Croatia Sees Remarkable Growth in Tech Ecosystem; Fintech Remains Nascent – Fintech Schweiz Digital Finance News

In the Central and Eastern Europe (CEE) region, Croatia is witnessing remarkable growth in its startup ecosystem. N

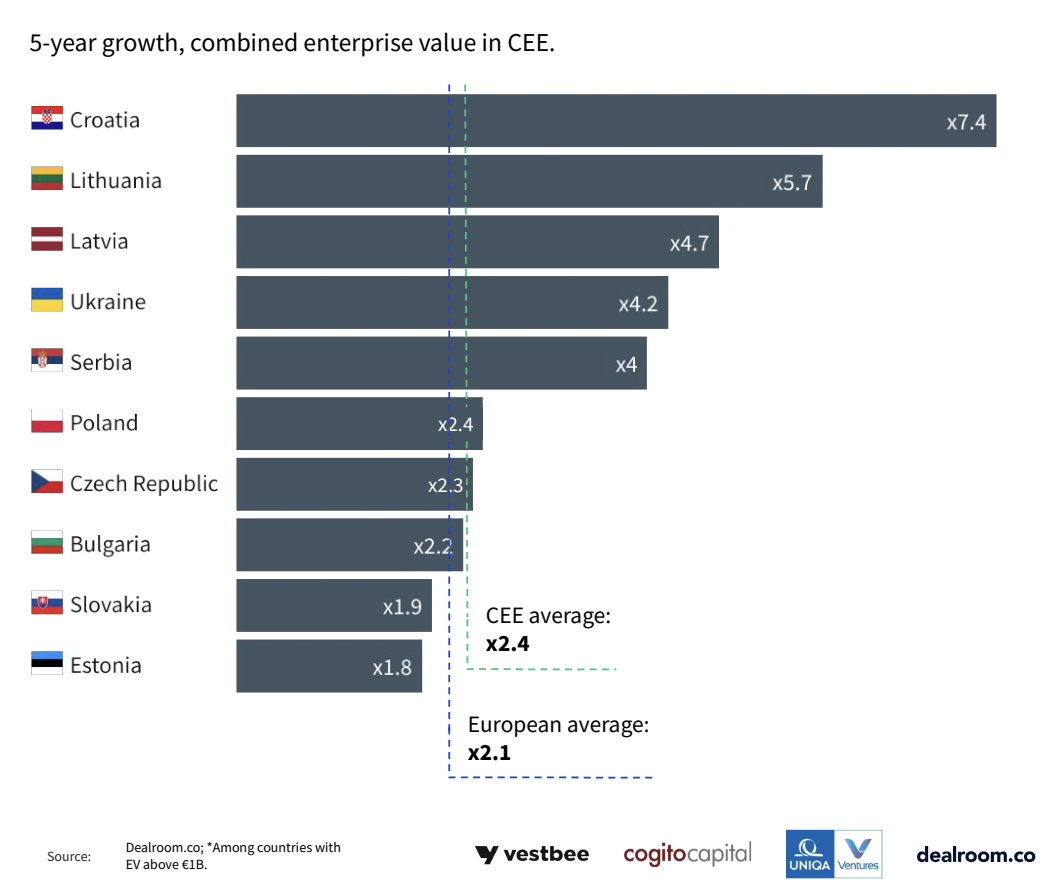

ew data released in a report by Dealroom, supported by Uniqa Ventures, Cogito Capital Partners and Vestbee, reveal that the country’s startup landscape has surged in value over the past five years. Since 2019, the combined enterprise value of Croatia’s tech startups has increased by a staggering 7.4 times, surpassing the growth rates of other rapidly developing tech hubs in the region like Poland (2.4 times) and Estonia (1.8 times).

This growth trend in Croatia’s startup scene is even more significant when compared to the European average, which stands at 2.1 times. This indicates that Croatia, along with other nations in the CEE region, is experiencing a rapid expansion of their startup ecosystems.

Five-year growth, combined enterprise value in Central and Eastern Europe (CEE), Source: Central and Eastern European Startups 2024, Mar 2024

The figures, featured in the fourth annual report on the startup and tech ecosystem of CEE, highlights the emergence of a young and vibrant startup ecosystem in the CEE region.

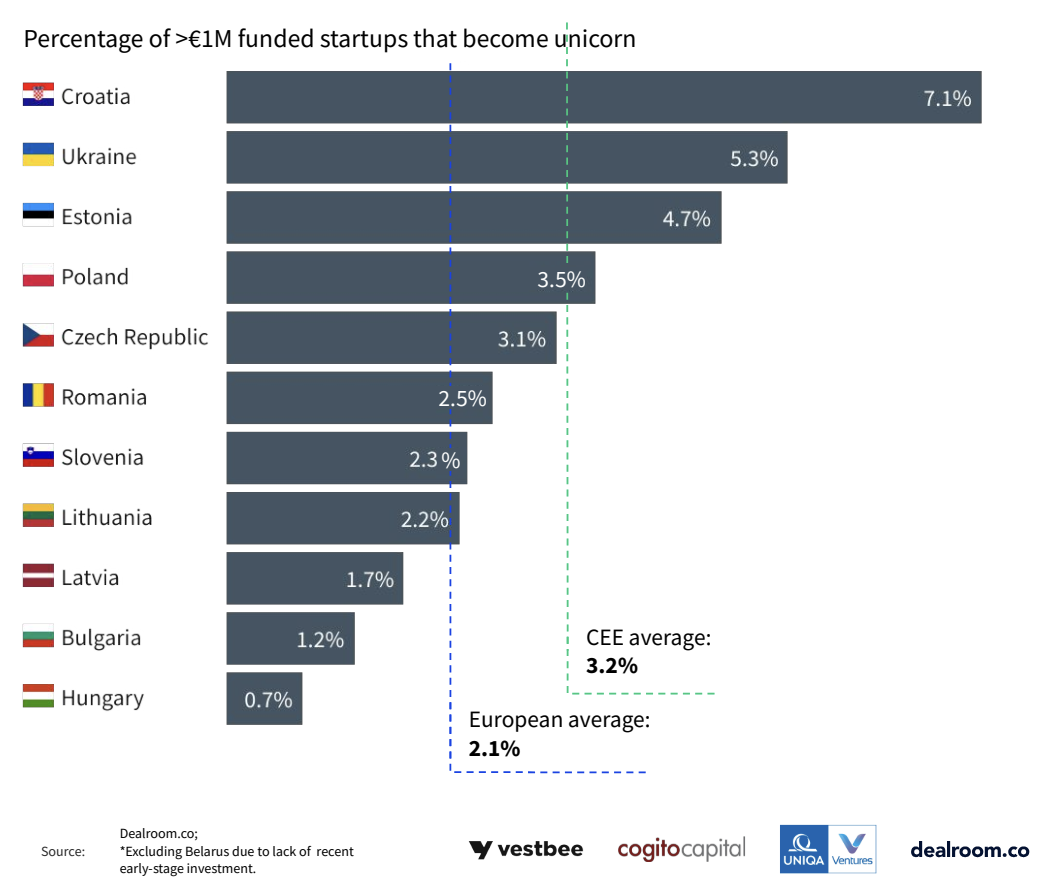

The report reveals that Croatian startups are not only growing rapidly but also achieving higher success rates than their CEE peers. About 7.1% of Croatian startups that secured more than EUR 1 million in funding have become unicorns, surpassing the rates of the overall CEE region (3.2%) and Europe (2.1%). More specifically, the report says that over 40 startups in Croatia have raised more than EUR 1 million in funding, with three of them already achieving unicorn status.

Percentage of > EUR 1 million funded startups that become unicorn, Source: Central and Eastern European Startups 2024, Mar 2024

A thriving startup ecosystem

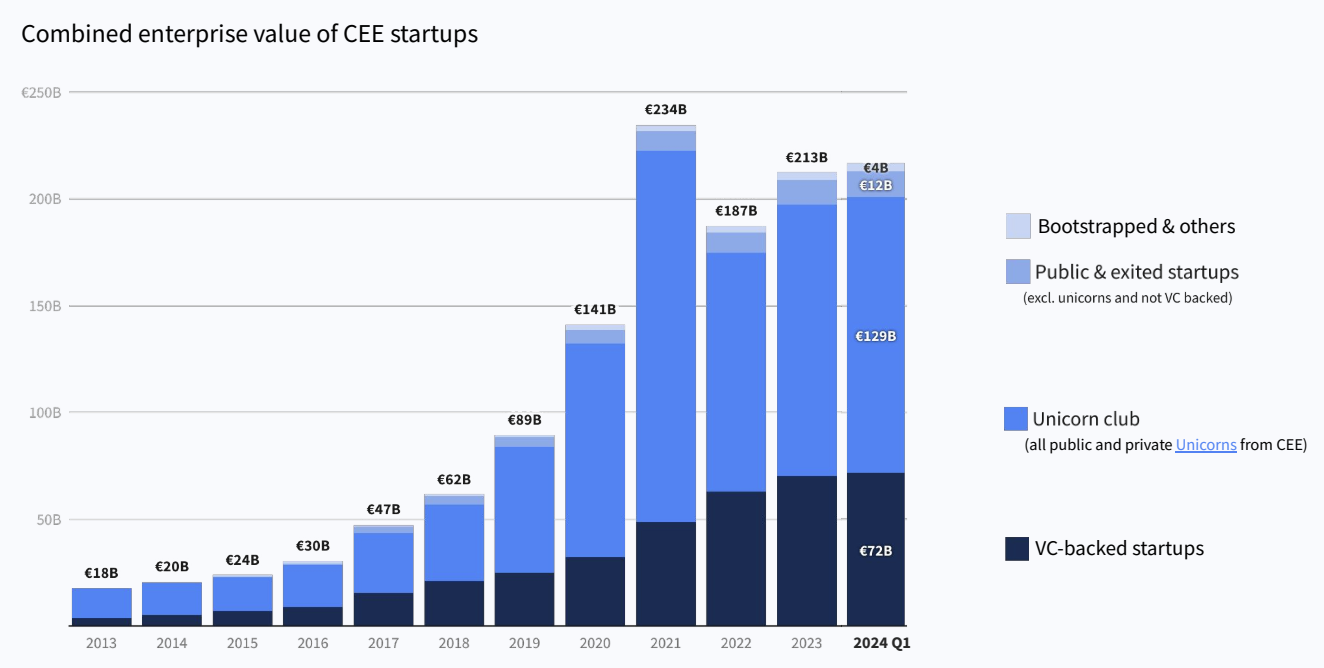

In recent years, the CEE region has emerged as a vibrant hub for tech innovation, driven by a thriving ecosystem of early-stage tech companies. Since 2019, the combined enterprise value of startups in the CEE startup ecosystem has grown by 2.4 times, soaring from EUR 89 billion in 2019 to EUR 213 billion in 2023.

Combined enterprise value of CEE startups, Source: Central and Eastern European Startups 2024, Mar 2024

According to the report, 60% of this combined worth is concentrated in the region’s 52 unicorns, totaling a total value of EUR 129 billion. Notably, startups from Poland, Ukraine, and Estonia contribute significantly to this value (50%), accounting for EUR 49 billion, EUR 28 billion, and EUR 28 billion, respectively.

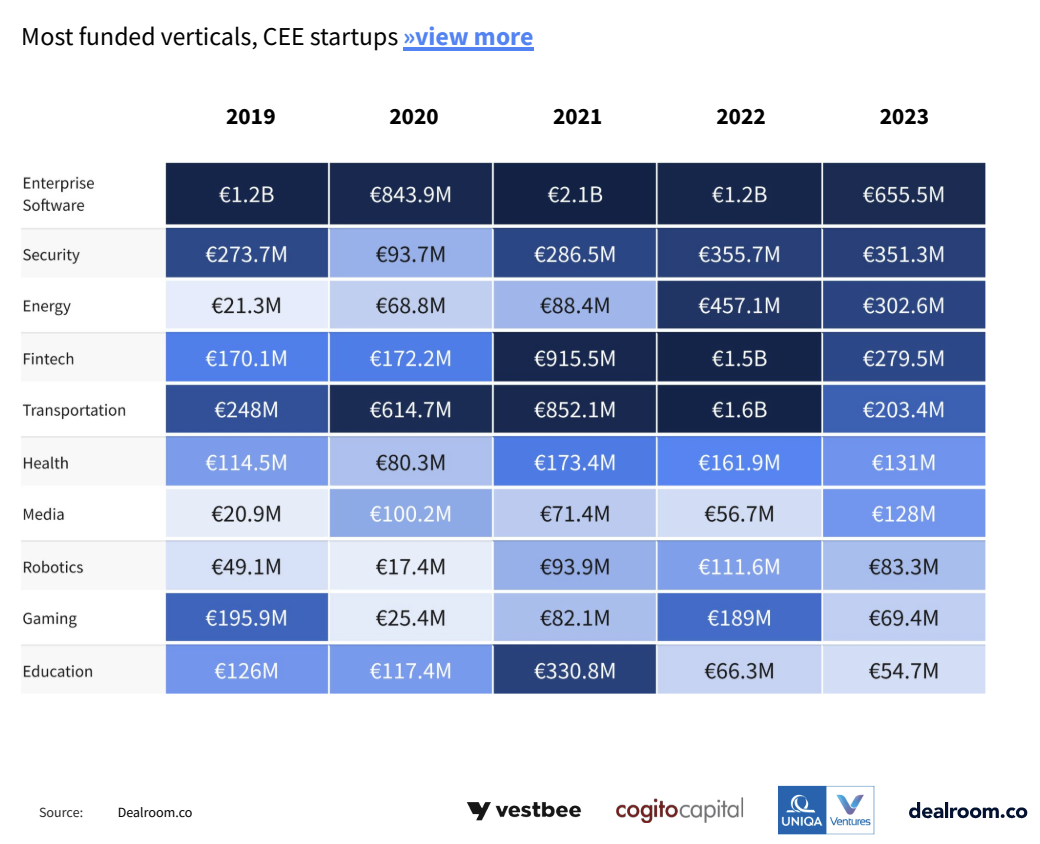

Looking at funding trends, CEE startups amassed EUR 2.1 billion in 2023, with enterprise software, security and energy dominating the funding landscape. Enterprise software and software-as-a-service (SaaS) remained the leading segment in the region in 2023, with over EUR 655 million raised. Enterprise software is followed by security with EUR 351.3 million raised, and energy, a segment that rose from being a niche just a few years ago, to capture a third of venture capital (VC) investment in CEE in 2023 (EUR 302.6 million).

In contrast, fintech saw a decline in appeal compared to other sectors, landing in fourth place with a total funding of EUR 279.5 million in 2023.

Most funded verticals, CEE startups, Source: Central and Eastern European Startups 2024, Mar 2024

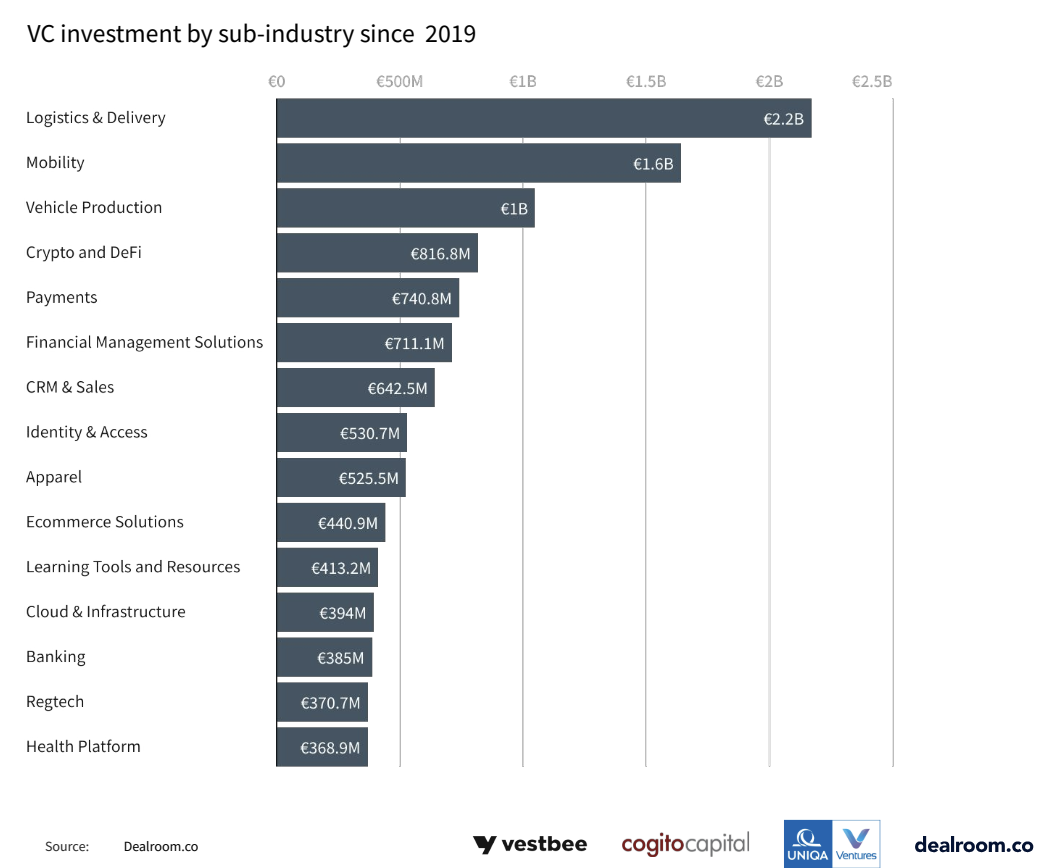

Looking at sub-industries, logistics and delivery, mobility, and vehicle production startups in CEE raised a combined EUR 4.8 billion since 2019, ranking as the top three categories. They were followed by three fintech verticals: cryptocurrency and decentralized finance (DeFi) (EUR 816.8 million), payments (EUR 740.8 million) and financial management solutions (EUR 711.1 million).

VC investment by sub-industry since 2019, Source: Central and Eastern European Startups 2024, Mar 2024

Croatia’s nascent fintech sector

In Croatia, the fintech sector is still in its early stages but is showing promising signs of growth and dynamism. A 2023 report by Hungarian digital product design agency Ergomania sheds light on the state of the industry, highlighting a growing interest in digital finance among industry players.

The report says that digitalization has become a banking priority in recent years, accelerated by the pandemic. This has prompted a shift towards enhancing customer experience across online, call center, and branch channels.

Filip Saravanja, formerly with HANFA, the Croatian Financial Services Supervisory Agency, highlighted Croatia’s potential in fintech innovation but notes challenges such as limited access to capital and foreign dominance in the financial sector.

Linardo Martincevic from the Croatian National Bank described efforts to enhance fintech knowledge within the institution. Since 2019, he has chaired a cross-department working group on fintech at the central bank comprising representatives from all sectors of the bank, and a pool of experts. Initially focused on crypto, the group has since expanded its scope to emerging technologies that fall within the bank’s regulatory framework.

Martincevic predicts the inevitable emergence of central bank digital currency (CBDC), stating that while Croatia is still heavily reliant on cash, there has been a gradual decline in this trend and increased adoption of mobile wallets.

This shift is mirrored in the findings of a recent MasterIndex survey. Conducted in October 2023 and involving over 1,000 Croatian banking customers, the survey found that 82% of respondents utilized their mobile phones for bill payments. Moreover, a significant 92% of participants expressed the belief that retailers should provide various payment options, including cards, cash, mobile apps, digital wallets, and even cryptocurrency.

Aircash, a licensed electronic money institution and a prominent fintech startup from Croatia, saw its revenue grow by a staggering 2,819% growth rate between 2019 and 2022, making it the fourth fastest-growing tech companies in Central Europe during the period, according to Deloitte’s recent Technology Fast 50 Central Europe ranking.

Aircash operates as a digital payment platform, providing services related to electronic money and mobile payments. The platform allows users to make payments, transfer money, and manage their finances digitally, offering convenience and accessibility. In 2023, Aircash reached the one million user milestone and was integrated into over 200,000 points of sale.

Featured image credit: edited from freepik