EU expected to impose import tariffs on Chinese electric vehicles | International trade

The EU is expected to notify China that it will impose tariffs on electric vehicle imports this week, firing the starting gun on a potential summer trade war with Beijing.

A formal pre-disclosure of tariffs could happen as early as Wednesday, after a lengthy investigation into China’s state subsidies for its car manufacturing, which is predicted to conclude that massive support continues to be concentrated on the EV sector.

Chinese manufacturers are already bracing themselves for new import duties, but experts anticipate that Beijing will retaliate with countermeasures that could hit a range of EU exports to the country, ranging from cognac to dairy products.

After meeting the Chinese president, Xi Jingping, in Paris last month, the European Commission president, Ursula von der Leyen, warned that “the world cannot absorb China’s surplus production”, saying the EU would “not waver” from protecting industries and jobs inside the bloc.

The anti-subsidy investigation was launched last October amid suspicions that China was flooding the EU with cheaper EVs as a result of overcapacity and dampened domestic consumer demand.

It is one of more than a dozen inquiries being conducted by the EU into Chinese state aid, including an investigation into exports of solar panels, heat pumps and wind turbines, which the energy sector says are undercutting the EU by 50%.

Experts suggest Beijing will see the imposition of tariffs as a test of strength, given that the electric car sector is fuelling China’s success in exports.

They predict that Xi will not waver from the national bet he has made to dominate the green tech sector around the world through EVs, solar panels and electric vehicle batteries, instead seeing trade as a battleground where he can set the terms.

Should the EU investigation conclude on Wednesday, as expected, that Chinese car manufacturers have won a competitive advantage, Beijing will receive a formal pre-notification of tariffs and will have four weeks to provide any evidence to disprove the European case.

Any decision to apply tariffs permanently must be backed by member states in November, about 13 months after the launch of the investigation.

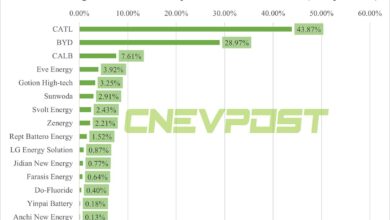

If imposed, the tariff schedule would involve three tiers: individual rates for the sample of companies investigated by the EU, which include the world’s biggest EV seller, BYD; an average tariff for companies that cooperated with inquiries but were not fully investigated; and a residual tariff for those that were not investigated at all.

The Rhodium Group consultancy, which specialises in research on China, said it expects the tariffs to be set at 15%-30%, which will be easy to absorb for conglomerates such as BYD, which launched its entry-level Dolphin hatchback in the EU last summer priced at just under €30,000 (£25,000). As part of its marketing push it is also an official partner of Uefa in the Euro 2024 football championship.

“Some China-based producers will still be able to generate comfortable profit margins on the cars they export to Europe because of the substantial cost advantages they enjoy,” Rhodium said.

after newsletter promotion

“Duties in the 40-50% range – arguably even higher for vertically integrated manufacturers like BYD – would probably be necessary to make the European market unattractive for Chinese EV exporters.”

China has long argued that it has not been subsidising its automotive sector, and even if it were, its exports help the countries of the west achieve their green targets.

Earlier this week on a tour of Spain and Portugal the commerce minister, Wang Wentao, insisted cooperation with the EU was a “win-win” strategy. “I hope that the European side will abandon protectionism and return to the correct path of dialogue and cooperation,” Wang said, calling on Spain to easy “anxiety” over a potential costly rift.

He said the overcapacity the EU keeps talking about is not an excess of production capacity but an excess of anxiety, and the so-called market distortion is not a distortion of the market but a distortion of mindsets.

Western governments say China can easily modulate its strategy, absorb tariffs and compete on a level playing field, but it cannot be allowed to dominate the future clean energy and tech market.

European consumers have already paid a heavy price through higher energy bills after Russia’s invasion of Ukraine exposed the EU’s over-reliance on Russian gas, and EU officials are determined not to repeat the mistake with China, pursuing an official “de-risk” strategy.