CRM Stock: Is It A Buy Right Now? Here’s What Earnings, Salesforce Stock Chart Show

Whether to buy CRM stock now depends on investor confidence in the “new” Salesforce (CRM) — a big cap software maker focused on improving profit margins. There’s also a new opportunity with generative artificial intelligence.

X

Salesforce stock tumbled on speculation it’s in talks to buy Informatica (INFA). Shares fell below Salesforce’s 50-day moving average.

Activist investors in 2022 pressured Salesforce to improve profit margins and avoid dilutive acquisitions. Salesforce in early 2023 disbanded a panel that explored mergers and acquisitions, implying it will make no more big deals. But that was before the rise of generative AI.

When reporting fourth quarter results, Salesforce announced its first dividend for CRM stock. Salesforce’s Q4 earnings and revenue that topped estimates while revenue guidance for fiscal 2025 came in below expectations.

Salesforce Stock Buybacks

Also, Salesforce increased its share buyback plan by $10 billion. Salesforce repurchased $1.7 billion worth of shares in Q4, bringing the total share repurchases to approximately $12 billion since the program began in August 2022.

Salesforce has refocused on improving operating margins amid cost-cutting spurred by activist investors. In late January, Salesforce said it would cut 700 jobs.

One big question is whether improving margins is enough to drive the stock higher. Some analysts say revenue growth needs to re-accelerate.

Also, valuation has been an issue. Salesforce stock has gained 4% in 2024. Further, Salesforce stock gained nearly 98% in 2023. That beat the Nasdaq index’s 43% gain. The S&P 500 rose 24%.

CRM Stock: Dreamforce Touts AI

Salesforce highlighted its heightened focus on generative AI at its Dreamforce customer conference in San Francisco in September. Salesforce is one of many AI stocks to watch.

At Dreamforce, Salesforce announced the launch of the Einstein 1 platform and Einstein Copilot feature. Copilot is a conversational AI assistant that is integrated within the user interfaces of all Salesforce apps. CoPilot is expected to be available in February.

UBS models only a 1% revenue boost for CRM stock from generative AI products in fiscal 2025, which starts in February.

While Microsoft (MSFT) is aligned with startup OpenAI, Salesforce is working with several developers of large language models. These provide the building blocks to develop applications.

Profitability Versus Sales Growth

Salesforce in January 2023 cut 10% of its workforce and reduce office space as part of a restructuring plan amid expectations that revenue growth will slow in fiscal 2024. More job cuts could be coming, some analysts speculate.

Further, rising corporate spending on digital transformation projects remains a plus for Salesforce stock.

Salesforce sells software under a subscription model. Its software helps businesses organize and handle sales operations and customer relationships. The company has expanded into marketing, e-commerce and data analytics.

Salesforce Stock: Digital Transformation

During the coronavirus pandemic, demand for next-generation collaboration and productivity tools increased. In addition, many companies aim to automate operations and track key business metrics in order to support employees working from home.

Digital transformation projects turn paperwork into electronic records and automate business workflows. More companies are investing in business analytics and artificial intelligence tools that scrub customer data.

The bar keeps rising when investors look at Salesforce’s “biggest acquisition ever.”

Its purchase of Exact Target in 2013 was followed by e-commerce platform Demandware in 2016, and MuleSoft in 2018. Last year, Salesforce ponied up $15.7 billion in an all-stock deal to buy data analytics firm Tableau Software.

Then came the Slack deal, which closed in July. Amid growing competition with Microsoft (MSFT), Salesforce agreed to pay $27.7 billion for workplace collaboration software maker.

The upbeat view is that acquisitions have enabled Salesforce to expand from its roots in customer relationship management software into marketing, e-commerce and other markets.

Salesforce is one of many big-cap tech stocks to watch. Started in 1999, Salesforce went public in 2004. Marc Benioff, who is also Salesforce’s founder, worked at Oracle for 13 years before he left to start the software company.

Moreover, CRM stock in 2020 was added to the Dow Jones Industrial Average. Meanwhile, CRM stock belongs to the IBD Long-Term Leaders list.

CRM Stock: The Threat From Rivals

Also, Salesforce faces some formidable competition. Microsoft’s Dynamics has gained traction as a lower-priced alternative to Salesforce tools, some analysts say. In addition, Microsoft is putting more salespeople behind the Dynamics business.

Also, Salesforce has been a fierce rival of Oracle (ORCL). And competition with Adobe Systems (ADBE), the digital media and marketing software firm, has been rising.

Meanwhile, newer rivals include Zendesk (ZEN) and HubSpot. And, Twilio (TWLO) has jumped into customer relationship management software with an acquisition.

The customers of software-as-a-service, or SaaS, companies like Salesforce purchase renewable subscriptions, rather than one-time software licenses. Also, customers receive automatic software updates via the web.

Salesforce Stock: Fundamental Analysis

Meanwhile, Salesforce Q4 earnings rose 36% to $2.29 per share on an adjusted basis. Also, the San Francisco-based enterprise software firm said revenue climbed 11% to $9.29 billion.

CRM stock analysts expected Salesforce to report earnings of $2.27 a share on sales of $9.22 billion.

A key financial metric, current remaining performance obligations, known as CRPO bookings, topped views. In Q4, CRPO rose 12% to$27.6 billion vs. estimates of $27.09 billion. CRPO bookings are an aggregate of deferred revenue and order backlog.

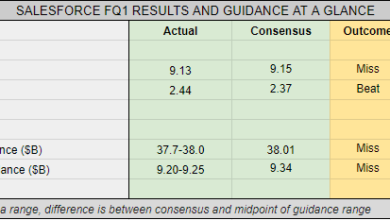

For the current quarter ending in April, Salesforce projected revenue in the range of $9.12 billion to $9.17 billion vs. estimates of $9.14 billion.

For full-year 2025, Salesforce said it expects revenue in a range of $37.7 billion to $38 billion, with growth of 9% vs. estimates of $38.57 billion, or 11% growth.

Salesforce Builds Artificial Intelligence Platform

One technology that Salesforce hopes will drive more revenue is artificial intelligence. The enterprise software maker introduced its “Einstein” AI software cloud platform in September 2016. The first Einstein AI software tools helped salespeople predict which deals are most likely to close based on a company’s historical lead and account data.

In addition, Salesforce has integrated AI tools into other enterprise software offerings over the past three years, targeting industries such as financial services in digital transformation. Einstein AI primarily works via chat bots.

But Salesforce has yet to disclose financial metrics on how much revenue the Einstein AI platform generates, directly or indirectly.

Meanwhile, Salesforce in 2019 agreed to buy data analytics firm Tableau for $15.7 billion in an all-stock deal. Tableau provides data visualization software. In addition, it enables customers to build databases, graphs and maps using time series analytics, a technique that analyzes a series of data points ordered in time.

Also, Salesforce expects synergy between its Einstein artificial intelligence tools and Tableau’s business intelligence software. In 2021, Salesforce announced that it would rebrand Einstein Analytics as Tableau CRM.

CRM Stock: Acquisition Spree

In 2018, Salesforce bought MuleSoft for $6.5 billion in cash and stock. MuleSoft’s software automates the integration of new tools with legacy enterprise platforms and speeds application development. MuleSoft’s business hit a bump in late 2021.

Meanwhile, Salesforce spent $4.6 billion on acquisitions in 2016. They included e-commerce platform Demandware.

E-commerce has boomed amid the coronavirus pandemic. The shift to online shopping has provided a lift to Salesforce’s “Commerce Cloud,” which has its roots in the Demandware purchase.

Further, Salesforce’s $2.5 billion purchase of Exact Target in 2013 jump-started its move into marketing software.

Bullish analysts say Salesforce AI’s tools, plus Tableau and MuleSoft will make a powerful combination for digital transformation projects.

Also, Salesforce aims to partner with IT services firms such as Accenture (ACN) to add customers. Despite U.S.-China trade tensions, Salesforce has added Alibaba Group (BABA) as a sales channel partner in China.

In cloud computing, Salesforce has partnered with Google for data analytics. In addition, Salesforce has expanded its venture capital investing.

Is Salesforce Stock A Buy?

After forming a long cup base from September 2020 to September 2021, Salesforce stock hit an all-time high of 311.75 on Nov. 9, 2021. Also, the stock pulled back in late 2021 as the software sector weakened. Then CRM stock retreated nearly 48% in 2022.

According to IBD Stock Checkup, CRM stock currently has a Relative Strength Rating of 89 out of a best-possible 99. The best stocks tend to have ratings of 80 and above.

Meanwhile, CRM stock holds an IBD Composite Rating of 95 out of a best possible 99.

IBD’s Composite Rating combines five separate proprietary ratings into one easy-to-use rating. Also, the best growth stocks have a Composite Rating of 90 or better.

In addition, CRM stock has an Accumulation/Distribution Rating of B. The rating analyzes price and volume changes in a stock over the past 13 weeks of trading. The rating, on an A+ to E scale, measures institutional buying and selling in a stock. A+ signifies heavy institutional buying; E means heavy selling. Think of the C grade as neutral.

As of April 15, Salesforce stock dropped below its 50-day moving average. Investors reaction to the terms of a possible Informatica deal will be key.

Follow Reinhardt Krause on Twitter @reinhardtk_tech for updates on artificial intelligence, cybersecurity and 5G wireless.

YOU MAY ALSO LIKE:

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Learn How To Time The Market With IBD’s ETF Market Strategy

How To Use The 10-Week Moving Average For Buying And Selling

Get Free IBD Newsletters: Market Prep | Tech Report | How To Invest