Chinese EV makers zooming by pioneer Tesla

Granted, Tesla’s share price has bounced on short covering and the return of perennial optimism after dropping by more than 40% since the beginning of the year.

But the Beijing International Automotive Exhibition should serve as a reminder that rivals in growing numbers have caught up with the electric vehicle (EV) pioneer – and are increasingly making it look like an ordinary car company.

About 1,500 makers of new energy vehicles (NEVs) and components are exhibiting at the exhibition – also called Auto China 2024 – that runs from April 25 to May 5. NEVs include battery-powered electric vehicles, electric motor and internal combustion engine hybrids and hydrogen fuel cell-powered vehicles.

The organizers of the event report that 278 NEVs including 117 new models are on display. Of the new models, 30 are from foreign companies – indicating a level of interest at variance with Western politicians’ hostility toward China.

Chinese exhibitors include top NEV brands BYD, Geely and Changan; battery EV specialists GAC Aion, Li Auto, Nio and Xpeng; and Xiaomi, a cell phone maker and software company that has started selling connected cars.

Component makers include Huawei and autonomous driving specialist Horizon Robotics, which ranks second to Nvidia in autonomous driving computing systems in China.

Foreign exhibitors include VW Group brands Audi, Porsche and Volkswagen, BMW and Mercedes-Benz, Hyundai and its affiliate Kia, Ford and Japan’s top three automakers, Toyota, Nissan and Honda.

Tesla is not there.

On April 25, Toyota and Tencent announced plans to collaborate in the development of electric vehicles for sale in China. Tencent, which has expertise in cloud computing, data processing and high-volume internet services, has turned to autonomous driving (which it refers to as AD) as a new growth market.

Tencent Intelligent Mobility Vice President Shuman Liu notes that, “With its complicated road systems, megacities, dense populations and unique traffic behaviors, China … provides richer scenarios, plentiful data and greater numbers of rare and unexpected so-called ‘corner cases’ essential for the safe and effective evolution of AD technology.” Corner case is engineer-talk for a problem outside normal parameters.

“Add to that a unique Gen-Z demographic that plans to purchase a car with Level2+ standards of driver assistance functions and you have ideal training conditions for AD,” he says. Toyota will almost certainly apply the lessons it learns in China to markets worldwide. Tencent is also reported to be working with Audi and Mercedes-Benz.

Toyota’s lagging competitor Nissan has signed an MOU with Chinese internet service company Baidu to explore cooperation in self-driving electric vehicles. Nissan has also announced new NEV models – two battery-EVs and two plug-in hybrids – developed with its Chinese manufacturing partner, Dongfeng Motor.

The VW Group has announced four world premieres in Beijing – the Audi Q6 L e-tron, the Lamborghini Urus SE, the Porsche Taycan 4 and the Volkswagen ID.Code, a concept car designed exclusively for China. Volkswagen, which entered the Chinese market 40 years ago, plans to invest 2.5 billion euros in its production and R&D center in Hefei to support joint development of EVs with Xpeng and the rollout of 30 new EV models by 2030.

Volkswagen now has 39 plants, more than 90,000 employees and an almost entirely domestic supply chain in China that includes Horizon Robotics. Its goal is to remain the top foreign car company in China and one of the top three in the Chinese market, where it is now running neck-and-neck with BYD in sales of all types of vehicles. To do that, it must rapidly expand its sales of NEVs.

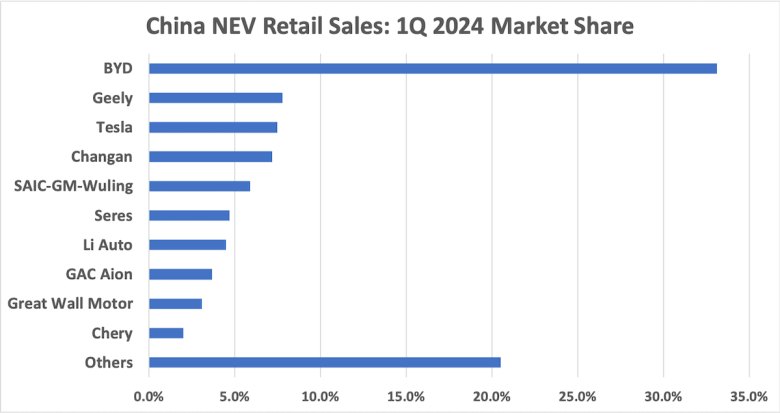

Meanwhile, Tesla has dropped to third place in the NEV retail sales ranking in China. Data from the China Passenger Car Association (CPCA) shows BYD selling 586,000 units in the first quarter of 2024, Geely 137,000, Tesla 132,000 and Changan 126,000. In the fourth quarter of 2023, BYD overtook Tesla in battery-powered EVs but BYD also sells hybrid vehicles, making that popular comparison less meaningful.

Tesla’s NEV unit sales were down 3.6% year-on-year while BYD’s were up 15.2%. Geely’s were up 2.4 times, Changan’s up 2.1 times and SAIC-GM-Wuling’s up 35.2%. With the exception of GAC Aion, the second tier of Chinese EV makers also recorded high growth in unit sales.

CPCA data shows Tesla’s production and sales in China declining for two consecutive quarters. At 7.5% in the three months to March, Tesla’s NEV market share in China no longer supports its reputation as an outstanding industry leader.

Tesla’s first-quarter financial results were as bad as preliminary reports had indicated, with sales down 9% year-on-year and net profit down 55%. The company’s operating margin declined from 11.4% to 5.5%. Cash flow from operating activities dropped by 90% and free cash flow turned negative.

The fundamental reasons for this were simultaneous declines in unit shipments and the average vehicle selling price. But these problems have been compounded by the recall of every Cybertruck shipped since last November – to fix a sticky accelerator pedal – and the resignation of two senior executives.

Tesla CEO Elon Musk is dealing with the situation by laying off more than 10% of the company’s workforce and conducting a thorough review of operations in order to cut other costs and increase efficiency. “This,” he said, “will enable us to be lean, innovative and hungry for the next growth phase cycle.”

That may be true but it is not an answer to BYD’s new mass market Seagull EV, the basic model of which is priced below $10,000. Musk plans to speed up the introduction of more affordable vehicles but Tesla’s idea of a low EV price is reported to be around $25,000.

Fortunately for Tesla, the US will almost certainly not allow ultra-cheap Chinese EVs into its market. The EU has already eliminated subsidies for imported EVs and may raise tariffs to keep them out. Tesla’s factory in Germany may share in the job cuts but is inside a potential European tariff barrier.

“The Chinese car companies are the most competitive car companies in the world,” Musk told investors and others listening to Tesla’s earnings call in January. “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

Last November, he said, “There’s a lot of people out there who think that the top 10 car companies are going to be Tesla followed by nine Chinese car companies. I think they might not be wrong.” Now it seems he was probably too optimistic about Tesla’s place in future rankings.

Follow this writer on X: @ScottFo83517667