Did C3.ai Just Become a Top Artificial Intelligence (AI) Stock to Buy?

C3.ai just issued fantastic guidance for this year.

C3.ai (AI 4.53%) is a polarizing artificial intelligence (AI) stock. It saw a lot of enthusiasm in early 2023, but that has since evaporated as the stock sits more than 30% off its highs established in 2023. However, that figure used to be as low as 55% in April, so the stock is gaining some enthusiasm again.

Part of that has been C3.ai’s results as some parts of its business are beginning to prove doubters wrong. But is this enough to persuade more investors to buy this stock?

Demand for C3.ai’s products is rising

C3.ai has evolved quite a bit as a company since its founding in 2009. It has gone from an energy management to an Internet-of-Things (IoT) to an AI applications business. However, its latest shift has been into generative AI, which management believes will “change everything.”

The company provides pre-built AI models that can be deployed to common situations found in many industries. This is an attractive proposition to many businesses, as they don’t need to hire software engineers to develop custom models. One of C3.ai’s largest emerging clients is the U.S. government, which accounted for nearly half of the company’s bookings in the fourth quarter of its fiscal 2024, which ended April 30.

In the press release for its earnings, management said, “The interest we are seeing in our generative AI applications is staggering.” This backs up what other AI companies like Palantir Technologies have been saying, and it bodes well for C3.ai’s future. But even now, C3.ai seems to be turning over a new leaf.

Great growth but far from breaking even

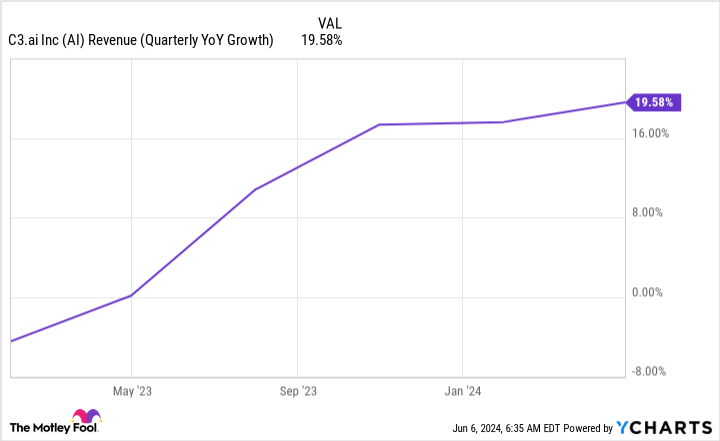

In Q4, revenue rose 20% year over year to $87 million. That’s solid growth acceleration compared to previous quarters and is a great sign for growth investors.

AI Revenue (Quarterly YoY Growth) data by YCharts

But Q4 isn’t going to be C3.ai’s high point. Management also issued fantastic guidance and expects the first quarter of fiscal 2025 (ending July 31) to be about $87 million, indicating 20% growth. For the full year, it expects around $383 million, which would amount to 23% year-over-year growth. Clearly, management expects its revenue growth to accelerate even more after Q1, which is music to investors’ ears.

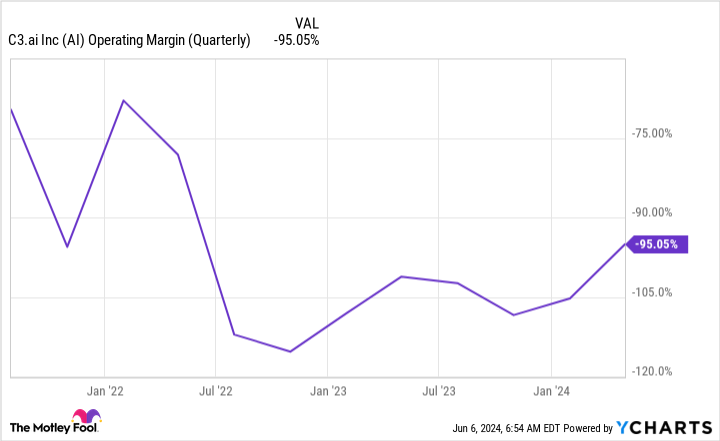

However, there is a downside with C3.ai’s stock. The company is one of the most unprofitable businesses in the software industry. Although it generated nearly $87 million in revenue in Q1, the cost of that revenue was $35 million, and its operating expenses totaled $134 million. Altogether, that gave C3.ai an operating loss margin of 95%, meaning it would take at least double its current revenue to break even without increasing its spending.

AI Operating Margin (Quarterly) data by YCharts

That’s not great for investors and continues a trend of deep unprofitability. Emerging from a hole that deep can take years, and some investors aren’t patient enough to wait for C3.ai to flip the profitability switch.

However, there is one piece of hope: C3.ai is a small company. Its quarterly revenue was only $87 million, which is fairly small compared to other AI software companies like Palantir. As a result, its deep unprofitability is a side effect of its wanting to capture as much market share as possible. While I’m not a fan of its unprofitability, this makes it somewhat palatable.

So, am I buying the stock? Right now, no. I’m no fan of the high losses at C3.ai’s current growth levels. If C3.ai doubled its revenue year over year, I’d be willing to look past it. However, C3.ai is a much more attractive stock than just a few months ago, thanks to its strong guidance and revenue acceleration. It’s starting to emerge as a top AI pick and may even cross into buying territory (for me) after a few quarters of solid growth and improving profitability.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.