Electric vehicle, recycling startups seek capital to expand

With many industries embracing electrification, Cenergy, a startup specializing in vanadium redox flow batteries is seeking investments of US$11.5 million over the next five years.

It hopes to get $4 million this year to set up a manufacturing plant.

Lithium-ion and redox flow batteries, with vanadium being the most common, will be the two most important battery technologies in the next 10-15 years, according to consulting firm Navigant.

A Cenergy spokesperson said: “If we can build the factory, their [redox flow batteries’] prices can compete with lithium-ion batteries. Their lifespan is three times longer.”

Electric motorcycle company Selex Motors is looking for $12 million to expand.

Its co-founder and CEO Nguyen Huou Phuoc Nguyen said it has received funding from the Asian Development Bank but is looking for more investors and partners.

Selex makes delivery vehicles with batteries that can be swapped out in just two minutes at nearly 70 stations in HCMC and Hanoi.

The company is currently a supplier to delivery apps like Grab, Gojek, Lazada, ShopeeFood, and Viettel Post.

|

Nguyen Huou Phuoc Nguyen, co-founder and CEO of Selex Motors, at a meeting with investors on May 23, 2024. Photo courtesy of the Climate Finance Accelerator Vietnam |

Grac, a provider of digital solutions for waste management and recycling in Vietnam, needs $500,000 to grow in the northern market and expand nationwide in the next three years.

LUPP!, a joint venture between Dutch recycling startup UPP! UpCycling Plastic and environmental services company Lagom Vietnam, is securing funds for a pilot plant that transforms dirty plastic bags into construction materials.

Hai Ngo, LUPP!’s project manager, said: “The plant is expected to have an annual capacity of 1,800 tons, with very competitive input costs because no one buys trash. We process highly contaminated and dirty waste to produce products cheaper and more durable than wood or cement.”

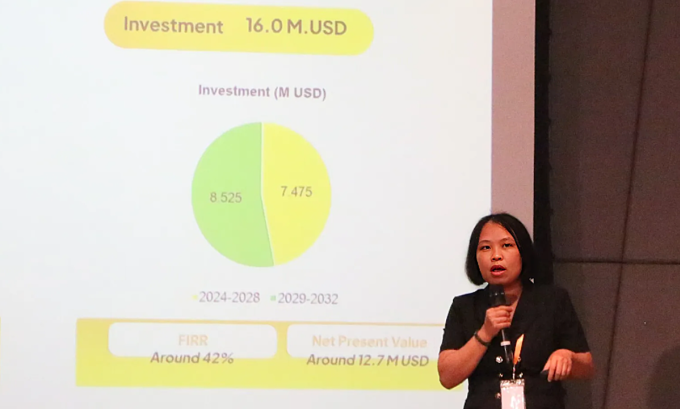

Other projects seeking investors include starch-based bioplastic startup Babio and plant-based meat producer Emmay & Colleagues.

|

|

A representative of Babio sought US$16 million in investment at a meeting with investors on May 23, 2024. Photo courtesy of the Climate Finance Accelerator Vietnam |

The demand for investment in sustainable, low-emission projects has been increasing recently, according to the Climate Finance Accelerator Vietnam, a program that helps climate projects improve their bankability and solicit investment.

Eleven projects have been chosen for the program, and they are seeking a total of $436 million in investments, CFA said.

Climate startups’ funding demand is rising as they see the growth potential in Vietnam’s green economy.

With annual sales expected to top 1.5 million units by 2030, the country currently has the largest electric motorcycle market in Southeast Asia and the second largest in the world after China, according to HSBC.

“We predict that electric motorcycles will lead the development of EVs in Vietnam,” the bank said in a recent report.

Investors are also increasingly interested in green projects.

Speaking at the recent “CFA in-country” event in HCMC, Emily Hamblin, the British consul general in HCMC, said projects in the CFA program have garnered significant attention from investors thanks to their “interesting and innovative approaches.”

Nguyen Hoai Phuong, Southeast Asia regional director at sustainable infrastructure investment firm InfraCo Asia, said an increasing number of foreign investors are interested in green projects in Vietnam.

“Investment in this sector is expected to increase soon.”

Abhinav Goyal, a CFA Vietnam representative and PwC Vietnam’s director of capital projects and infrastructure, said sustainable startups should carefully craft a compelling story that resonates with investors in addition to focusing on technical and financial aspects.

“The project should also align with the country’s development direction, as investors are very interested in scalability. Additionally, the project should have an impact on people and the job market.”