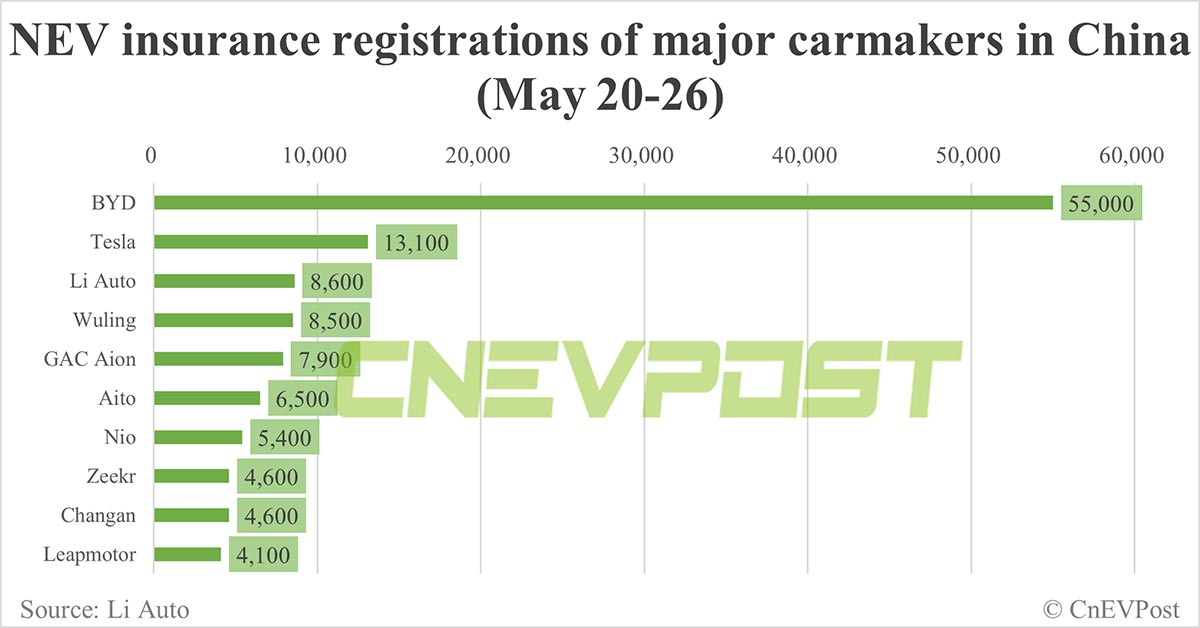

China EV insurance registrations for week ending May 26: Nio 5,400, Tesla 13,100, BYD 55,000, Xiaomi 2,700

During the May 1-26 period, insurance registrations for Nio vehicles were 15,400, Tesla 43,900, BYD 209,900 and Xiaomi 6,700.

Major electric vehicle (EV) makers continued to see mixed insurance registration performance in China last week.

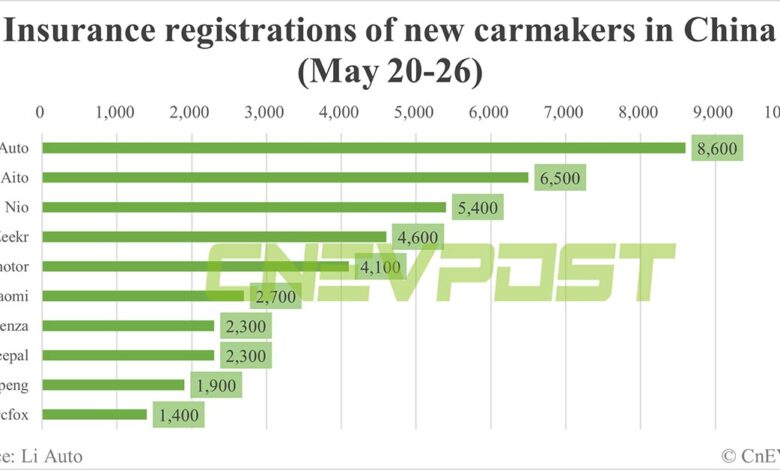

For the week of May 20-26, Nio (NYSE: NIO) vehicles saw 5,400 insurance registrations in China, up 22.73 percent from 4,400 in the previous week, according to data shared today by Li Auto (NASDAQ: LI).

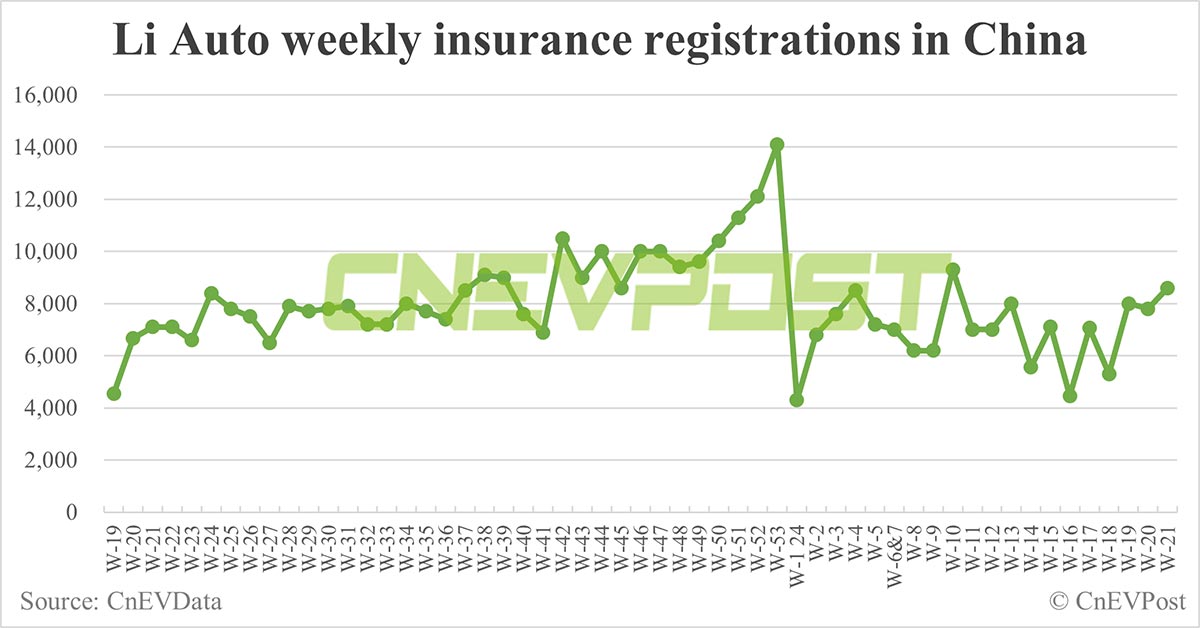

Li Auto stopped sharing weekly insurance registration numbers earlier this year, after doing so for about 1 year. In early May, it resumed sharing those figures. The company did not share month-to-date numbers as it had done previously.

The latest figures mean that insurance registrations for Nio vehicles stood at 15,400 from May 1-26, considering it was at 10,000 from May 1-19.

Nio delivered 15,620 vehicles in April, up 31.64 percent from March and up 134.60 percent year-on-year, according to figures it announced on May 1.

Nio, along with its major peers, is expected to report May delivery figures on Saturday, June 1. Nio’s fourth-quarter 2023 earnings report will be released on June 6, before the US stock market opens.

Yesterday, Nio said it saw its 200,000th vehicle delivery of its main selling model, the ES6.

Li Auto had 8,600 insurance registrations last week, up 10.26 percent from 7,800 the previous week.

Li Auto’s insurance registrations for May 1-26 were 27,200 units, considering it was at 18,600 units for May 1-19.

The company delivered 25,787 vehicles in April, up 0.41 percent year-on-year but down 11.03 percent from March.

Li Auto guided second-quarter vehicle deliveries to be in the range of 105,000 to 110,000 units in its May 20 earnings report, implying year-on-year growth of 21.3 percent to 27.1 percent.

Considering Li Auto delivered 25,787 vehicles in April, the guidance means it expects to deliver a total of 79,213 to 84,213 vehicles in May and June.

The company said in its earnings call last week that it won’t release any all-electric SUV this year, and that they will be released in the first half of next year.

Li Auto said in its previous earnings call that it would release three all-electric SUV models in the second half of 2024.

Li Auto is one of the major extended-range electric vehicle (EREV) players in China, with the main models on sale being the L-series EREVs, including the Li L6, Li L7, Li L8 and Li L9.

Li Auto’s first BEV, the Li Mega MPV (multi-purpose vehicle), was launched on March 1 this year, and its less-than-expected performance, as well as the challenges facing L-series sales, may be part of the reasons why Li Auto had adjusted its product launch strategy.

Xpeng (NYSE: XPEV) had 1,900 insurance registrations last week, down 5 percent from 2,000 the week before.

Xpeng’s insurance registrations for May 1-26 were 6,700 units, considering it was at 4,800 units for May 1-19.

The company delivered 9,393 vehicles in April, up 4.07 percent from March and up 32.69 percent year-on-year.

Xpeng guided for second-quarter deliveries of between 29,000 and 32,000 vehicles when it reported fourth-quarter 2023 results on May 21, representing year-on-year growth of about 25.0 percent to 37.9 percent.

The guidance means Xpeng had projected it would deliver between 19,607 and 22,607 vehicles in May and June combined, considering it delivered 9,393 vehicles in April.

Xpeng is expected to debut the first model of its sub-brand codenamed Mona in June and the model will go on sale and start deliveries in the third quarter.

An uncamouflaged spy photo of Mona’s first model began circulating widely on Chinese social media yesterday.

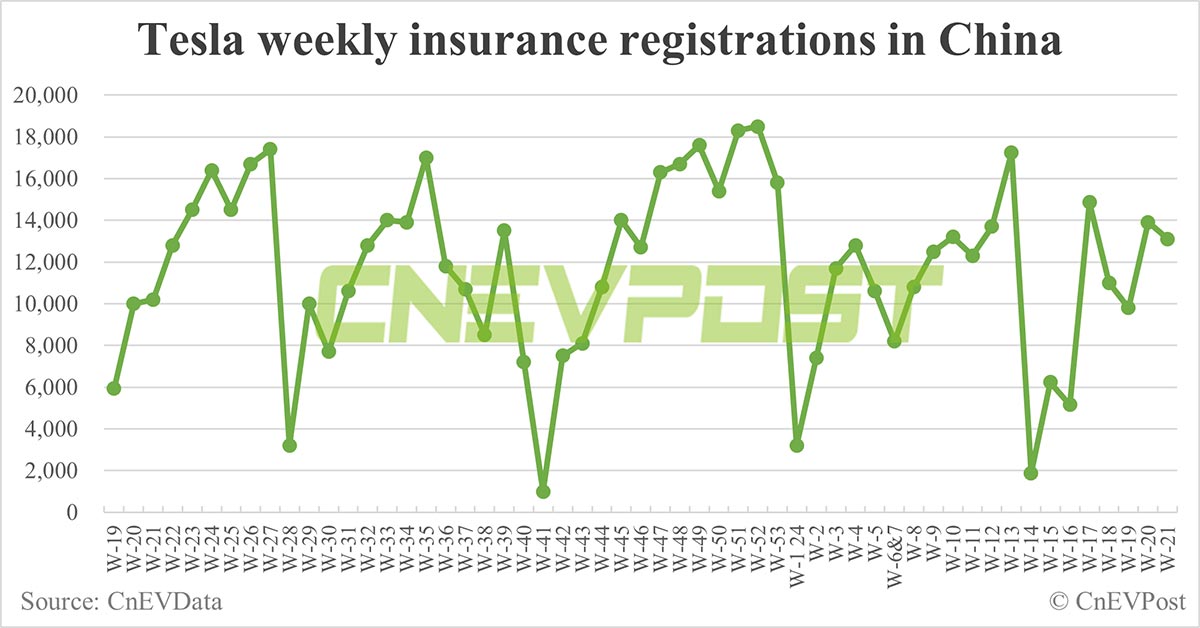

Tesla (NASDAQ: TSLA) had 13,100 insurance registrations in China last week, down 5.76 percent from 13,900 the week before.

The US EV maker had 43,900 insurance registrations in China from May 1-26, considering it had a May 1-19 figure of 30,800 units.

On May 24, Reuters reported that Tesla’s Shanghai factory planned to cut Model Y production by at least 20 percent between March and June.

It is unclear whether the production cuts will extend into the second half of this year or the Model 3, and whether Tesla’s factories in the US and Germany are taking similar production cuts, the report noted.

Tesla’s Shanghai factory, which produces the Model 3 sedan and Model Y crossover, is its largest in the world, with an annual capacity of more than 950,000 vehicles.

Tesla ramped up its marketing in China in May, saying on Weibo yesterday that Chinese customers who complete their vehicle deliveries between May 25 and June 30 will have a chance to win a free tour of its Fremont, US factory.

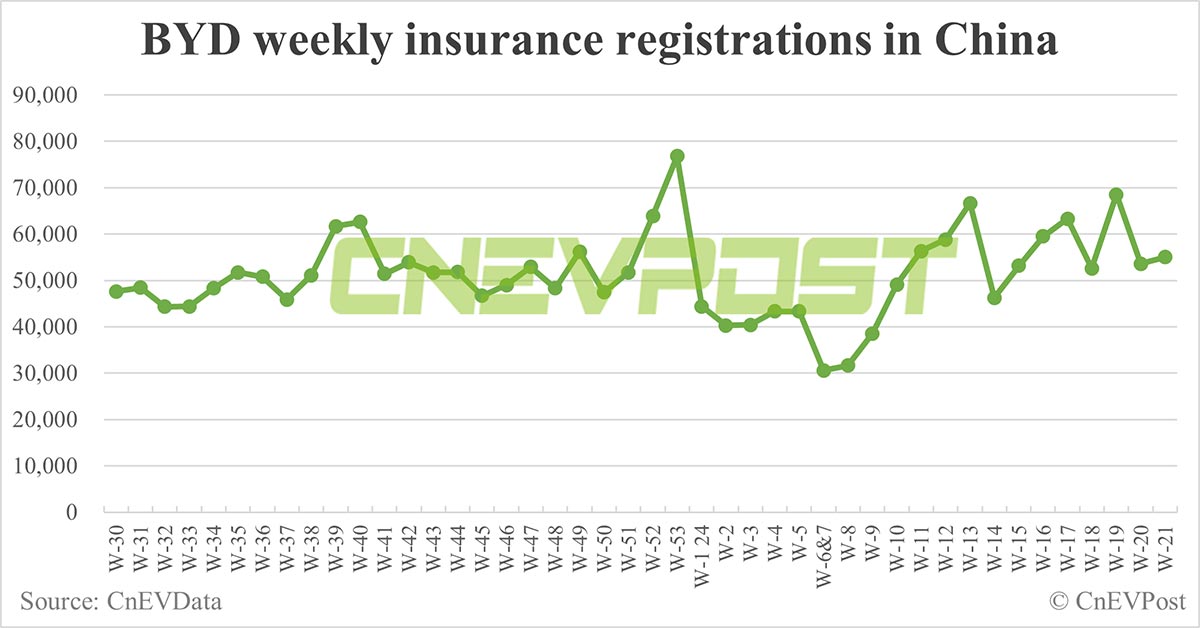

BYD (HKG: 1211, OTCMKTS: BYDDY) vehicles saw 55,000 insurance registrations in China last week, up 2.61 percent from 53,600 vehicles the week before.

From May 1-26, a total of 209,900 BYD vehicles were registered for insurance in China, CnEVPost calculations show. The company had that figure at 154,900 vehicles in the May 1-19 period.

BYD sold 313,245 new energy vehicles (NEVs) in April, up 48.96 percent from 210,295 in the same month last year and up 3.57 percent from 302,459 in March.

The company will launch its fifth-generation DM (Dual Mode) hybrid technology later today and the Qin L and Seal 06 will hit the market.

Xiaomi had 2,700 insurance registrations last week, up 35 percent from 2,000 in the previous week.

The company’s insurance registrations for May 1-26 stood at 6,700 units, considering it had a figure of 4,000 vehicles for May 1-19.

Xiaomi launched the SU7 on March 28, offering three variants — standard, Pro, and Max — at starting prices of RMB 215,900 ($29,800), RMB 245,900, and RMB 299,900, respectively.

The Xiaomi EV factory will begin double-shift production in June and will deliver at least 10,000 units that month, Xiaomi management said in a May 23 earnings call.

Xiaomi EV will deliver at least 100,000 units for the full year of 2024 and will challenge the delivery target of 120,000 units, Xiaomi management said.

On May 24, Xiaomi EV said in a Weibo post that it added CATL batteries to the standard version of the SU7, instead of using only BYD batteries as it had done previously, to boost capacity.

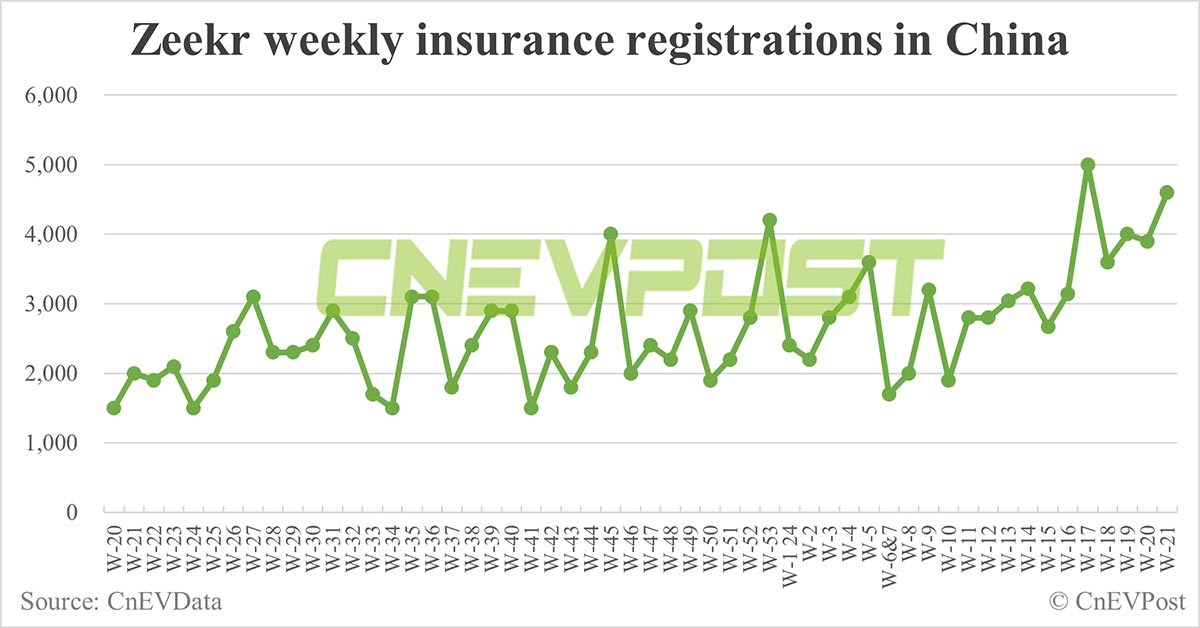

Zeekr (NYSE: ZK) had 4,600 insurance registrations last week, up 17.95 percent from 3,900 the previous week.

Zeekr’s insurance registrations for May 1-26 stood at 14,100 vehicles, considering it had a May 1-19 figure of 9,500 vehicles.

Zeekr went public on the New York Stock Exchange on May 10, becoming the latest Chinese EV maker to list in the US.

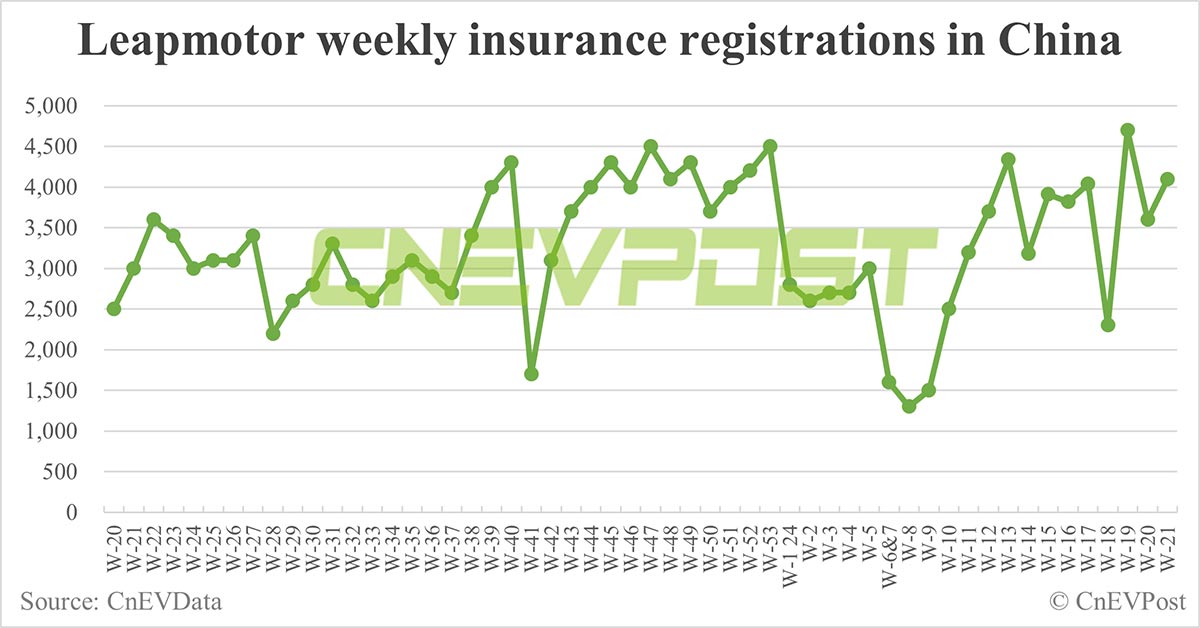

Leapmotor had insurance registrations of 4,100 vehicles last week, up 13.89 percent from 3,600 the week before.

Leapmotor’s joint venture with Stellantis NV, Europe’s second-largest car maker by sales, Leapmotor International, was formed on May 14 and will begin sales in Europe in September.

Aito, Huawei‘s joint brand with Seres Group, saw insurance registrations of 6,500 vehicles last week, down 1.52 percent from 6,600 the week before.

With sales exploding, especially for the Aito brand, Huawei’s automotive business turned a profit in the first quarter, Richard Yu, chairman of the tech giant’s smart car solutions BU, said in an interview earlier this month.

($1 = RMB 7.2462)