Enhancing CX in Insurance with IoT-Driven Predictive Analytics

Thanks to the rapidly evolving digital landscape, the insurance industry has experienced significant changes. AI and machine learning are changing predictive analytics in insurance organizations, mainly due to the integration of IoT. The Internet of Things (IoT) has changed how insurers interact with customers and streamline their workflow.

IoT involves the integration of multiple devices that share data. These devices include wearable smart devices and sensor alarms in the insurance industry. Insurers collect and analyze data from these devices.

Predictive analysis is based on data analysis using machine learning and algorithms. By accurately assessing risks, insurers can predict future outcomes and set premiums that genuinely reflect the level of risk associated with an individual policyholder.

Benefits of IoT-Driven Data Analysis

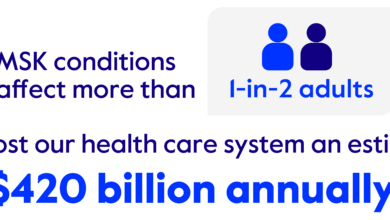

IoT is used in many sectors, including healthcare, transportation, manufacturing, energy, and construction. Healthcare is the sector with the most IoT-related cases.

Insurance software is revolutionizing with the integration of IoT. From filing claims to enhancing the insurance customer experience, this has altered the traditional reality of insurance.

Improved Fraud Detection

IoT devices provide insurers with data to predict potential fraud cases. By analyzing patterns in data, insurers can indicate whether it is legitimate or not, comparing the patterns with other fraudulent activities.

IoT devices enable them to act quickly and effectively, which mitigates losses. This way, premiums can be offered to honest customers at more affordable prices, improving customer satisfaction.

Enhanced Risk Assessment

Health insurers can evaluate health patterns through data and assess their health ratings in real time. This personalizes the customer-insurer relationship and improves patients’ physical health.

Customer Segmentation

Customers can be segmented into categories based on their preferences, behaviors, or activities. This enables them to make more personalized products that match the customer’s risk profile. This would help optimize pricing strategies and increase customer satisfaction in the organization.

Proactive Customer Service

The whole purpose of predictive analytics is to anticipate incidents. For example, if a car indicates that it requires maintenance, insurers can ensure that customers make it to the service station. This would avoid potential accidents and claims.

Moreover, IoT devices can ensure quick action for any leakage in water pipes or fire alarm systems. Through this proactive customer service, insurance firms can win the trust and loyalty of customers.

Features of IoT

If you want to use IoT, you have to be aware of what essential features comprise IoT.

- The first is connectivity with all the major network providers. Take the example of a cloud-based computing system, where one can use software across devices and sync data. Similarly, IoT needs a communication network to transfer data across devices.

- Automation is the next feature which controls the system remotely. Remote monitoring and management allow data control and analysis from various devices conveniently and efficiently.

- Data analytics, through machine learning and AI, gives data meaningful information. Predictable behaviors are only possible through data analysis.

- Sensors, such as motion sensors, temperature sensors, light sensors, and many more, are used in IoT devices to ring the bells when surroundings show unusual activity.

- This system handles the client’s data and must be regulatory compliant and secure. Breaches in security measures would do more harm than good. A robust policy is needed to address this challenging part.

Challenges In IoT-Driven Predictive Analytics

Data Privacy and Security

The primary purpose of IoT devices is to collect data, which has always been a source of challenge for privacy and security. Customers can show concerns about their personal and sensitive data. Insurers need a satisfying privacy policy and security measures to protect customer data and build trust.

Integrating With Existing Systems

The IoT integration system is flexible enough to interconnect with customers’ other devices. However, insurers’ extensive legal systems may not handle the influx of real-time data. Upgrading these systems to advanced ones can be costly and time-consuming.

Conclusion

The integration of IoT in insurtech has changed the industry’s various aspects, including customer interaction, claims handling, risk assessment, and predictive analysis. With IoT, insurance workflow can be smoother and streamlined, strengthening the client relationship.

However, this revolution is not without challenges. Major ones are data privacy and security, integration of various devices, and analysis of big data. Addressing these challenges is crucial for enhancing customer experience in the insurance industry with IoT-driven predictive analytics.