Electric Vehicle Tariffs Put Geopolitics Before Climate Change

The winner of the escalating, zero-sum green technology trade war between the United States and China may well be climate change. In the latest surge of election-year techno-nationalism, to protect and advance his green transition—and to out-Trump former U.S. President Donald Trump—President Joe Biden last week imposed a wave of new tariffs on Chinese-made electric vehicles (EVs), batteries, and solar cells as well as other Chinese goods, in addition to retaining all of Trump’s tariffs on China.

There’s no question that China’s EV industry, which produces more than half the world’s EVs and already accounts for 60 percent of global EV sales, is positioned to—as Tesla chief Elon Musk recently quipped—“demolish” all global rivals unless barriers put in place. Similarly, the International Energy Agency reported in July 2022 that China boasts an 80 percent share of all stages in solar panel production, as well as dominating the production and refinement of batteries, critical minerals, and other components of the green tech supply chain.

And the wave of exports is just gearing up: China has recently shifted its state-driven industrial strategy away from property and infrastructure to focus instead on green tech manufacturing. Beijing is hoping to export its economy out of its current economic maladies.

Biden quadrupled EV tariffs, which will reach 100 percent. Tariffs on lithium-ion EV batteries and battery parts more than tripled, increasing to 25 percent, and those on solar cells doubled, reaching 50 percent. In a tacit acknowledgement of China’s dominance in key sectors, some of the tariffs—such as those targeting non-EV lithium-ion batteries, graphite, and permanent magnets—are scheduled to be phased in by 2026. In order to give the U.S. industry and friendshoring partners time to catch up.

In some products, particularly EVs, Biden’s gambit appeared preemptive, aimed at avoiding an anticipated China Shock 2.0, a new wave of cheap Chinese manufactured goods that would likely impede the U.S. manufacturing revitalization. There are very few Chinese EVs sold in the United States thus far, but the industry has been anticipating a wave of arrivals in a sector where China is widely acknowledged to be several years ahead of the United States.

The European Union, where Chinese EVs comprise more than 20 percent of the market, is likely to also impose some tariffs on them, and a host of industrializing nations—India, Brazil, Mexico, and Indonesia—are registering complaints about cheap manufactured goods from China.

Tariffs are about buying time—to become competitive or to negotiate compromises. But the pressures of climate change limit the timeline. There is a tension between realizing economic nationalist goals and immediacy of climate change. A Rhodium Group report published in March 2023 concluded the current U.S. energy transition efforts (primarily addressed in the Inflation Reduction Ac)t—assuming that they continue post-November—will fall short.

The paradox is that cheap Chinese solar and EVs and batteries have helped accelerate the green transition even as they threaten U.S. industry: China’s oversupply threatening the U.S. solar power industry also drove down prices more than 80 percent. For the United States, the bad news is that while tariffs may protect some jobs, the effect of decoupling from China’s green tech may inadvertently be the opposite of U.S. intent: Biden may be putting his green transition at risk, at best delaying goals and raising costs.

Why? To achieve the 2015 Paris Agreement goal of keeping global warming to less than 2 degrees Celsius compared to preindustrial levels, Biden has committed to the ambitious climate targets set in the Inflation Reduction Act: a 50 percent to 52 percent reduction in greenhouse gas emissions (compared to 2005 levels) by 2030, zero net emissions by 2050, and 50 percent all new vehicles being zero-emission by 2030.

These targets are unlikely to be reached in their desired time frames while also decoupling from Chinese green tech. Playing catch-up is not easy, particularly at a time of low growth, high interest rates, and the challenge of disentangling complex global supply chains.

Biden’s agent of change to revive green and other strategic manufacturing is his industrial policy, mainly comprised of three seminal legislative acts: the Bipartisan Infrastructure Deal, the CHIPS and Science Act, and the Inflation Reduction Act. The problem is not industrial policy per se, which is a U.S. tradition that has ranged from Alexander Hamilton’s 1791 Report on the Subject of Manufactures to the Defense Advanced Research Projects Agency financing the digital age. Rather, with regard to green tech, the issues are an incomplete, overly rigid, and cumbersome industrial policy that misses parts of the supply chain, and a polarized political environment in which some people are still denying climate change even as their coasts sink from ocean rise.

Incentivizing100% of EV batteries to be manufactured in North America may be a noble goal of the IRA. But given China’s dominance in mining critical minerals (and the dirty business of processing them), its lead on advanced battery tech, and its huge EV manufacturing edge, the act may be making the perfect the enemy of the good. How different would the EV picture look if the Inflation Reduction Act had required only 70 percent US components, with a more flexible timeline for getting to 100 percent? In order to qualify for the full tax credit?

At present, only 22 models of more than 110 electric vehicles available for sale in the United States are eligible for the full $7,500 consumer tax credit in the act, which was designed to incentivize purchases. EU and Japanese complaints forced the White House to revise rules that initially gave the credits only to imports from nations with which the United States had a free trade agreement. The United States had none with the EU or Japan, so Biden created a loophole allowing leased EVs of any origin to access $7,500. Recently, the administration also gave a two-year exemption to South Korean automakers using Chinese graphite (China refines more than 90% of the world’s graphite) so their vehicles could retain the $7,500 tax credit. This hints at the limits of “friendshoring,” – rewiring complex supply chains to include only allies and trusted pasrtners”

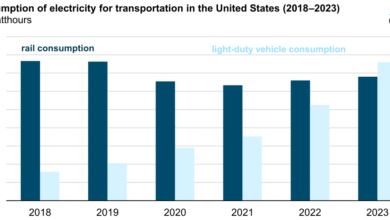

There are real questions about whether tariff protection can adequately boost the U.S. auto industry in the face of cooling EV demand and political headwinds. Incentivized by the Inflation Reduction Act, EV sales have grown rapidly—a record 1.2 million sold in 2023—but still comprised less than 8 percent of U.S. car sales, and EVs make up just 1 percent of registered cars on the road. Automakers are scaling back EV production and promoting hybrids instead. High prices and limited range appear to be some of the main drivers sapping the euphoria: A $7.5 billion program in the Bipartisan Infrastructure Act to build charging stations across the nation has, after two years, resulted in just seven new charging stations of the 500,000 envisioned in Biden’s green transition by 2026.

Still more problematic is the impact of political polarization on EVs. A Republican Party (with its share of climate change deniers) that seems to see preventing the future as an organizing principle is opposing a green transition and EVs in particular. A recent Pew Research Center poll found that just 12 percent of Republicans and Republican-leaning respondents viewed climate change as a priority. Trump—the party’s presumptive presidential nominee—is campaigning against EVs as an existential issue; EVs, seen as “woke” to some Republicans, have become part of the culture wars. In mid-May, Florida Gov. Ron DeSantis signed a law banning references to climate change in state law as well as prohibiting offshore wind turbines in state waters. Some red states—even those leading in wind and solar energy production—are trying to block renewable energy.

What does all this add up to? In between warnings of the apparent dangers posed by Beijing, U.S. Secretary of State Antony Blinken said in a major 2023 China policy speech that “China is also integral to the global economy and to our ability to solve challenges from climate to COVID.” But administration rhetoric about competing and cooperating notwithstanding, Biden’s policies to achieve green tech separation from China say the opposite.

This may be the right course, and China has certainly earned the pushback. But the data suggests that this burgeoning economic nationalism is more likely to complicate rather than accelerate the U.S. energy transition. The current green tech predicament was long in the making. While the United States was debating whether climate change was a hoax and fighting forever wars, China identified advanced manufacturing and green tech as the next wave of growth, and a decade ago, it launched its Made in China 2025 plan to achieve autonomous production of what Beijing defined as strategic sectors, green tech beingf a priority

The fraught economic relationship with China has echoes of the 1980s fears of being overtaken by a rising economic power. In the ’80s, the trade war was with Japan Inc running large surpluses and threatening the U.S. electronics industry. The response was multifaceted. There was industrial policy, the government creation of SEMATECH—a manufacturing research consortium—to revitalize the U.S. semiconductor sector, with mixed results. There were tariffs and quotas. Most dramatically, there was the Plaza Accord, a 1985 agreement intended to realign the Japanese yen with the U.S. dollar and other currencies.

The Plaza Accord helped tamp down anti-Japanese frenzy, but perhaps the biggest difference was Japanese investment in the United States, which reached a record $721 billion in 2021, and Japanese companies employ nearly 1 million U.S. workers. U.S. automakers also diffused Japanese management techniques and technology, becoming more competitive.

Are there lessons from Japan to apply to our China dilemma? Of course, Japan is a U.S. ally. But like the EU, Japan was also an economic competitor. Some observers are considering a Plaza Accord 2.0. But currency misalignment is not the major problem. A new agreement would need to involve World Trade Organization negotiations on subsidies and transparency. But it is not clear how to define or measure subsidies, rendering such an exercise problematic and protracted, especially as Biden’s industrial policy bears some resemblance to China’s.

What about China transferring tech in the U.S. direction for a change? China could build EV, battery, and solar factories in the United States, hiring American workers in the process. But in the fraught, demonized political climate, that would spark congressional outrage. In fact, it already has.

When Ford announced in February 2023 that it would license advanced battery tech from CATL, China’s largest battery firm, to build a factory in Michigan, lawmakers asked the White House to investigate. Ford scaled back its plant. But the reality is that China leads the United States in battery tech, with lighter, faster-charging, and cheaper lithium—and next generation sodium—batteries. Ford sought to transfer lithium-iron phosphate CATL tech to the United States in order to learn the technology, which U.S. firms don’t yet produce at scale, and to be more competitive.

An Economist headline from July 2023 expressed a widely shared concern: “A battery supply chain that excludes China looks impossible.” Thus, it is no surprise that one result of Trump/Biden tech tariffs is that friendshoring-driven imports from Southeast Asia and India are booming—but they are mostly from reassembled Chinese components.

The United States, still a global leader in innovation, could—with time and money—create alternate supply chains. There are ample minerals outside of China, though mining permits and processing would take years. But the pace of climate change does not offer that luxury.

Protectionism has its costs and consequences. The energy consultancy A Wood Mackenzie report published in February found that without China, the cost of a U.S. green transition would be 20 percent higher. The U.S. green transition will occur, but probably not close to the time scale envisioned. The impact of China’s EVs and array of green tech will likely be miniscule at best in the United States, but they will permeate markets in Europe and the global south. This will almost constrain market opportunities for competing green tech from the United States.

At the end of the day, this green tech story highlights both a growing fragmentation of the trade and financial order, increasingly driven by national security imperatives. But more fundamentally, it suggests that zero-sum great-power competition and efforts to address existential global problems are inherently hard causes to reconcile.