CRWD vs. S: Which Cybersecurity Stock Is the Better Buy?

In this piece, I evaluated two cybersecurity stocks, CrowdStrike Holdings (NASDAQ:CRWD) and SentinalOne (NYSE:S), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a neutral view of CrowdStrike and a bearish view of SentinelOne.

CrowdStrike provides next-generation endpoint protection via the cloud through its Falcon platform on a software-as-a-service (SaaS) subscription model. Meanwhile, SentinelOne provides an autonomous cybersecurity platform that utilizes artificial intelligence for prevention, detection, and response.

Shares of CrowdStrike Holdings have soared 51% year to date and 154% over the last year, while SentinelOne stock has plunged 36% year-to-date, although it’s still in the green over the last year, up 11%.

With such a dramatic difference in the companies’ year-to-date returns, the gap between their valuations is no surprise. Unfortunately, SentinelOne isn’t profitable, so we’ll compare the companies’ price-to-sales ratios to gauge their valuations against each other and against that of their industry.

For comparison, the application software industry is trading at a P/S of 8.8x, in line with its three-year average. It’s also trading at a price-to-earnings (P/E) ratio of about 100x versus its three-year average of 155x.

CrowdStrike Holdings (NASDAQ:CRWD)

At a P/S of around 27.8x and a P/E of 721.9x, CrowdStrike appears to be trading at a massive premium to its industry. While there could be some upside left, the stock is behaving somewhat like a bubble that’s just waiting to pop. Thus, a neutral view seems appropriate — pending a better entry price.

Part of the recent surge in CrowdStrike’s stock price followed the announcement that the company would be joining the S&P 500 (SPX) later this month, but most of it came before. When the stock does join the index on June 24, we could see another upside bump as the rest of the passively managed funds that track the S&P buy shares to account for the index’s quarterly rebalancing.

With such a high valuation, it seems only a matter of time until a correction occurs. CrowdStrike insiders have been taking profits as the stock has climbed, as evidenced by the $63 million in Informative Sell transactions and numerous Auto Sell transactions over the last three months.

Additionally, the company’s relative strength index (RSI) is just above 70, the point at which a stock tips into overbought territory.

Of course, there is plenty to like about CrowdStrike, and its recent earnings release reveals why. The company beat earnings estimates and smashed revenue estimates, posting adjusted earnings of 93 cents per share on $921 million in revenue. Consensus estimates for the quarter were 90 cents per share on $904.6 million in revenue.

However, the press release revealed some even more impressive metrics, including $3.65 billion in annual recurring revenue (ARR) at the quarter’s end, up 33% year-over-year. Such a high growth rate in ARR on top of an already-high ARR shows why we can expect CrowdStrike’s steady, impressive growth to continue.

Thus, I would monitor CrowdStrike regularly for the next correction because I believe this is one stock to buy and hold for the long term. Its share-price gains of 545.8% since the June 2019 initial public offering offer further support for picking up some shares the moment it goes on sale. In the meantime, investors who don’t want to wait could grab a few shares, but I would caution against building a sizable position at current prices.

What Is the Price Target for CRWD Stock?

CrowdStrike Holdings has a Strong Buy consensus rating based on 31 Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $399.96, the average CrowdStrike stock price target implies upside potential of 3.3%.

SentinelOne (NYSE:S)

At a P/S of 8.2x, SentinelOne is trading roughly in line with its industry. However, it remains unprofitable, and its revenue growth slowed dramatically in its latest fiscal year. Meanwhile, insiders have been unloading shares while the stock has been plummeting. Thus, a bearish view seems appropriate — despite the RSI of around 37, which suggests it could enter oversold territory soon.

Like CrowdStrike, SentinelOne did post some impressive earnings results in its latest quarter. The company posted adjusted losses of one cent per share on $186.4 million in revenue versus the consensus numbers of five cents per share in losses on $181.1 million in revenue.

SentinelOne remains unprofitable and is a fraction of the size of CrowdStrike, although SentinelOne’s annualized recurring revenue also rose 35% year-over-year to $762 million in the recent quarter. The company did manage to report its first quarter of positive free cash flow, so it could be starting to turn a quarter.

In fact, SentinelOne’s total revenue in the recent quarter rose 40% year-over-year, although its full-year revenue growth plummeted from 106% in Fiscal 2023 to 47% in Fiscal 2024 (which ended in January). For Fiscal 2025, SentinelOne actually cut its revenue guidance to between $808 million and $815 million—down from the previous range of $812 million to $818 million in the previous quarter.

Thus, SentinelOne remains largely a show-me story, especially given that management didn’t even mention progress toward profitability in the recent letter to investors.

What Is the Price Target for S Stock?

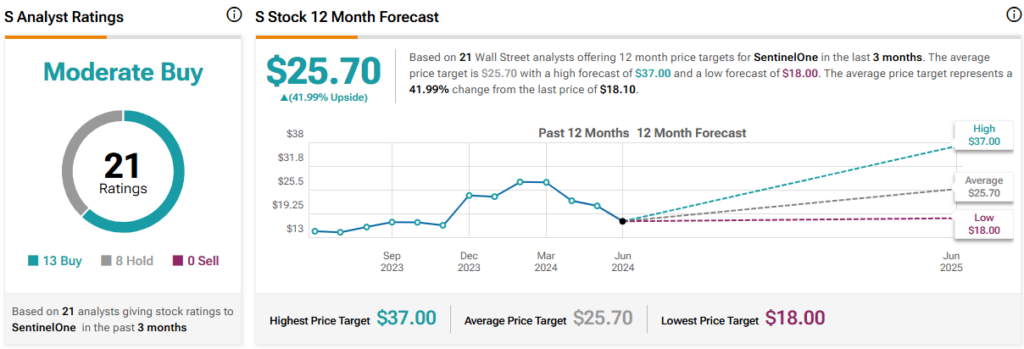

SentinelOne has a Moderate Buy consensus rating based on 13 Buys, eight Holds, and zero Sell ratings assigned over the last three months. At $25.70, the average SentinelOne stock price target implies upside potential of 42%.

Conclusion: Neutral on CRWD, Bearish on S

CrowdStrike’s profitable status is still relatively new, although it had to post at least five profitable quarters before becoming eligible to join the S&P 500. Now that the company is profitable, it’s clear to see the trajectory of continued growth. However, CrowdStrike’s valuation is rather high, so I would monitor it closely for the next correction, which might not be far away.

On the other hand, SentinelOne could eventually become the next CrowdStrike, but it appears that won’t happen anytime soon. The company’s years-long lack of profitability is a major cause for concern, and I would need to see significant progress before becoming more constructive on the stock.