Elon Musk Keeps Talking About the Future of Robotics With Optimus, but This Phenomenal Growth Stock Has Already Been Using Robots in Restaurants for Over a Year.

This is a high-tech investment idea that’s still easy to understand.

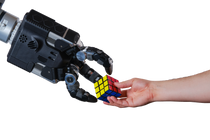

In September 2022, a humanoid robot prototype sauntered out on stage for Tesla (TSLA -5.55%) at its AI Day presentation. It’s called Optimus, and many investors believe that the future potential of Tesla stock hinges on its success or failure.

The outsized expectations placed on Optimus come from none other than Tesla CEO Elon Musk himself. His goal is simple but ambitious: Musk wants multiple Optimus robots in every household around the world performing menial tasks for their owners.

Prior to its unveiling, Musk talked about Optimus at a shareholder meeting, saying, “My prediction is that the majority of Tesla’s long-term value will be Optimus.” And he’s not bashful about his conviction, saying that it’s a prediction he’s “very confident of.”

Musk’s optimism for Optimus is unrelenting. In Tesla’s earnings call earlier in April, he said, “I think Optimus will be more valuable than everything else combined.”

In Musk’s opinion, “everything else” is worth trillions of dollars. This is why investors are so excited when he says that Optimus will be worth even more than this on its own.

However, if there’s a downside to the excitement over Optimus, it’s the uncertain timetable. In the recent conference call, Musk said commercial availability might come by the end of 2025. But the timetable has been pushed back before. Furthermore, not only do investors have to wait for launch, scaling something so ambitious could take years as well.

For those who love the idea of investing in robots doing human tasks, there’s a little-known restaurant stock that’s already got robot servers in its locations today.

The sushi restaurant chain taking the U.S. by storm

In June 2022, Kura Sushi (KRUS -0.65%) rolled out robot servers at its restaurants. The KuraBot — or Kur-B — brings diners their drinks or condiments. Granted, it’s not a humanoid robot like Optimus, and it has limited functions. But it’s nonetheless part of what makes Kura Sushi such an interesting investment opportunity.

Kura Japan has operated in Japan for over four decades and has over 550 locations — meaning it’s quite successful. The company decided to export the concept to the U.S. in 2009 under the Kura Sushi name. Kura Sushi is a subsidiary of Kura Japan, with the parent company owning about a third of the Class A shares.

Having only started in the U.S. in 2009, Kura Sushi is still small — it had 59 locations as of Feb. 29. But these locations excel when it comes to sales volume. On average, these restaurants did $4.3 million in sales in its fiscal 2023, or about 40% more than the average location for Chipotle Mexican Grill.

Kura Sushi has high sales volume already, but it’s consistently still going up. This is measured with a metric called same-store sales. Here’s a table of the last eight quarters for the company.

| Quarter | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 |

|---|---|---|---|---|---|---|---|---|

| Same-store sales growth | 65.3% | 27.6% | 6.9% | 17.4% | 10.3% | 6.5% | 3.8% | 3% |

Data source: Kura Sushi’s press releases. Table by author.

Why are diners flocking to an obscure restaurant brand such as Kura Sushi? Management believes it’s because of tech innovations such as Kur-B. It calls it “eater-tainment.” Basically, people hear about its cool tech, go check it out, and then discover that they actually like the food.

It’s more than just the Kur-B robot. Plates on a conveyor belt buzz past tables, allowing diners to just pull whatever looks good off of the line. Empty plates are later put in the automatic dishwasher slot, and the system then counts up plates and bills the customer automatically.

After 15 plates, Kura Sushi’s customers get a toy dispensed from the Bikkura-Pon machine at the table. Management actually believes customers wind up buying more food than planned so that they can get the toy.

Kura Sushi is clearly a differentiated chain that has the ability to attract diners and grow its footprint. Moreover, the financials are great. The company’s tech helps it keep labor costs down. And its restaurant-level operating margin is an attractive 20% as of the second quarter of its fiscal 2024.

Kura Sushi is not shooting for thousands of restaurants — it’s only shooting for 290. However, that’s nearly five times as many locations as it has now, which is a big deal.

Kura Sushi is a differentiated concept, it has attractive financials, and it has strong growth potential. All of this makes me believe that Kura Sushi stock has more upside potential than popular restaurant investment Chipotle.

It’s a simple investment idea. And yet there’s still a high-tech angle. Therefore, investors who like both things should consider taking a bite of Kura Sushi stock.