Could Generative AI Destroy UiPath’s Success Story?

Better faster cheaper is the mantra of every organization that’s looking to improve shareholder value by either selling more stuff or spending less. While software produces data exhaust that can be used to optimize performance, humans are a bit trickier to optimize because, well, they’re human.

Initially, corporations turned to cheaper labor for efficiencies – John in Mumbai and Rosie in Manila. Then, they realized that the recipe-driven approach utilized by Mumbai back-office operations was a prime candidate for automation. Robotic Process Automation (RPA) was born, and now digital agents are cannibalizing back offices while chatbots are eyeing Rosie in Manila’s job. As a result, everything is becoming better, faster, and cheaper. Then came generative AI.

UiPath, RPA, and Generative AI

We don’t just pay compliments to our paying subscribers because they give us money. These people are not only extremely good looking, but they also ask some great questions. For example, many have asked if generative AI makes RPA solutions obsolete. The impetus behind those questions is our investment in one of the leading RPA firms out there – UiPath (PATH), which recently reported year-end earnings and talked about some generative AI functionality in the pipeline.

For those of you who also believe accountants using fiscal years should be shot dead on sight, we’ll translate the timeline for you. The first half of Fiscal 2025 means that UiPath will be previewing these products to some clients on or before June of this year.

Our recent video on Generative AI looked at how McKinsey’s MBAs believe that generative AI will mostly benefit AI firms that already have their tentacles in some of the world’s largest organizations. If UiPath is already deploying successful automation solutions in 10,830 companies, they only need to sprinkle their platform with some generative AI capabilities to capture even more revenue. Threats aren’t likely to come from new incumbents, though existing competitors may also use AI to capture more market share. One of UiPath’s biggest competitors in RPA, Microsoft (MSFT), also happens to be providing generative AI capabilities to UiPath in a partnership that seems rather odd given the circumstances. Keep your enemies closer?

“AI expands capabilities by enabling automations to learn how to read, write, listen, recognize patterns, and make complex decisions,” says UiPath, and the upside would come in the form of additional use cases the company could address which should expand their total addressable market (TAM). Of course, it’s all just generative AI spinning stories until we see progress reflected in the form of revenue growth from existing customers.

The latest earnings call saw analysts pounce all over the AI opportunity with a question raised about Cognition, the start-up which launched their new AI software engineer which received rave reviews on social media. UiPath responded by saying they’ve put together a top-tier AI team internally to build their own foundational model that “combines the knowledge of a subject matter expert, like an accountant or like an auditor, with the knowledge of how to use the system applications.” That’s what the $300 million in R&D spending last year is helping to build.

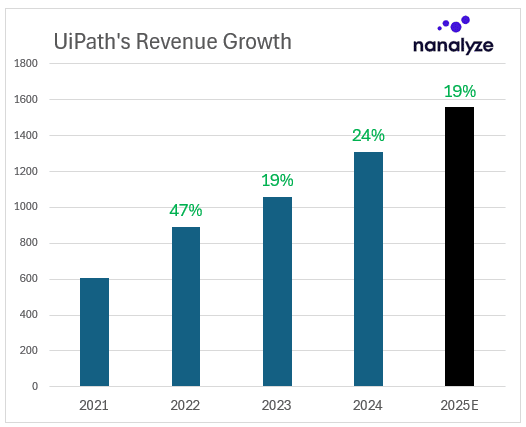

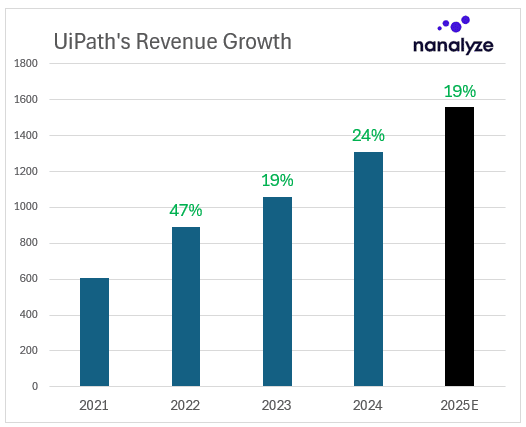

UiPath’s Revenue Growth

What’s acceptable revenue growth for a disruptive technology stock? The answer depends partly on size – the bigger you get, the tougher it is to post large growth numbers. When you’re trying to attack a $93 billion opportunity, revenue growth becomes a proxy for how much market share you’re capturing. Double-digit growth seems like the minimum one should expect, and UiPath is posting up projections on par with Palantir – nearly 20% growth this year (at a third of the valuation mind you).

Last year, UiPath saw 12% of revenue growth come from new customers while 88% was attributable to existing customers. They’re sure paying a lot for those new customers considering $713 million was spent on sales and marketing during the year (about 55% of revenues). Operating expenses are now on the decline as the company looks to rein in spending. Positive operating cash flows of nearly $300 million last year means they’re continuing to accumulate cash – $1.87 billion now – though some of it is being used to buy back shares which have been arguably undervalued relative to some of the hyped AI names out there.

Land and Expand

Net retention rate (NRR) tells us how much more existing customers are spending every year, and that becomes increasingly important as new customers become more difficult to acquire. UiPath provides their NRR number once a year, and it currently sits at 119% vs 124% last year. A decline is always a concern, but it still sits around the 120% average you’d expect from a SaaS company. Uplift from existing customers can also be measured by looking at the net increase in customers for each revenue bucket.

- More than $100K: 269 customers

- More than $1 million a year: 59 customers

- Less than $100K a year: 30 customers

New low-spend customers on the platform have rapidly tailed off, but that might change with (wait for it) the emergence of generative AI. The company’s new “AI AutoPilot” is being touted as everything from a Microsoft Copilot replacement (that’s not saying much) to a tool developers can use. “In some cases up to 1,000 companies are looking at Autopilot,” said the company in their earnings call, and you start to get Palantir AIP vibes from the whole thing. Getting someone to tinker around with some flashy demo tools at a brown bag is a long way from getting signatures at the C-suite.

Harvesting more money from existing customers is always easier than getting new ones. Think about how GitLab and GitHub have quickly released generative AI tools for developers that increase productivity and nearly double the possible money they might get from paying subscribers. In the same way, UiPath’s use of generative AI should create new monetization opportunities to capture. When we consider UiPath’s TAM breakdown, there’s a crossover with DevOps in the areas of no-code and application testing.

This goes back to that analyst’s question about how UiPath plans to compete against newcomers in AI. If building turns out to be a dead end, they certainly have the cash for buying.

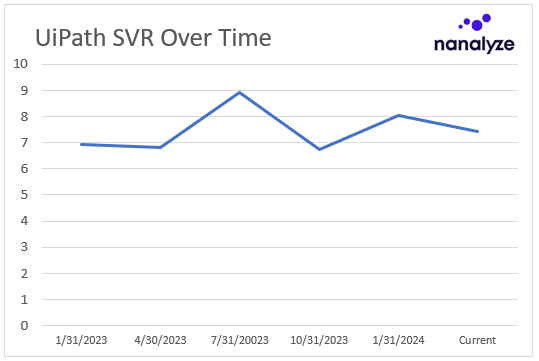

Valuing UiPath Stock

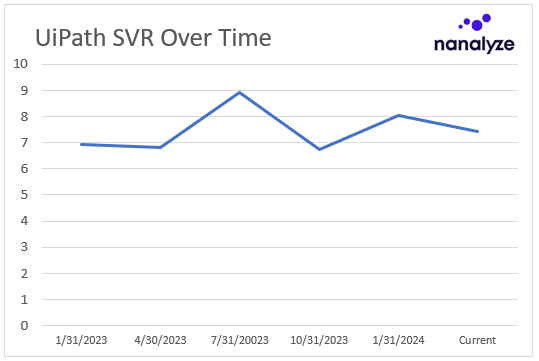

Until a company moves from profits to losses our simple valuation ratio (SVR) provides a way to value companies based on how much revenue they’re producing. About a year ago we asked, Is UiPath Stock Trading at a Bargain Valuation? At that time, UiPath sported an SVR of 7.5 compared to a catalog average of about 6.5. Here’s that number plotted over time:

A steady valuation ratio shows that AI hype hasn’t caught up with UiPath which is great. We always want quality companies trading at the lowest valuations possible. We’ve already maxed out our UiPath position, but if we were looking to add, anything under an SVR of 7 (the average of the above data points) might be an attractive valuation target. (Compare that to the first day of trading for UiPath when the SVR was around 38.)

Conclusion

Robotic process automation seems like the perfect gateway drug for companies to begin implementing generative AI solutions. Automations that become more intelligent can then move from record-playback macros to actual coworkers that you interact with via email and chat with seamlessly. UiPath’s relationship with one of their most formidable competitors, Microsoft, seems like a double-edged sword. Let’s hope UiPath’s OpenAI implementation adds more value than Microsoft Copilot. As always, the proof will be in the revenue growth pudding. Getting that net retention rate to trend upwards again will show that UiPath is successfully monetizing more features as opposed to keeping up with the Joneses.