Electric Light Commercial Vehicle Market Size Expected to Reach USD 868.29 Bn by 2032

Electric Light Commercial Vehicle Market Size Expected to Reach USD 868.29 Bn by 2032

Ottawa, April 26, 2024 (GLOBE NEWSWIRE) — The global

electric light commercial vehicle market

size surpassed USD 289.38 billion in 2023 and is predicted to hit around USD 803.97 billion by 2031, a study published by Towards Automotive a sister firm of Precedence Research.

Light commercial vehicles (LCVs) play a crucial role in various industries as they provide a versatile and efficient means of transporting goods. These vehicles typically have at least four wheels and are designed specifically for the transportation of goods rather than passengers. One defining characteristic of LCVs is their mass, which distinguishes them from larger trucks. The mass limit for LCVs varies by country and region but typically falls between 3.5 and 7 metric tonnes.

Download a short version of this report @

https://www.towardsautomotive.com/insight-sample/1214

The use of light commercial vehicles has witnessed a steady increase across different sectors, driven by their flexibility, affordability, and ability to navigate urban environments with ease. As applications in industries such as e-commerce, logistics, construction, and utilities continue to expand, the demand for high-performance and powerful LCVs has also surged.

Several companies have capitalized on this growing demand by introducing innovative LCV models tailored to the specific needs of different industries. These product launches have not only contributed to the growth of the LCV market but have also had a positive impact on the global economy by creating jobs and stimulating economic activity.

However, the market for light commercial vehicles faces challenges, including the implementation of stringent energy standards and emissions regulations. Meeting these standards requires investment in new technologies and engineering solutions, which can increase manufacturing costs and affect profit margins for LCV manufacturers. Additionally, the availability of flexible vehicles that can adapt to changing market demands remains a concern for industry players.

Despite these challenges, the outlook for the LCV market remains optimistic, fueled by various factors. Government initiatives aimed at promoting electric vehicles and reducing emissions are expected to drive the adoption of electric LCVs, especially in the logistics sector. The increasing demand for electric trucks as a sustainable transportation solution is projected to positively impact the global LCV market, offering growth opportunities for manufacturers and suppliers alike.

You can place an order or ask any questions, please feel free to contact us at

sales@towardsautomotive.com

Development of the e-commerce industry

E-commerce has revolutionized the way goods are bought and sold, with freight forwarders playing a crucial role in transporting products from warehouses to customers’ doorsteps. Third-party logistics (3PL) services have emerged as key facilitators in managing and tracking e-commerce shipments, allowing businesses to focus on core activities like merchandising. Major players in the logistics industry, such as FedEx, XPO Logistics, and DHL, leverage a diverse fleet of commercial vehicles to ensure timely delivery of goods to their destination points.

In urban environments where last-mile delivery is critical, the use of small commercial vehicles has become predominant due to their agility and flexibility. Despite their higher fuel consumption compared to heavy commercial vehicles, small commercial vehicles are preferred for their ability to navigate congested city streets efficiently. This has led to a significant expansion of commercial vehicle fleets operated by logistics providers.

The automotive industry is also witnessing a shift towards electric vehicles (EVs) in the commercial segment. While electric cars for personal use have gained traction, the adoption of electric commercial vehicles is considered a crucial step towards achieving sustainable transportation and reducing carbon emissions. In recent years, there has been a notable increase in electric vehicle registrations in the light commercial vehicle (LCV) market, driven by factors such as lower ownership and operating costs.

Fleet managers, in particular, are inclined towards electric LCVs due to their cost-effectiveness and predictable usage patterns. The ability to accurately predict vehicle movements allows fleet managers to optimize routes, manage operating expenses, and implement efficient charging strategies. This strategic advantage positions electric LCVs as preferred options for fleet operators looking to embrace sustainable transportation solutions while reducing overall operational costs.

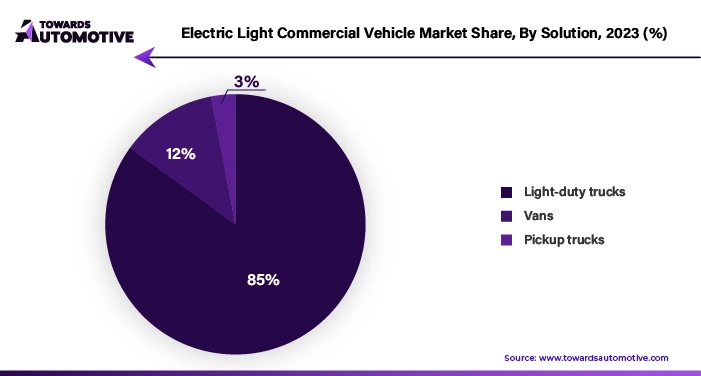

Light Commercial Pick-up Trucks is the largest segment by Sub Body Type.

- E-commerce and the logistics sector are driving forces behind the automotive industry, with online sales and e-commerce experiencing significant growth fueled by increased internet and smartphone usage.

- The demand for light commercial vehicles has surged to facilitate timely delivery of goods to customers, with global production expected to reach 18,593.85 thousand units in 2021, up from 17,217.99 thousand units.

- Despite challenges such as the COVID-19 pandemic, which initially disrupted supply chains, the rise in online shopping has bolstered the e-commerce market, with global revenues reaching US$26.7 trillion in 2021.

- The pandemic accelerated the shift towards online shopping, leading to a substantial increase in the number and share of online shoppers worldwide.

- Major automotive manufacturers like Daimler, Nissan, Ford, and Renault have witnessed a significant uptick in e-commerce sales, further driving growth in the logistics sector.

- Trucks and pickup trucks play a crucial role in meeting the transportation demand for e-commerce deliveries, thereby positively impacting the global light commercial vehicle market.

Development of the automotive industry

In recent years, the automotive industry has witnessed substantial growth driven by advancements in technology and the introduction of vehicles equipped with fuel-saving technologies. Leading companies like Ashok Leyland and Tata Motors have been pivotal in this growth trajectory, developing and launching advanced commercial vehicles in various markets worldwide. For instance, in September 2020, Ashok Leyland announced plans to introduce a new range of light commercial vehicles (LCVs) aimed at mitigating potential business risks associated with future job losses.

Moreover, major players in the industry are actively innovating existing products to enhance their competitiveness and profitability in the market. An illustrative example is Nissan, which unveiled the latest update for its light commercial vehicle, the NV300 Combi, in February 2021. This update incorporates safety enhancements along with improvements in the train and engine to deliver superior performance.

These developments and technological innovations underscore the continued growth trajectory of the global light commercial vehicle market. As companies strive to meet evolving consumer demands and regulatory requirements, the introduction of advanced commercial vehicles with enhanced features and capabilities is expected to further drive market expansion during the forecast period.

Ford Motor Company and Mercedes-Benz, along with other key players in the electric vehicle (EV) industry, are strategically positioning themselves to capitalize on the rapidly expanding EV market. To achieve this, they are adopting various strategies aimed at enhancing their businesses and accelerating growth in the EV segment.

Investment in Research and Development: Ford and Mercedes-Benz are heavily investing in research and development to drive advancements in EV technology. This includes improving battery efficiency, enhancing charging infrastructure, boosting vehicle performance, and innovating in areas such as autonomous driving and connectivity. By staying at the forefront of technological innovation, these companies aim to differentiate themselves in the competitive EV market and meet evolving customer needs.

Strategic Partnerships: Both Ford and Mercedes-Benz are forging partnerships with other automakers, technology firms, and EV suppliers to leverage additional expertise and resources. These partnerships may involve joint ventures, technology agreements, or collaborative development efforts to expedite the introduction of new EV models to the market. By pooling resources and knowledge, they seek to accelerate innovation and expand their EV portfolios more efficiently.

Expansion of Charging Infrastructure: Recognizing the importance of charging infrastructure in facilitating the widespread adoption of EVs, Ford and Mercedes-Benz are investing in plans to expand charging networks. This includes collaborating with energy companies, government agencies, and private investors to establish a robust network of charging stations. By addressing consumers’ concerns about range anxiety and accessibility, they aim to make EV ownership more convenient and appealing.

Advocacy for Government Support: Ford and Mercedes-Benz are actively lobbying governments to implement policies that promote the adoption of EVs. This involves advocating for incentives such as tax credits, rebates, and subsidies for EV purchases, as well as policies that incentivize the development of clean transportation solutions. By fostering a supportive regulatory environment, they seek to create a more favorable market for EVs and drive economic growth in the process.

Implementation of Stringent Emission Norms

The escalating concerns regarding carbon emissions and their environmental impact have prompted governments worldwide to enact stringent energy standards, significantly affecting the growth of internal combustion engines in light commercial vehicles (LCVs). In response to these concerns, regulatory bodies like the European Union (EU) have implemented strict CO2 emission targets for LCVs to curb their environmental footprint.

For instance, in 2018, the EU set a CO2 emission target of 175 grams per kilometer for light commercial vehicles. Subsequently, in April 2019, the EU introduced even more rigorous carbon dioxide emissions standards for both passenger cars and LCVs, with the aim of further reducing emissions. These new standards, which came into effect in January 2020, lowered the permissible CO2 emissions for LCVs to 147 grams per kilometer. The ultimate goal of these regulations is to achieve a 31% reduction in average CO2 emissions from LCVs by 2030 compared to 2021 levels.

To enforce compliance with these emission targets, the EU has imposed penalties in the form of excess emissions charges on manufacturers whose registered LCVs exceed the specified CO2 emissions threshold. Specifically, manufacturers will face an excess emissions price of 112.15 grams per kilometer for every LCV that surpasses the emissions target.

Moreover, the stringent CO2 emission regulations have had ripple effects throughout the automotive industry, impacting the production of equipment and components used in LCV manufacturing. These restrictions have posed challenges to manufacturers and suppliers alike, thereby impeding the growth trajectory of the global light commercial vehicle market.

Overall, the imposition of strict energy standards and CO2 emission regulations underscores the urgent need for greener and more sustainable transportation solutions. While these measures present challenges for the automotive industry, they also catalyze innovation and drive the adoption of cleaner technologies in the pursuit of a more environmentally conscious future.

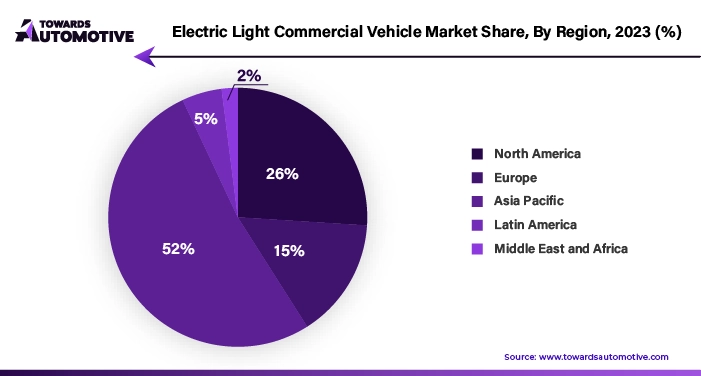

Asia-Pacific Is Expected to Be the Leading Market

The Asia-Pacific region is poised to assert its dominance in the global electric light commercial vehicle market, capturing a substantial more than 50% share by 2023. This trend is fueled by a convergence of factors contributing to the region’s leadership in electric vehicle adoption. Governments in key countries such as China, Japan, and South Korea have implemented robust policies and incentives aimed at promoting the widespread use of electric light commercial vehicles. These initiatives not only drive investment in electric vehicle production but also incentivize businesses to transition their fleets toward cleaner, more sustainable alternatives.

Heightened concerns surrounding poor air quality and pollution in densely populated urban areas further underscore the appeal of electric light commercial vehicles. As governments and citizens increasingly prioritize environmental sustainability, electric vehicles emerge as an attractive solution for mitigating the adverse impacts of vehicle emissions on air quality and public health.

Moreover, the burgeoning growth of e-commerce, particularly in countries like India, has emerged as a significant catalyst propelling the electric vehicle market in the Asia-Pacific region. The surge in online shopping activities has led to a heightened demand for efficient and environmentally friendly shipping options, driving businesses to adopt electric light commercial vehicles for last-mile deliveries and logistics operations. This trend not only aligns with sustainability goals but also addresses the pressing need for more energy-efficient and eco-friendly transportation solutions in the rapidly evolving landscape of urban commerce.

The convergence of strong government policies, growing environmental awareness, and the expanding e-commerce sector positions the Asia-Pacific region as a powerhouse in the global electric light commercial vehicle market. As businesses and governments alike embrace the transition towards electric mobility, the region is poised to lead the way in shaping the future of sustainable transportation.

Electric Light Commercial Vehicle Market Key Players

- Bollinger

- Chevrolet

- Ford Motor Company

- Fuso

- Maxus (SAIC Motor Corporation)

- Mercedes- Benz

- Renault Group

- Rivian Automotive LLC

- Tesla Inc.

- Volkswagen

-

Workhorse Group Inc.

Electric Light Commercial Vehicle Market News

- In September 2023, Ford Motor Company announced a new initiative aimed at promoting the adoption of electric vehicles (EVs) in urban areas. As part of this program, customers purchasing select models of Ford’s electric cars and vans will receive a significant rebate of up to $5,000, along with complimentary installation of home charging stations. This incentive package is designed to make EV ownership more accessible and affordable for urban dwellers, contributing to the transition towards sustainable transportation solutions.

- In December 2022, Tesla Inc. unveiled its plans to expand its presence in the electric commercial vehicle market with the introduction of the Tesla Semi truck. The Tesla Semi is set to revolutionize the long-haul trucking industry with its groundbreaking features, including autonomous driving capabilities, enhanced safety systems, and impressive range. With production scheduled to ramp up in 2023, Tesla aims to address the growing demand for emission-free freight transport and accelerate the adoption of electric trucks on a global scale.

- Volvo Group announced in February 2022 its collaboration with leading energy company Shell to establish a network of high-powered charging stations for electric trucks across Europe. The initiative, known as “Project Tundra,” aims to address the critical infrastructure gap hindering the widespread adoption of electric commercial vehicles. By deploying ultra-fast charging stations along major transportation routes, Volvo and Shell seek to enable long-haul electric trucking and support the transition towards carbon-neutral freight transport in Europe.

- General Motors (GM) revealed plans in April 2022 to invest $7 billion in electric vehicle manufacturing facilities in Michigan, USA. This investment will facilitate the production of a new lineup of electric pickup trucks and vans, targeting both consumer and commercial markets. GM’s commitment to expanding its electric vehicle portfolio underscores its dedication to sustainability and innovation, positioning the company as a leader in the transition to electric mobility.

-

In March 2023, Volkswagen Commercial Vehicles introduced the ID. Buzz Cargo electric van, designed to revolutionize urban delivery operations. Equipped with cutting-edge technology and advanced connectivity features, the ID. Buzz Cargo offers unparalleled efficiency and versatility for last-mile logistics. Volkswagen’s entry into the electric commercial vehicle segment reflects its commitment to sustainable transportation solutions and its vision for a zero-emission future.

Browse More Insights of Towards Automotive:

-

The

traffic signal recognition market

size is projected to rise from USD 36.22 billion in 2023 to expand to USD 51.49 billion by 2032, reflecting 4.54% CAGR between 2023 and 2032.

-

The

low-emission vehicle market

size to surge from USD 167.97 billion in 2023 and is expected to reach USD 488.08 billion by 2032, expanding at a CAGR of 12.58% during the forecast period.

-

The

off-highway vehicle engine market

size calculated USD 43.31 billion in 2023 and is projected to achieve USD 78.18 billion by 2032, with a CAGR of 6.78% during the forecast period.

-

The

automotive lighting market

size is estimated at USD 39.25 billion in 2024 to calculate USD 58.25 billion by 2032, growing at a CAGR of 5.21% during the forecast period.

-

The

vehicle security systems market

size was valued at USD 11.40 billion in 2023 and is expected to reach USD 18.74 billion by 2032, growing at CAGR of 4.86% during the forecast period.

-

The

automotive alternator market

size is was at USD 26.89 billion in 2024 and is expected to reach USD 46.46 billion by 2032, growing at a CAGR of 7.40% during the forecast period.

-

The

automotive relay market

size is expected to grow from USD 16.62 billion in 2023 to USD 34.29 billion in 2032, expanding at a CAGR of 8.38% during the forecast period.

-

The

automotive fault circuit controller market

size was projected USD 1.85 billion in 2022 and is expected to reach USD 6.33 billion in 2032, increasing at CAGR of 11.92% from 2023 to 2032.

-

The

automotive torque converter market

size to rise from USD 3.72 billion in 2023 to reach USD 6.11 billion by 2032, increasing at CAGR above 5.56% between 2023 and 2032.

-

The

automotive gears market

size to rise from USD 5.79 billion in 2023 and predicted to hit USD 10.27 billion by 2032, expanding at 6.58% CAGR during the forecast period.

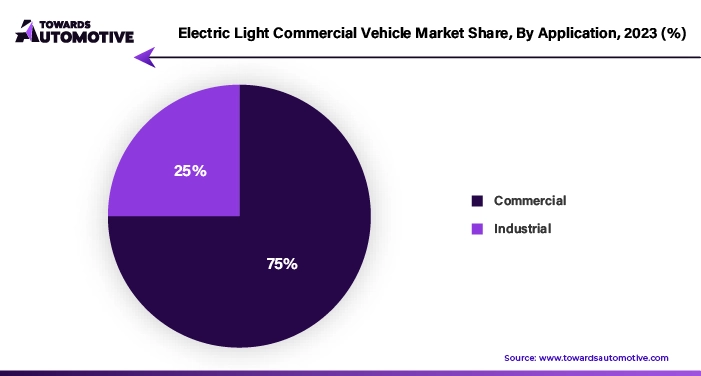

Market Segmentation

By Solution

- Light-duty Trucks

- Vans

-

Pickup Trucks

By Propulsion Type

By GVW

- Below 6,000 lbs

- 6,001 lbs- 10,000 lbs

-

10,001 lbs – 14,000 lbs

By Application

By Geography

- North America

- Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

-

Latin America

- Brazil

- Rest of Latin America

-

Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Acquire our comprehensive analysis today @

https://www.towardsautomotive.com/price/1214

You can place an order or ask any questions, please feel free to contact us at

sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive

:

Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

Web:

https://www.precedenceresearch.com

For Latest Update Follow Us:

https://www.linkedin.com/company/towards-automotive