Elastic: Generative AI Opportunity Awaits (NYSE:ESTC)

Khanchit Khirisutchalual

Elastic N.V. (NYSE:ESTC) is providing investors with an opportunity for significant growth in the coming year. The company has continued to show strong results as many companies are seeing weakness in the software space. Yet the company is still not seeing AI applications boosting revenue growth with that to come in the long term. Being a search company with an AI lake, Elastic has a big advantage over the competition with its Elasticsearch relevance engine. This will allow it to have strong growth through 2024 and into 2025, allowing for significant share appreciation. Cash flow continues to improve and the growth in RPO has outpaced revenue, leaving potential upside. While software has been very mixed in 2024 with winners and losers, ESTC has the potential to be a big winner for the second half of the year. The sector has shown recent weakness, with Salesforce earnings throwing cold water on the software equities. However, if you have a long-term outlook now is a great time to begin a position in Elastic.

ESTC Q4 Results (ESTC IR)

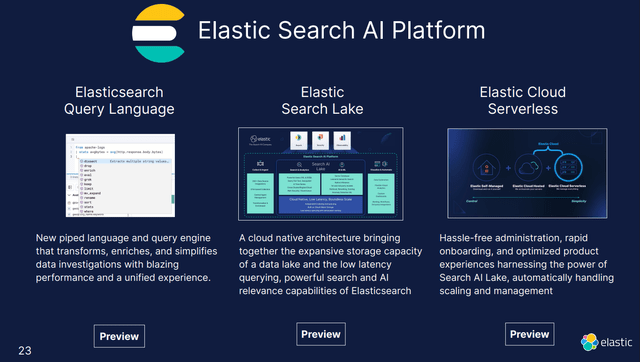

The two biggest additions to the platform to bring the company to the next level are the search AI Lake and the Cloud serverless offering. These two offerings are coming in the next few quarters as they roll this offering out worldwide on the three major hyperscale cloud players. This will allow huge scale and quick search in a cloud-native platform, meaning companies don’t need to give up speed in their data lakes. The serverless offering will give a boost to the small business cohort, as adoption is easier for them. It allows more workload types as well as gives more flexibility for optimization. On the security side, attack discovery will help SOC analysts save time by automatically triaging the alerts helping save time. This will help enrich their SIEM product with a competitive market ripe for disruption with many acquisitions in the industry in recent times. The company also has the ability to scan large language models for corporations and give them a safety assessment to keep those pricey assets safe. These improvements have led to 1000 customers to date using ESTC for AI applications, a number which should grow considerably through 2024. 145 of those customers are significant ones with ARR over $100,000 per year which is significant and growing quickly. Elastic is making the right moves for the future, with growth to come in the coming two years from moves made today to support growth in AI areas. Importantly none of the above is in the guidance, allowing for potential upside if these initiatives end up stronger than expected.

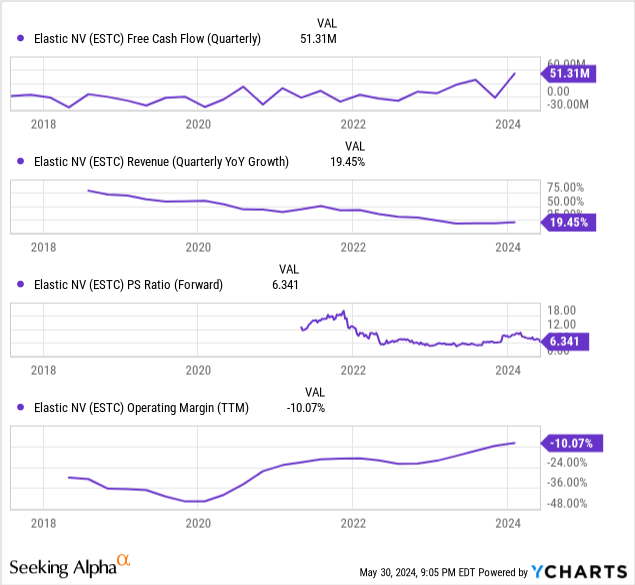

Guidance for the coming fiscal year was set to a prudent 16% revenue growth, even as remaining performance obligations are up 22%. The sector still has significant headwinds with money being expensive and companies focusing on cutting costs wherever possible. Some of this RPO strength is as customers continue to opt for long-term, multi-year commitments – not a problem for Elastic. Some were just early renewals but the long-term nature of customer relationships is a big positive for ESTC. Q4 revenue was $335 million, good for 20% growth with 32% growth in Elastic cloud. This is the main engine driving performance with its speed to market and ability to be deployed anywhere cloud agnostic. It does mean that customers are increasing spend steadily, as suggested by the 110% net retention rate from Q4 results. The macro environment is still being dominated by C-level scrutiny on spend as well as elongated sales cycles. In particular, small and medium-sized businesses are a headwind to growth at the moment. This segment has been flat on revenue for quite some time and ESTC has avoided spending marketing dollars here, for good reason. ESTC continues to focus on customer success for large Global 2000 organizations that benefit most from Elastic. Free cash flow is starting to trend up as you can see below after not being consistently positive.

This is powered by the operating margin that on a GAAP basis has improved to just -10%. The reason for the GAAP losses of $41.1m is mostly stock-based compensation of $66.9m – a staple of technology companies trying to retain top talent. This dilution level is reasonable compared to peers and is growing slightly slower than revenue growth. While revenue growth has slowed to the high teens, the stock has also reflected this at just 6.3x forward sales. This is equal to the trough valuations from 2022 and 2023. This valuation will be a tailwind in the coming Fiscal year 2025 with growth remaining strong and operating margin to increase by 1% at the midpoint. As customers continue to add workloads and AI applications take off we could see growth re-accelerate and cause a significant rerating in the stock. Revenue growth is evening out as you can see, even as other peers have seen significant deceleration over the past six months.

Look through the selloff – Buy rated

If you are looking long-term at the opportunity ESTC has with both search and security, now is a good time to buy shares. Shares are down 30% from the peak earlier this year, but still in a longer-term uptrend since the 2022 software crash. The valuation is now reasonable compared to history with growth at a consistent level and cash flow now significantly positive. Management is doing a good job staying flexible between on-premise and cloud deployments, meeting customers where they are to close deals. AI isn’t the reason to own Elastic shares, it is merely a bonus and those skeptical of the AI narrative can still do well here as it is not baked into any guidance. Under $110 Elastic shares present a great opportunity for long-term investors looking for a quality name in many growing themes in software.