CRM, SOFI, or SQ: Which Growth Stock is the Most Attractive Pick?

The recently reported results of several growth companies reflected resilience despite a high interest rate environment. While elections and the uncertainty around rate cuts might impact near-term performance, Wall Street remains bullish about the long-term potential of several growth stocks. Using the TipRanks’ Stock Comparison Tool, we placed Salesforce (NYSE:CRM), Sofi Technologies (NASDAQ:SOFI), and Block (NYSE:SQ) against each other to find the most attractive growth stock, as per Wall Street analysts.

Salesforce (NYSE:CRM)

Shares of Salesforce, a customer relationship management (CRM) software provider, tanked significantly after the company’s first-quarter revenue and Q2 outlook missed the Street’s expectations.

Salesforce’s Q1 FY25 (ended April 30, 2024) revenue increased about 11% to $9.13 billion but slightly lagged analysts’ consensus estimate of $9.15 billion. However, the company’s adjusted earnings per share (EPS) jumped to $2.44 from $1.69 in the prior-year quarter.

The company saw a moderation in revenue momentum in Q1 FY2025 compared to the previous quarter due to elongated deal cycles, curtailed spending by clients, and a change in its go-to-market strategy, which led to softer bookings.

Salesforce projects revenue growth in the range of 7% to 8% for Q2 FY25 and 8% to 9% for the full year. It cautioned that deal compression and customers delaying or slowing projects in the professional services business are expected to weigh on the top-line growth.

On the positive side, it is worth noting that Salesforce paid its first-ever dividend of $0.40 in April 2024. Overall, the company returned $2.2 Billion to shareholders through share repurchases and $0.4 billion via dividends in Q1 FY25.

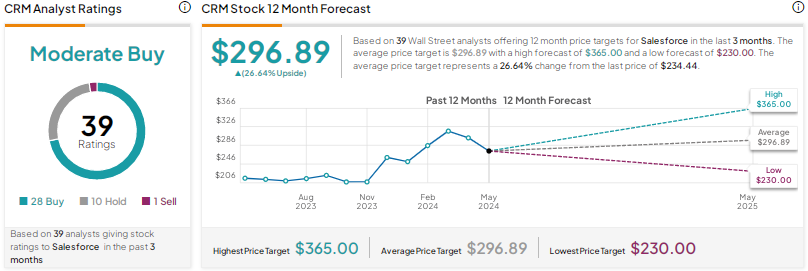

Is CRM a Buy or Sell?

Following the Q1 print, Piper Sandler analyst Brent Bracelin slashed his price target for Salesforce stock to $250 from $300 and reiterated a Hold rating. The analyst noted that bullish opinions about last year’s 9% price increase protecting revenue growth in FY25 have proven to be too optimistic, with the company’s guidance indicating that top-line growth could decelerate due to macro challenges and forex headwinds.

Bracelin prefers to be on the sidelines until further signs of stabilization.

With 28 Buys, 10 holds, and one Sell recommendation, Salesforce stock has a Moderate Buy consensus rating. The average CRM stock price target of $296.89 implies nearly 27% upside potential. Shares are down 11% year-to-date.

SoFi Technologies (NASDAQ:SOFI)

Fintech company SoFi Technologies’ better-than-expected first-quarter results failed to trigger a rebound in its shares. The company’s revenue surged 37% to about $645 million. Moreover, it swung to an EPS of $0.02 from a loss per share of $0.05 in the prior-year quarter. However, the company’s second-quarter forecast missed the Street’s estimates and dragged down the shares.

SoFi is calling 2024 a “transitional year,” as the company is shifting its focus from lending to its Tech Platform and Financial Services segments. It expects these two segments to drive growth and account for about 50% of total adjusted net revenue this year, up from 38% in 2023.

Despite SoFi’s growing customer base and strength in some key metrics, investors have been concerned about the potential deterioration in credit quality if high interest rates for a prolonged period impact customers’ loan-repaying ability.

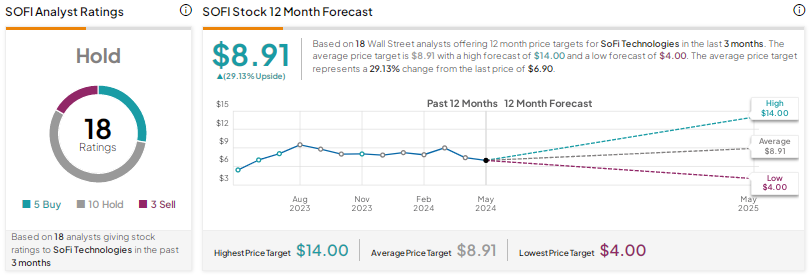

What is the Future Price of SoFi Stock?

In reaction to the Q1 results, UBS analyst Tim Chiodo lowered the price target for SoFi Technologies stock to $7.50 from $8.00 and reaffirmed a Hold rating.

The analyst continues to believe that SoFi stock is relatively well positioned among the U.S. Neobanks, a market in which UBS expects to see both “consolidation and re-bundling of services.” He thinks that the expectations about SoFi maintaining GAAP profitability seem positive. That said, Chiodo remains on the sidelines as he sees a balanced risk-reward in SoFi stock at current levels.

Wall Street has a Hold consensus rating on SOFI stock based on five Buys, 10 Holds, and three Sells. At $8.91, the average SOFI stock price target implies 29.1% upside potential. SOFI shares have plunged about 30% year-to-date.

Block (NYSE:SQ)

Fintech giant Block, which operates the Square ecosystem for sellers and Cash App peer-to-peer payments ecosystem, delivered upbeat first-quarter results in early May. The company’s revenue grew 19% to $5.96 billion, while adjusted EPS jumped to $0.85 from $0.43 in the prior-year quarter.

Remarkably, the company’s gross profit grew 22% to $2.09 billion, with Cash App gross profit rising 25% due to robust performance across Cash App Card, BNPL (buy-now-pay-later) platform, Bitcoin (BTC-USD) products, and Cash App Borrow. The overall gross profit also gained from a 19% rise in Square gross profit, thanks to strength in the company’s banking products and international markets.

Despite the company’s upgraded outlook following a solid Q1 report, shares are still in the red due to concerns over a report disclosing that the U.S. prosecutors are investigating the company’s compliance practices after a whistleblower informed the government about breaches in know-your-customer and anti-money-laundering rules.

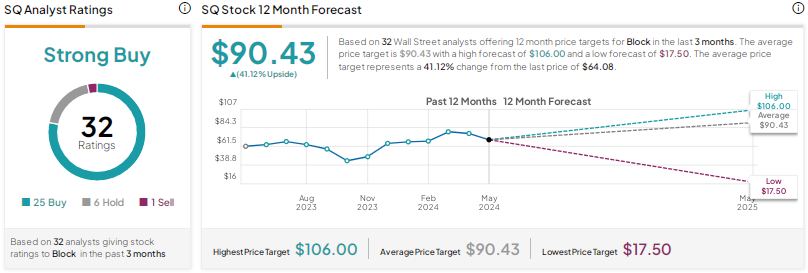

Is SQ a Good Stock to Buy?

Following a meeting with Block’s former Head of Product Sales, Jefferies analyst Trevor Williams reiterated a Buy rating on SQ stock with a price target of $100. The meeting’s agenda was to discuss the initiatives needed to improve the U.S. GPV (gross payment volume) trajectory for Square.

The analyst noted that SQ is “playing catch-up on product” and needs to improve its brand’s position with restaurants and larger sellers. That said, following the meeting, the analyst is optimistic that the company’s recent initiatives could ultimately boost GPV acceleration. These initiatives include better alignment of brand and product marketing, internal reorganization, and the consolidation of vertical apps.

Overall, Block stock scores a Strong Buy consensus rating based on 25 Buys, six Holds, and one Sell recommendation. The average SQ stock price target of $90.43 implies 41.1% upside potential. Shares have declined 17% so far this year.

Conclusion

Wall Street is highly bullish on Block, cautiously optimistic about Salesforce, and sidelined on SoFi stock. Currently, analysts see the pullback in Block stock as a good opportunity to build a position in the fintech company and gain from its long-term growth potential.