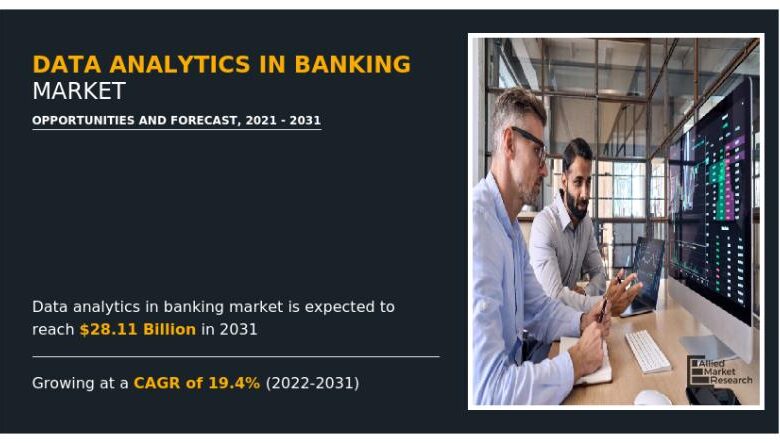

Data Analytics in Banking Market Expected to Reach $28.11

Allied Market Research recently published a report, titled, “Data Analytics in Banking Market by Component (Solution, Services), by Deployment Model (On-Premise, Cloud), by Organization Size (Large Enterprises, Small & Medium Sized Enterprises), by Type (Predictive Analytics, Prescriptive Analytics, Descriptive Analytics, Others), by Application (Fraud Detection & Prevention, Customer Management, Sales & Marketing, Workforce Management, Others): Global Opportunity Analysis and Industry Forecast, 2021-2031”. As per the report, the global data analytics in banking industry was pegged at $4.93 billion in 2021, and is estimated to reach $28.11 billion by 2031, growing at a CAGR of 19.4% from 2022 to 2031.

Download Sample Report:

https://www.alliedmarketresearch.com/request-sample/17021

The rise of the worldwide data analytics in banking industry has been fueled by a significant increase in illegal activities such as accounting fraud, money laundering, and payment card fraud. These fraudulent behaviors are discovered using a machine learning algorithm, which leads to an increase in banking analytics. Furthermore, data analytics has aided banks and financial institutions in predicting incoming and departing financial positions as well as consumer flow, which is propelling the data analytics in banking market forward.

Drivers, restraints, and opportunities

Increased demand for data analytics to help financial institutions to know customers and their buying patterns and behaviors and rise in fraudulent activities such as accounting fraud, money laundering, and payment card fraud have boosted the growth of the global data analytics in banking market. However, issues regarding implementation and integration among banks and financial institutions hinder the market growth. On the contrary, use of artificial intelligence in mobile banking apps and surge in demand from developing economies would open new opportunities in the future.

Covid-19 scenario:

The pandemic had a significant impact on the market due to surge in use of data analytics in banking sectors to study and research the consumer data to implement effective strategies.

The banks and fintech industries use data analytics to offer their customers useful and appropriate insights to predict the future positions and situations. During the pandemic, the demand from customers regarding insights on future market positions and financial situations increased.

The fraud detection & prevention segment to manifest the highest CAGR through 2031

By application, the fraud detection & prevention segment is estimated to register the highest CAGR of 24.4% during the forecast period. Fraud detection and prevention in transaction monitoring assist banks in detecting various frauds and taking suitable steps before any financial assets of the bank are lost, which drives the growth of the segment. However, the customer management segment dominated the market in terms of revenue in 2021, contributing to nearly one-third of the global data analytics in banking market, and is expected to continue its dominance throughout the forecast period. This is due to increased rivalry among businesses to deliver higher customer satisfaction and a more tailored experience.

Specific Requirement on COVID-19? Ask to Our Industry Expert:

https://www.alliedmarketresearch.com/request-for-customization/17021?reqfor=covid

The solution segment held the largest share

By component, the solution segment held the largest share in 2021, contributing to nearly three-fifths of the global data analytics in banking market, and is expected to retain its leading position from 2022 to 2031. Data analytics solutions have assisted banks in identifying clients’ money spending categories and cash flow trends, allowing them to retain better customer interactions and boosting data analytics in banking. However, the services segment is estimated to register the highest CAGR of 22.5% during the forecast period, as services for data analytics are critical for banks and financial institutions since they aid in the deployment and integration of various IT solutions in a corporate ecosystem.

The cloud segment is projected to register highest CAGR by 2031

By deployment model, the cloud segment is expected to showcase the highest CAGR of 21.9% during the forecast period. Cloud-based predictive data software combines numerous applications, such as data access, visualization, wrangling, analysis, forecasting, and prediction of bank data, into a single platform that is more dependable. This fuels the growth of the segment. However, the on-premise segment held the largest share in 2021, contributing to nearly three-fifths of the global data analytics in banking market revenue, and is expected to maintain its dominance during the forecast period. The on-premises data deployment approach is frequently used in banks and financial institutions since it requires a substantial investment to establish and requires businesses to acquire data software to administer the system & analyze previous data trends to anticipate future events.

The large enterprises segment held the largest share

By organization size, the large enterprises segment accounted for the largest share in 2021, holding nearly two-thirds of the global data analytics in banking market, and is estimated to continue its leading position during the forecast period. Large banks and financial institutions have expanded their attention on risk analysis, particularly to effectively detect, analyze, and manage risk, which has fueled the segment. However, the small & medium sized enterprises segment would manifest the highest CAGR of 21.4% during the forecast period. Small and medium-sized enterprises (SMEs) are adopting new technologies and platforms to develop their businesses, which drive the growth of the segment.

North America held the lion’s share

By region, the global data analytics in banking market across North America held the largest share in 2021, accounting for more than one-third of the market, and is expected to continue the dominance during the forecast period. This is due to large number of market players indulged in various development such as partnership, acquisition, and collaboration. However, the market across Asia-Pacific region is projected to portray the highest CAGR of 22.8% during the forecast period, due to increase in use of big data analytics across the region to solve a wide variety of business problems and other challenges.

Major market players

Adobe Inc.

Alteryx, Inc.

Amazon Web Services, Inc.

Aspire systems

Dell Inc.

Google

IBM

Microsoft Corporation

Mu Sigma

Oracle

SAP SE

SAS Institute Inc.

Sisense Inc.

Tableau Software, LLC (Salesforce)

Zoho Corporation Pvt. Ltd

KNIME AG

TIBCO Software Inc.

KEY BENEFITS FOR STAKEHOLDERS

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data analytics in banking market forecast from 2021 to 2031 to identify the prevailing data analytics in banking market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the data analytics in banking market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global data analytics in banking market trends, key players, market segments, application areas, and market growth strategies.

Key Market Segments

Application

Fraud Detection & Prevention

Customer Management

Sales & Marketing

Workforce Management

Others

Component

Solution

Services

Deployment Model

On-Premise

Cloud

Organization Size

Large Enterprises

Small & Medium Sized Enterprises

Type

Predictive Analytics

Prescriptive Analytics

Descriptive Analytics

Others

Top Trending Reports:

Equity Indexed Life Insurance Market https://www.alliedmarketresearch.com/equity-indexed-life-insurance-market-A223007

Smart Contracts Market https://www.alliedmarketresearch.com/smart-contracts-market-A144098

Asset Servicing Market https://www.alliedmarketresearch.com/asset-servicing-market-A238323

Smart Bands Payments Market https://www.alliedmarketresearch.com/smart-bands-payments-market-A10050

Weather-Based Crop Insurance Market https://www.alliedmarketresearch.com/weather-based-crop-insurance-market-A10049

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int’l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.