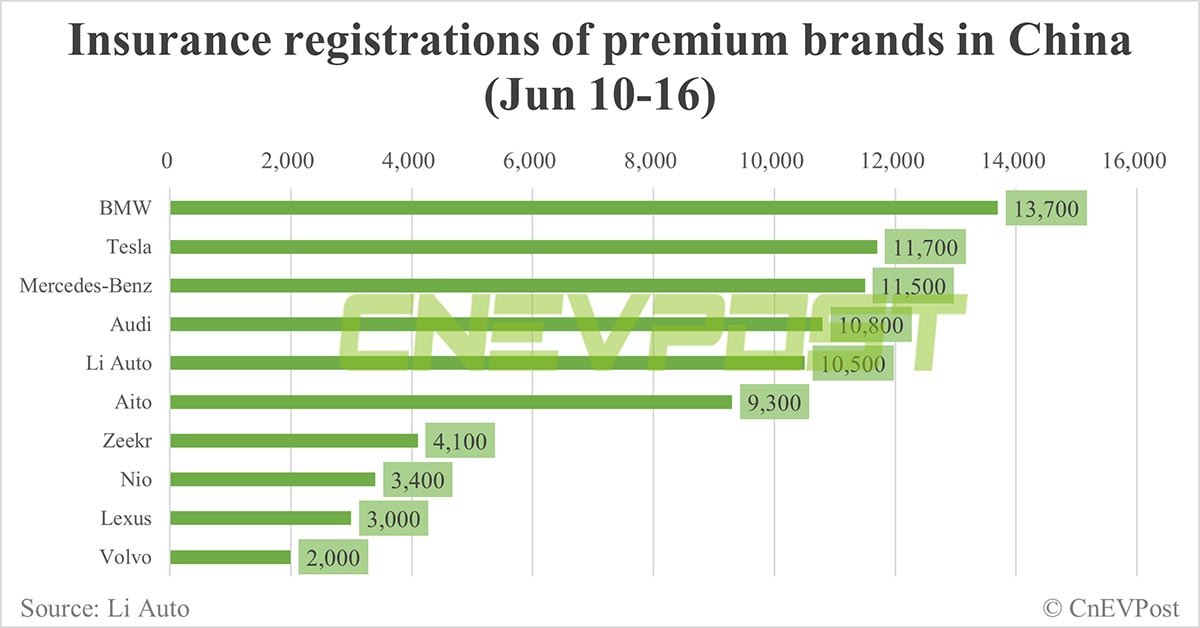

For the week of June 10-16, insurance registrations for Nio (NYSE: NIO) vehicles in China were 3,400, down 2.86 percent from 3,500 in the previous week, according to data shared today by Li Auto (NASDAQ: LI).

Li Auto stopped sharing weekly insurance registration numbers earlier this year, after doing so for about 1 year. In early May, it restarted sharing those numbers.

Nio delivered 20,544 vehicles in May, surpassing July 2023’s record high of 20,462 vehicles, according to data it released on June 1.

That was up 233.78 percent from 6,155 vehicles in the same period last year and up 31.52 percent from 15,620 in April.

Nio guided for second-quarter deliveries of between 54,000 and 56,000 units when it announced its first-quarter earnings on June 6, implying that June deliveries are expected to be between 17,836 and 19,836 units.

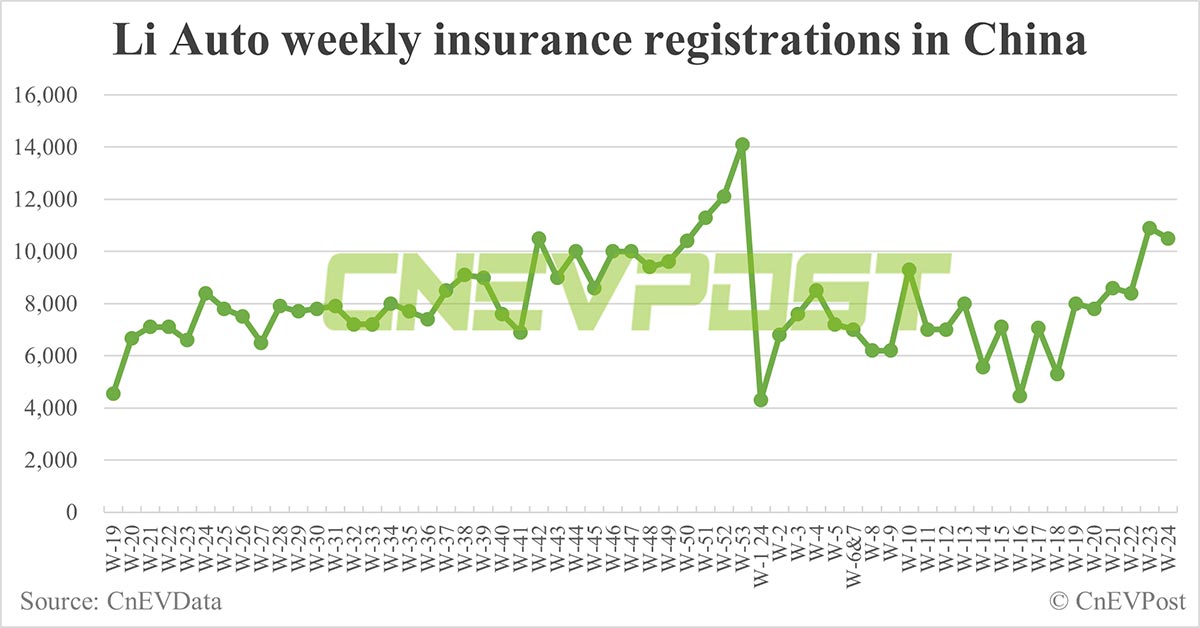

Li Auto had 10,500 insurance registrations last week, down 3.67 percent from 10,900 the week before.

The company delivered 35,020 vehicles in May, up 35.8 percent from April and up 23.85 percent year-on-year.

May’s deliveries were Li Auto’s highest for a single month so far in the year, though still well below last December’s record 50,353 vehicles.

Li Auto guided on May 20 that vehicle deliveries for the second quarter would be between 105,000 and 110,000 units, implying year-on-year growth of 21.3 percent to 27.1 percent.

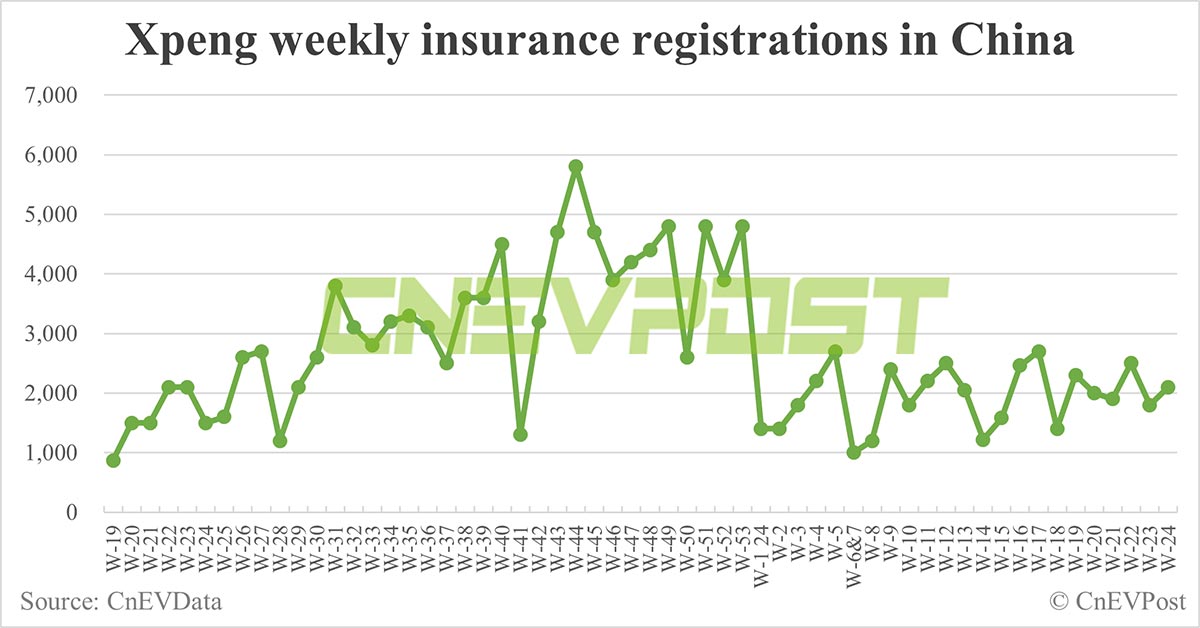

Xpeng (NYSE: XPEV) had 2,100 insurance registrations last week, up 16.67 percent from 1,800 the week before.

The company delivered 10,146 vehicles in May, surpassing the 10,000 mark for the first time this year.

Xpeng on May 21 guided second-quarter vehicle deliveries in the range of 29,000 to 32,000 units, representing year-on-year growth of about 25.0 percent to 37.9 percent.

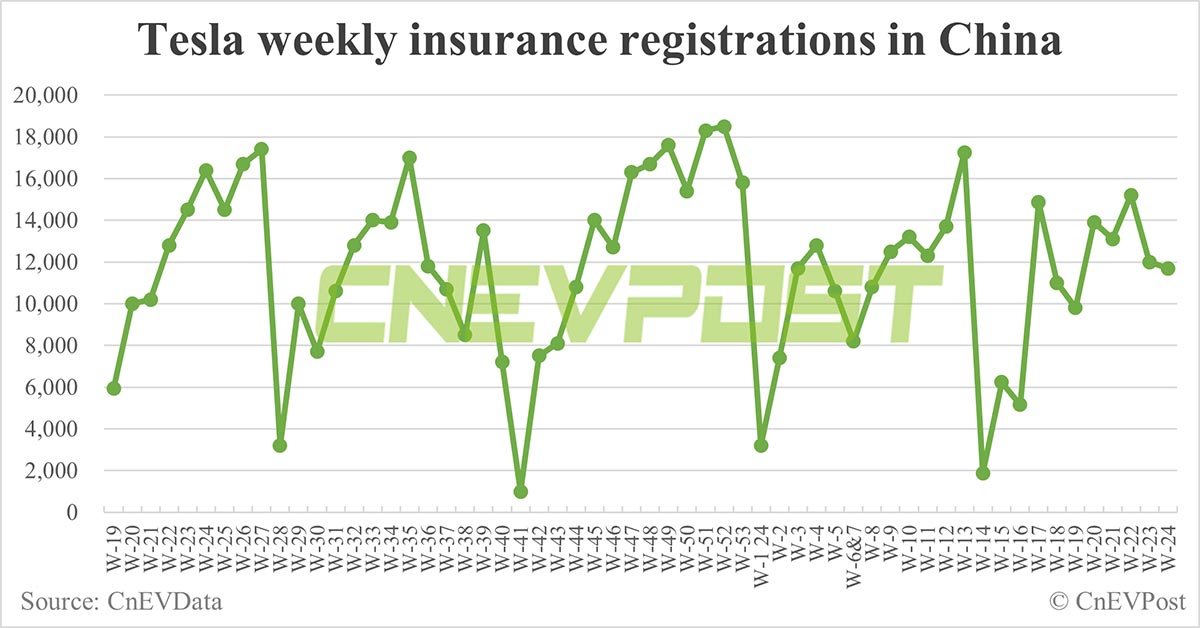

Tesla (NASDAQ: TSLA) had 11,700 insurance registrations in China last week, down 2.50 percent from 12,000 the previous week.

Tesla’s Shanghai factory, which produces the Model 3sedan and Model Y crossover, is its largest in the world, with an annual capacity of more than 950,000 vehicles.

Tesla’s pattern is to produce cars for export in the first half of the quarter and for the local market in the second half, it previously said.

On May 24, Reuters reported that Tesla’s Shanghai factory planned to cut Model Y production by at least 20 percent between March and June.

Tesla sold 55,215 vehicles in China in May, up 29.89 percent from 42,508 in the same month last year and up 75.73 percent from 31,421 in April, according to the China Passenger Car Association (CPCA).

Tesla’s Shanghai factory exported 17,358 vehicles in May, down 50.67 percent from 35,187 a year earlier and down 43.54 percent from 30,746 in April.

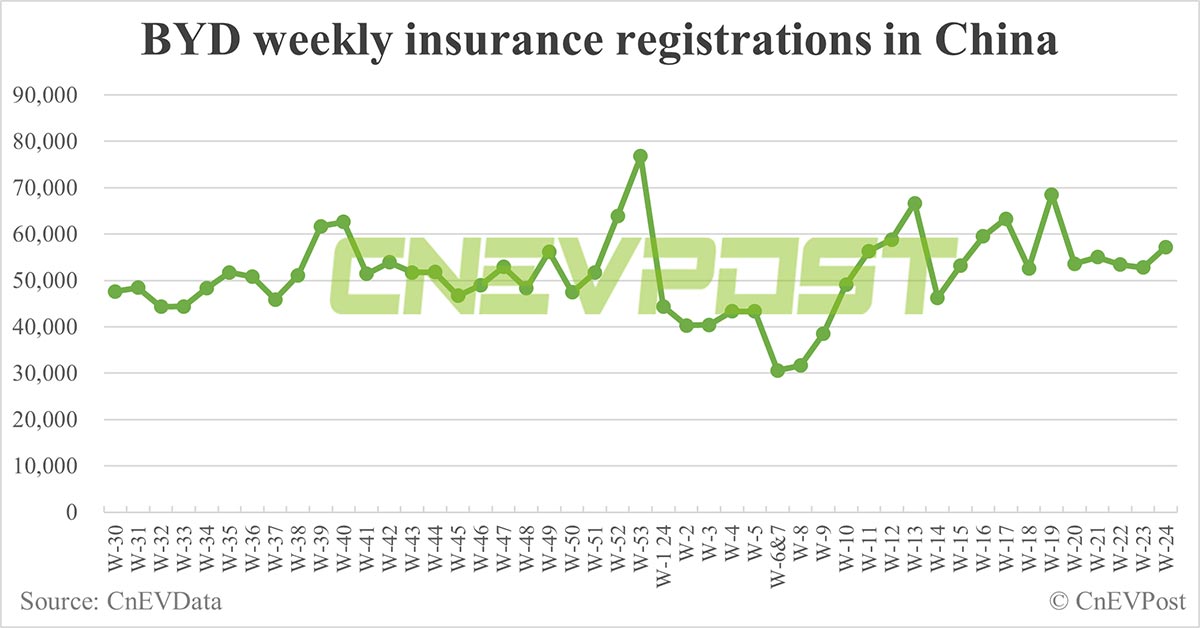

BYD (HKG: 1211, OTCMKTS: BYDDY) vehicles had 57,200 insurance registrations in China last week, up 8.33 percent from 52,800 the week before.

The company sold 331,817 new energy vehicles (NEVs) in May, further closing in on its all-time high of 341,043 units in December last year.

BYD sold 146,395 passenger battery electric vehicles (BEVs) and a record 184,093 passenger plug-in hybrid electric vehicles (PHEVs) in May.

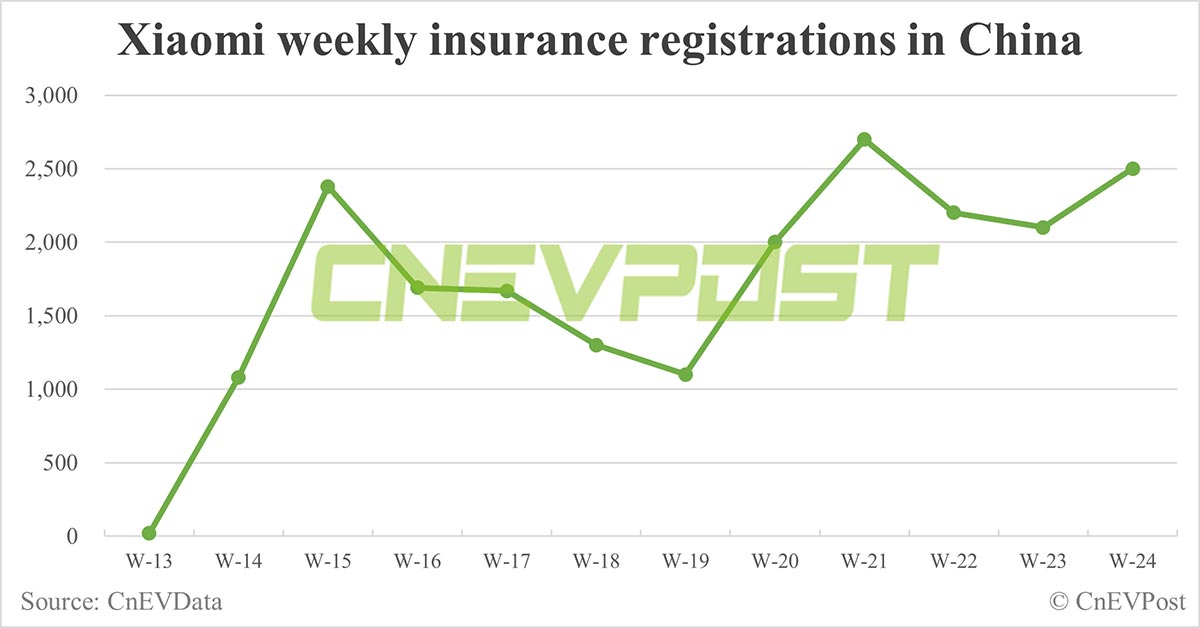

Xiaomi EV had 2,500 insurance registrations last week, up 19.05 percent from 2,100 the previous week, as it continues to face capacity bottlenecks.

Xiaomi EV delivered 8,646 vehicles in May, bringing cumulative 2024 deliveries to 15,764, according to a Xiaomi announcement on June 2 on the Hong Kong Stock Exchange.

Xiaomi launched the SU7 on March 28, offering three variants — standard, Pro, and Max — with starting prices of RMB 215,900 ($29,800), RMB 245,900, and RMB 299,900, respectively.

The Xiaomi EV factory would begin double-shift production in June and will deliver at least 10,000 units that month, Xiaomi management said in a May 23 earnings call.

Xiaomi EV would deliver at least 100,000 units for the full year of 2024 and will challenge the delivery target of 120,000 units, Xiaomi management said.

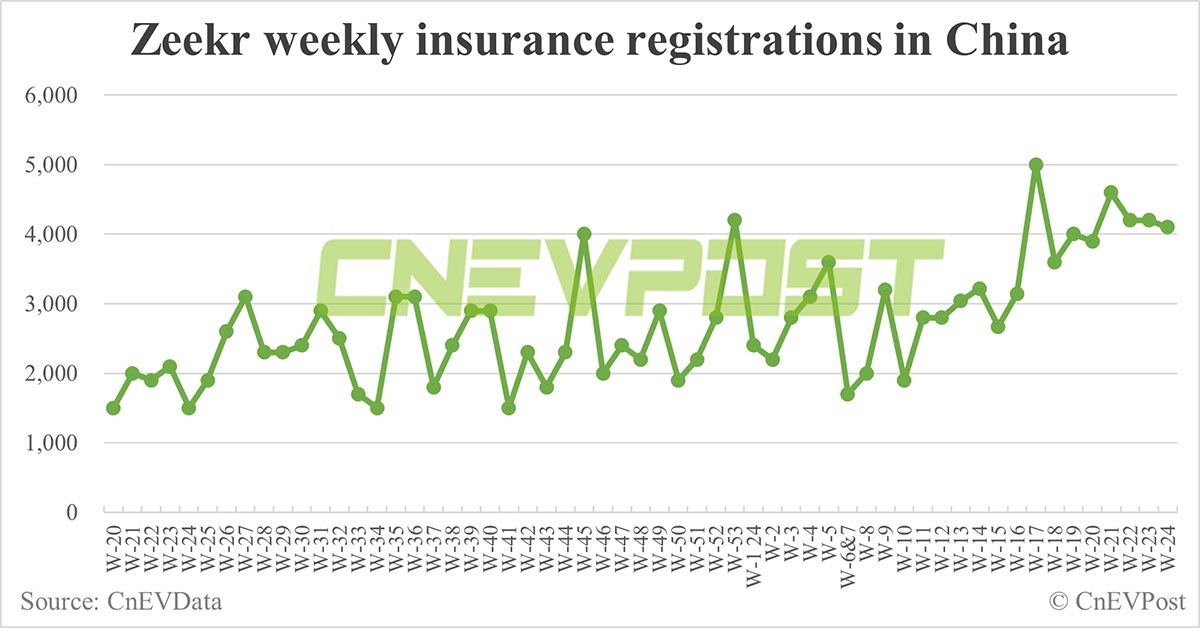

Zeekr (NYSE: ZK) had 4,100 insurance registrations last week, down 2.38 percent from 4,200 the week before.

The company delivered 18,616 vehicles in May, surpassing its previous record of 16,089 vehicles in April for its second consecutive record month.

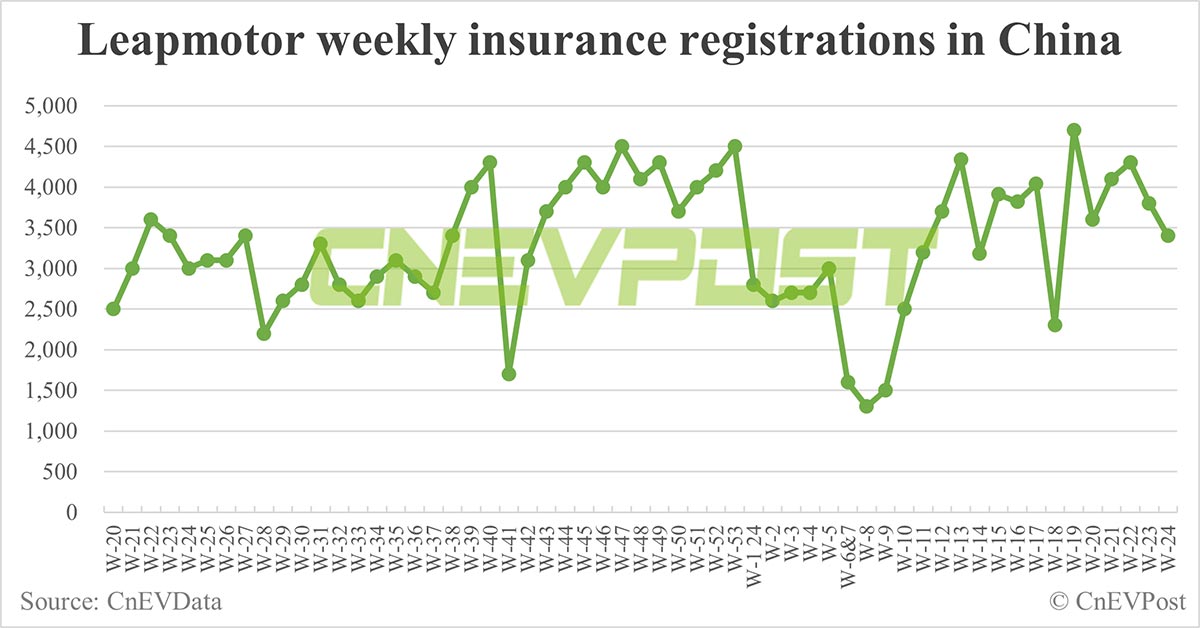

Leapmotor’s insurance registrations were down 10.53 percent last week to 3,400 vehicles, compared to 3,800 the previous week.

The company delivered 18,165 vehicles in May, a year-to-date high and close to its all-time high at the end of last year.

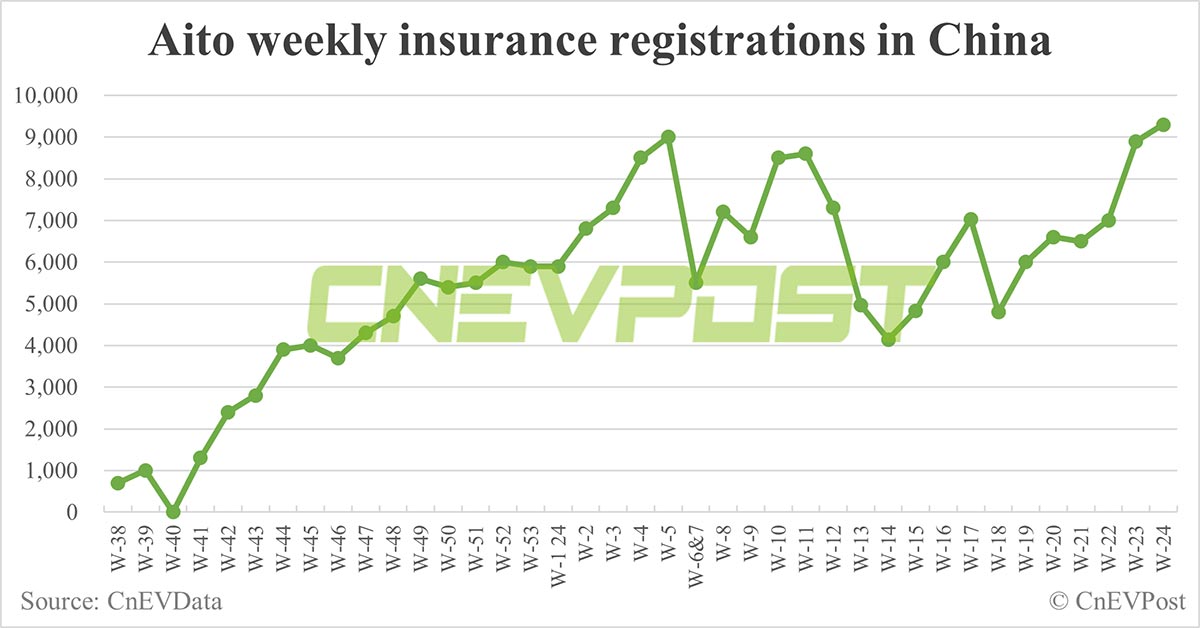

Aito, the brand jointly created by Huawei and Seres Group, saw its highest single-week insurance registrations at 9,300 vehicles last week, up 4.49 percent from 8,900 the week before.

Become A CnEVPost Member

Become a member of CnEVPost for an ad-free reading experience and support us in producing more quality content.