Electric car owner exposes wild $4,000 price difference: ‘Absolute joke’

Electric vehicle (EV) prices are plummeting, with increased competition from Chinese brands like BYD putting downward pressure on the market. But while the upfront price tag is coming down, there is still one area where electric car owners are being slugged with hefty costs.

It is more expensive to insure an EV than it is to insure a combustion engine car and the difference can be hundreds to thousands of dollars. The peak insurance body told Yahoo Finance there were a few factors that played into the higher premiums.

One EV owner recently took to social media to share his surprise at the staggering price difference to insure his Tesla versus his Kia cars.

RELATED

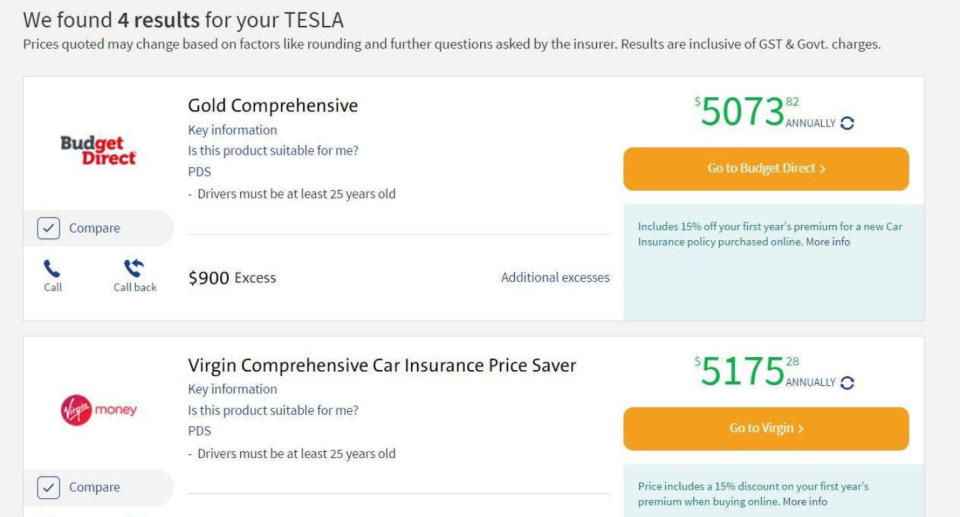

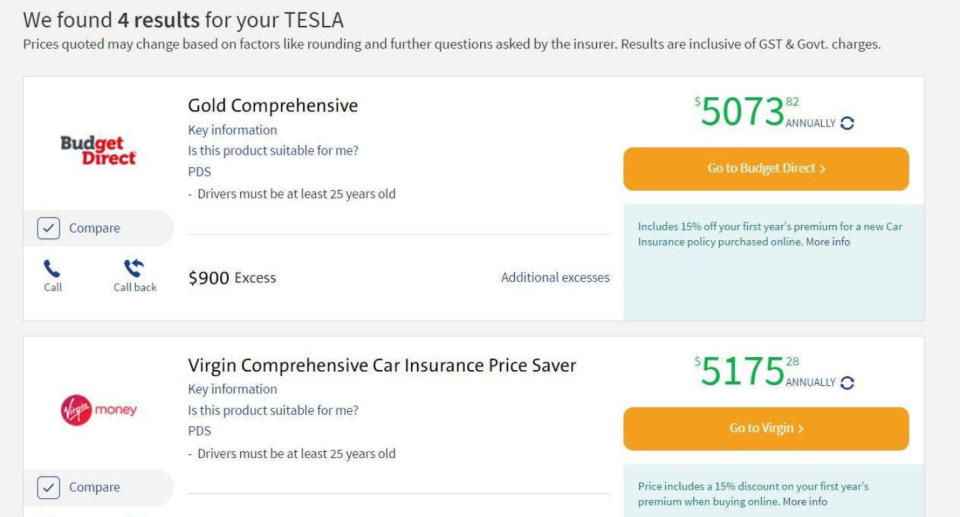

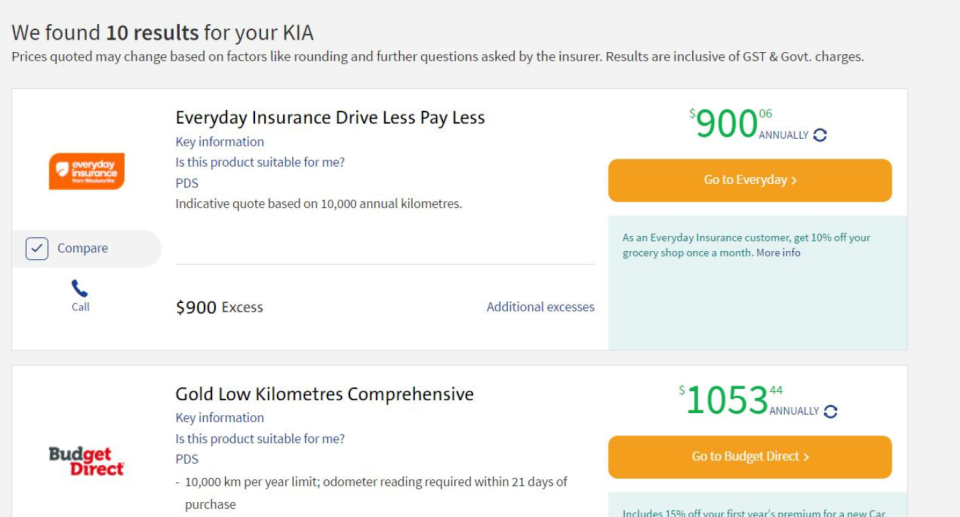

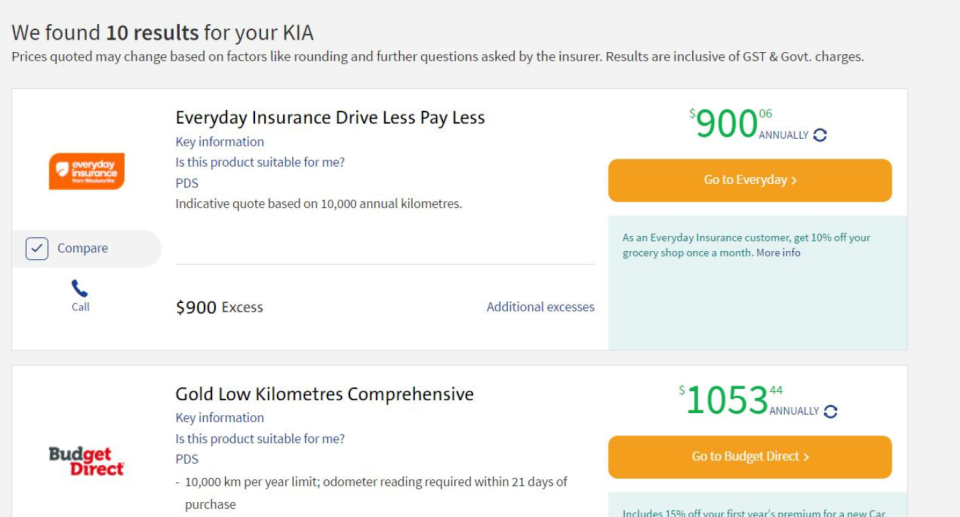

Screenshots show that comprehensive insurance for a Tesla would be between $5,073 and $5,175 based on two quotes from different insurers. In comparison, insurance for his Kia was quoted as being between $900 and $1,053.

“Take a look at the price difference between Tesla under a lease and my Kia which is owned outright,” he said of the $4,000 price difference.

“What an absolute joke.”

Do you have a story to share? Contact tamika.seeto@yahooinc.com

Why are EVs more expensive to insure?

The Insurance Council of Australia (ICA) said the cost of EVs was one factor that made them more expensive to insure.

“EVs are generally more expensive to purchase than internal combustion (IC) vehicles and have more complex systems and components, specifically their motor parts and batteries,” a spokesperson told Yahoo Finance.

“The cost of these parts and the limited number of qualified service centres and technicians contributes to the higher cost of insurance premiums for EVs than IC vehicles.”

The ICA noted that repairing damaged EVs required importing parts to Australia. Other factors playing into the higher premiums included expensive battery replacement costs, which can be between $7,500 and $30,000 or up to 40 per cent of the EV’s total value.

The absence of a local network means most batteries will need to be returned overseas. They also require speciality removal equipment, along with disposal and recycling methods.

More generally, the ICA noted factors like the driver’s age and history, storage, make and model of the vehicle would play into premiums.

Factors like whether the car is under lease can also make your insurance more expensive, according to Finder, compared to you owning it outright.

According to Drive, comprehensive insurance is the second-biggest ongoing expense for Aussie EV owners. On average, it found owners are paying $661 more per year on insurance compared to traditional cars.

Why are EVs dropping in price?

The price of some EVs have plummeted by as much as $20,000. The Nissan Leaf has gone from $50,990 to $39,990, the Polestar 2 2024 Long Range Single Motor from $71,400 to $58,990, while the Tesla Model Y dropped from $72,000 to $55,000.

CarExpert.com founder Paul Maric told Yahoo Finance that increased competition among manufacturers was driving the price war.

“It’s all been spurred on by Chinese brands who have started bringing in much more affordable electric vehicles to what we’re used to,” Maric said.

“And typically what happens with volume brands is they don’t really adjust their pricing after it’s set. But we’ve seen brands like Peugeot take like $20,000 out of some of their electric cars, which is unheard of and it also gives you an idea of how much margin they actually had built into them.”

More Chinese-made EVs are expected to flood the market over the coming month with cars from Aion, Changan, GAC Motor, Geely Auto, Jaecoo, Leapmotor, Skywell, XPeng and Zeekr confirmed to enter the market.

Get the latest Yahoo Finance news – follow us on Facebook, LinkedIn and Instagram.