Danny De Gracia: Don’t Punish Electric Vehicle Owners For Doing The Smart Thing

One of the concepts that’s become important to our understanding of progress in recent years is something called “disruptive innovation.” This refers to when a product, service or way of doing things disrupts the status quo because it easier, more cost-effective/profitable, better received, and so on.

My graying fellow GenXers have probably experienced several waves of disruptive innovation. The word processor pushed aside the mechanical typewriter. (I hear from my fellow graduate students at UH that now artificial intelligence can write the whole paper for you.) The compact disc, then digital MP3 players, and finally streaming audio services replaced the audio cassette tape.

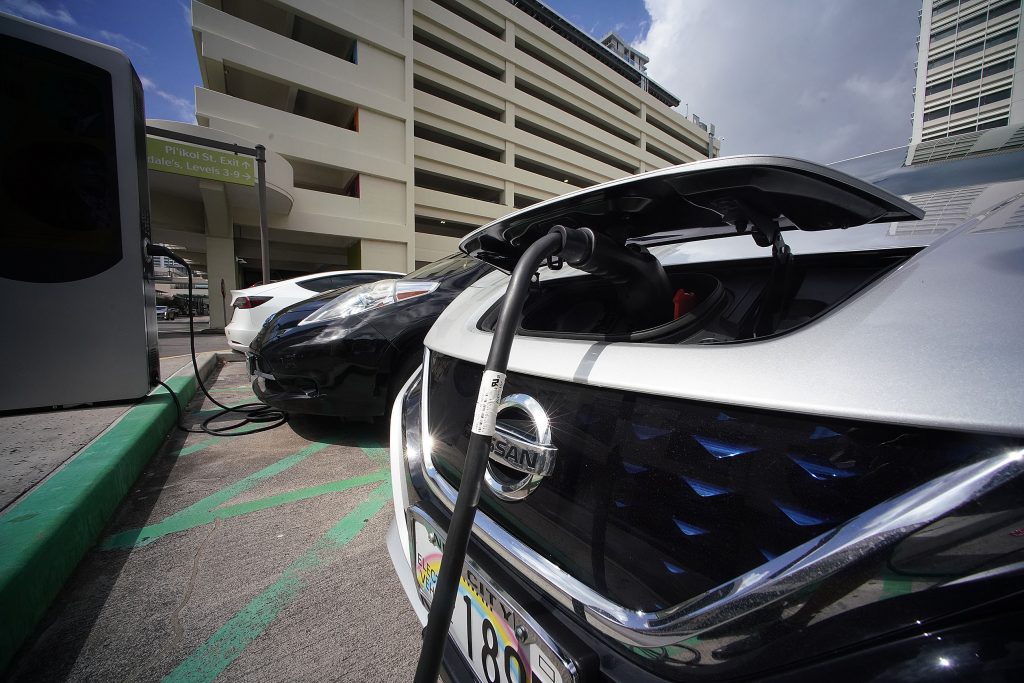

And now, in our era of high costs of living and skyrocketing energy prices, yet another disruptive innovation has taken to the streets: electric vehicles.

So popular are EVs that the International Energy Agency reports that last year there were over 250,000 EV registrations per week across the globe. There are now 40 million EVs in service around the world, and sales were 35% higher in 2023 than they were in 2022. Kelley Blue Book data likewise shows that in the United States, last year was an all-time high for EV purchases, with sales reaching 52% higher in the fourth quarter of 2023 than in 2022.

It’s easy to see why people like EVs. Though the average price in the U.S. is around $50,789, that cost is perceived by many drivers as an up-front investment in saving costs over the long term.

Not having to pay $5.30 per gallon to fill up a 14- to 16-gallon tank every week is one EV benefit. Plus many people recognize that clean energy is socially responsible, and it makes a number of people feel good, or at least better, about helping to reduce climate change. (Yes, many power sources around the world that charge EVs are still fueled by coal, but we’ll talk about that another time in more detail.)

When I was a college freshman in 1997, professors talked about the concept of EVs eventually helping to reduce America’s dependence on oil from bad guy countries and encourage world peace instead of resource wars.

Later, during my final year working at the Hawaii Legislature in 2010, enabling legislation for promoting not only EVs but anything renewable had taken government officials by storm. There was almost an end-of-history view of EVs and renewable energy among legislators at the time, and we had to get ready, or so they said.

Too Much Of A Good Thing?

By March 2019, though, it seems the private benefits of EVs and increasingly fuel efficient conventional automobiles were already too much for our establishment to bear. Because people weren’t buying as much gas at the pump, fewer taxes were being collected to pay for the upkeep of roads.

Then-Gov. David Ige’s administration floated the possibility of road use charges with a series of 14 community town halls around the state to collect input on a system where “vehicle owners pay for actual miles driven versus a gasoline tax system where owners pay by the amount of fuel their vehicle consumes.”

So basically, the government wanted all of us to go clean and stop being gas guzzlers, and private industry delivered. Then, government told us wait a minute, you’re so good at going clean and doing what we taught you in public schools that now you’re causing us to lose money. We need to tax you more to make up for the money you’re saving!

This session, we came within mere inches of another tax on EVs at the Legislature.

This would be the policy equivalent of me one day becoming governor of Hawaii and asking the Senate to enact a bill that imposes an additional $1 fee on all alcoholic beverages sold in the state of Hawaii regardless of volume to fund local treatment of all types of liver disease.

Then, when people adapt to the policy change by drinking less alcohol in favor of more club soda or plain bottled water, I complain that revenues for liver treatment are down so, wait for it, we will impose a fee on bottled water. Better yet, I will ask the Legislature to create a bill that will require people to report to authorities how much water they drink per year, and based on the number of cups they drink, I will then assess their taxes for liver research.

Does that sound fair? No, it sounds dystopian, if not fascist, and the worst kind of big brother control imaginable.

But this story is not over. The late President Ronald Reagan once said that the most terrifying words in the English language were “I’m from the government and I’m here to help.” Sad to say, he was wrong. The scariest words are actually “The Legislature finds that …” because every time you read that in a bill, you know you’re about to get inconvenienced.

And so it was in July 2023 when Gov. Josh Green signed Act 222, which set the groundwork for EV owners to be charged “a fair share of Hawaii’s roadway maintenance costs.” The measure mandates that by 2028, “in addition to all other fees and taxes … electric vehicles shall be subject to a state mileage-based road usage charge … at the rate of 0.8 cents per mile traveled, multiplied by the number of miles traveled, less the estimated amount of paid state fuel taxes that correspond with the miles traveled.”

Is There No Way To Win In This State?

Okay, so let’s say we all begrudgingly agree that EV owners should pay more despite investing in an expensive car meant to save them money. Let’s say we even agree that the government’s core function is road maintenance. I guess a road use charge is reasonable at the state level, assuming that’s the end of it. Right?

Wrong.

This session, we came within mere inches of another tax on EVs at the Legislature, this time empowering the counties to impose identical mileage-based road usage charges of their own. Senate Bill 3183, a governor’s package bill, used language similar to Act 222 in crafting a way to stack on top of the state taxes new county taxes. The bill died in conference committere, but the fact that it got this far says a lot.

Some might say the additional tax wouldn’t be that high, but that’s not the point. EV owners already paid more up front in anticipation of the benefits they would get from investing in disruptive innovation, and now government is trying to get a cut of their savings.

At what point does this mentality on taxes stop? Eventually, one will come to the same evil bureaucratic conclusion Margaret Thatcher came to as prime minster of the UK: People should be taxed for their existence regardless of whether they buy or save, have a job or are unemployed.

It reminds me of something economist Alan Greenspan once said about government tax-and-spend policies: “There is no way to protect savings from confiscation … The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.”

Are we allowed, as private individuals, to win at all in this state? Do we ever get to save money by making smart decisions? Wasn’t the whole point of buying EVs to save money and save the planet?

Why are we penalizing people for doing the right thing?