Electric cars: EU needs 8 times more charging points per year by 2030 to meet CO2 targets – ACEA

Brussels, 29 April 2024 – A new European Automobile Manufacturers’ Association (ACEA) report reveals an alarming gap between the current availability of public charging points for electric cars in the EU and what will be needed in reality to meet CO2-reduction targets.

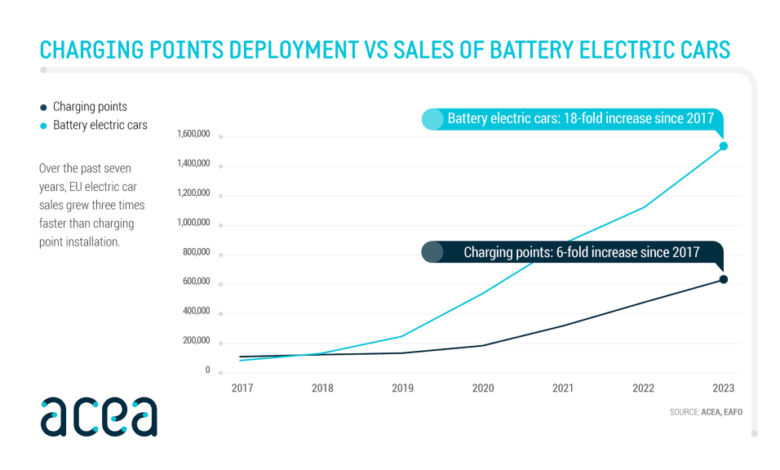

EU electric car sales grew three times faster than charging point installation between 2017 and 2023, ACEA’s report shows. Looking ahead, the EU needs eight times more charging points annually by 2030, according to industry estimations.

“We need mass-market adoption of electric cars in all EU countries to achieve Europe’s ambitious CO2-reduction targets. This will not happen without widespread availability of public charging infrastructure right across the region,” stated ACEA’s Director General, Sigrid de Vries.

“We are very concerned that infrastructure rollout has not kept pace with battery-electric car sales in recent years. What is more, this ‘infrastructure gap’ risks widening in the future – to a much greater extent than European Commission estimates.”

Just over 150,000 public charging points were installed last year across the EU (less than 3,000 per week on average), reaching a total of over 630,000.

According to the European Commission, 3.5 million charging points should be installed by 2030. Reaching this target would mean installing around 410,000 public charging points per year (or nearly 8,000 per week) – almost three times the latest annual installation rate.

However, ACEA estimates that 8.8 million charging points will be needed by 2030. Reaching this would require 1.2 million chargers to be installed per year (or over 22,000 per week) – eight times the latest annual installation rate.

“Easy access to public charging points is not ‘nice to have’, but an essential condition to decarbonise road transport, in addition to market support and a competitive manufacturing framework in Europe. Investments in public charging infrastructure must be urgently ramped up if we are to close the infrastructure gap and meet climate targets,” cautioned de Vries.

EU electric car sales grew three times faster than charging point installation between 2017 and 2023, ACEA’s report shows. Looking ahead, the EU needs eight times more charging points annually by 2030.

Notes for editors

- “Charging ahead: accelerating the rollout of EU electric vehicle charging infrastructure” – is the first in a series of new ACEA Automotive Insights reports analysing key automotive trends and data

- The European Commission estimated the need for about 3.5 million publicly accessible charging points in 2030: https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_22_7785

- There is a significant difference between the Commission and ACEA estimations of the number of charging points needed by 2030 due to several factors:

- the Commission underestimates the number of vehicles on EU roads that will need a charger by 2030: their estimate is 30 million, versus 65 million as estimated by Strategy& and Fraunhofer ISI and used in ACEA calculations. ACEA figures include battery-electric vans, which are primarily charged using the same infrastructure as cars, as well as plug-in hybrid electric vehicles, whereas the Commission only counts battery-electric cars;the Commission assumes significantly lower vehicle energy consumption compared to recent real-world monitoring figures (14.8 kWh/100 km for battery electric vehicles (BEV) and 19.2kWh/100km for plug-in hybrid electric vehicles (PHEV), versus 20 kWh/100km for BEV and PHEV by ACEA); and

- the European Commission acknowledges that the Alternative Fuels Infrastructure Regulation (AFIR) requirements represent the minimum coverage needed, and will be insufficient to enable the CO2 targets for cars and vans to be met.

About ACEA

- The European Automobile Manufacturers’ Association (ACEA) represents the 15 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Nissan, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group

- Visit www.acea.auto for more information about ACEA, and follow us on http://www.twitter.com/ACEA_auto or http://www.linkedin.com/company/ACEA/

Contact:

- Cara McLaughlin, Communications Director, cm@acea.auto, +32 485 88 66 47

- Ben Kennard, Content Editor and Press Manager, bk@acea.auto, +32 485 88 66 44

About the EU automobile industry

- 12.9 million Europeans work in the automotive sector

- 8.3% of all manufacturing jobs in the EU

- €392.2 billion in tax revenue for European governments

- €101.9 billion trade surplus for the European Union

- Over 7% of EU GDP generated by the auto industry

- €59.1 billion in R&D spending annually, 31% of EU total