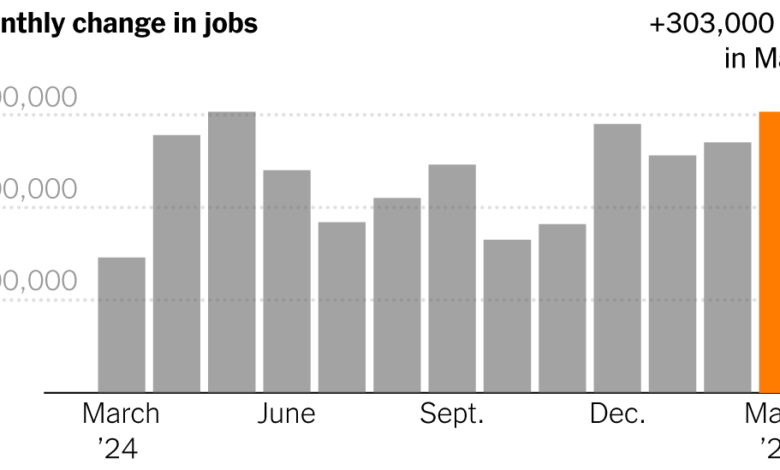

Employers added 303,000 jobs in the 39th straight month of growth.

Another month, another burst of strong job gains. Employers added 303,000 jobs in March on a seasonally adjusted basis, the Labor Department reported on Friday.

It was the 39th straight month of job growth and a much larger gain than forecast. The unemployment rate fell to 3.8 percent, from 3.9 percent in February.

The continuing strength, labor market analysts say, may increase confidence among investors and the Federal Reserve that the U.S. economy has reached a healthy equilibrium in which a steady roll of commercial activity, growing employment and rising wages coexist.

It’s a remarkable change from a year ago, when top financial analysts were largely convinced that a recession was only months away.

From late 2021 to early 2023, inflation was outstripping wage gains, but that also now appears to have firmly shifted, even as wage increases cool from their peak rates of growth in 2022. Average hourly earnings for workers rose 0.3 percent in March from the previous month and were up 4.1 percent from March 2023.

Revisions to employment data in recent months showed a total uptick of 22,000 jobs.

Some analysts were worried about a trend in one of the two surveys that the government uses to track the labor market: out of step with most other data on job growth and layoffs, it showed weak hiring rates that, if correct, would have probably indicated an economy “already in recession,” according to the economic research team at Bank of America.

But even that worrying bit of outlier data improved in the latest report.

“The vanishingly few areas to criticize this labor market are melting away,” said Andrew Flowers, a labor economist at Appcast, a recruitment advertising firm.

Some have worried that as the booming labor market recovery transitioned into a slower expansion, job growth would mostly narrow to less cyclical sectors like government hiring and health care. Gains in health care — including hospitals, nursing and residential care facilities and outpatient services — led the way in this report, but job growth, for now, remains broad-based.

The private sector added 232,000 jobs overall. Construction added 39,000 jobs in March, about twice its average monthly gain in the past year. Employment in hospitality and leisure, which plunged during the pandemic, continues to bounce back and is now above its February 2020 levels.

The “continued vigor,” said Joe Davis, the global chief economist at Vanguard, has come from “household balance sheets bolstered by pandemic-related fiscal policy and a virtuous cycle where job growth, wages and consumption fuel one another.”

Data analysts note that better-than-expected gains in business productivity and work force participation have added fuel, too. Businesses large and small have had to navigate an obstacle course this decade: a pandemic, inflationary pressures and a steep rise in the cost of credit. But recently released data from the Bureau of Economic Analysis shows corporate profits have reached a record high.

Officials at the Fed, which rapidly raised interest rates in 2022 and early 2023 to combat inflation, have expressed cautious optimism that they are approaching their goals of low unemployment and more stable prices.

Inflation has fallen drastically from its peak of 7.1 percent, according to the Fed’s preferred measure. But it ticked up in February to 2.5 percent, still a half-percentage point away from the Fed’s target. And some worry that rising oil prices or geopolitical chaos could upend the delicate state of affairs.

Sal Gilbertie, the chief executive at Teucrium Trading, which covers commodities markets, said he thinks that energy prices could do a “touch higher on oil if Ukraine keeps the pressure on Russia and economic numbers remain healthy.”