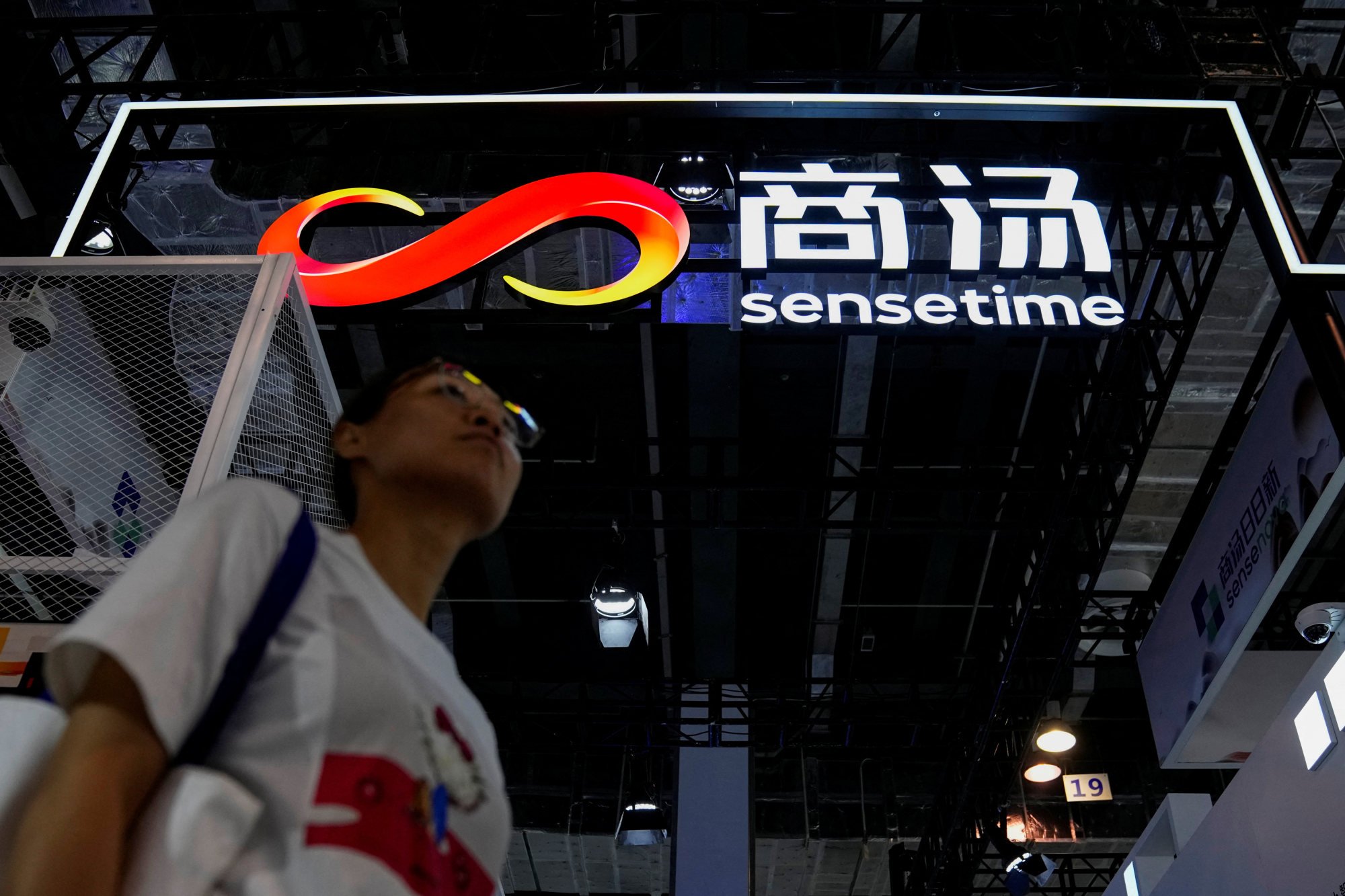

Exclusive | China’s SenseTime says generative AI will help the firm turn a profit within 2 years

SenseTime, one of China’s artificial intelligence (AI) pioneers, is aiming for profitability within the next two years as revenue from its generative AI business tripled last year, and is expected to become the company’s new profit engine, according to CEO and co-founder Xu Li.

Hong Kong-listed SenseTime reported revenue of 1.184 billion yuan (US$163.4 million) from its generative AI-related business for 2023, marking a 199.9 per cent year-on-year increase, according to its latest annual financial report.

In April last year, SenseTime launched its self-developed large language model (LLM), SenseNova, amid the explosion of LLM projects in China since Microsoft-backed OpenAI introduced innovative generative AI tools, including ChatGPT and more recently text-to-video service Sora.

“We set the goal for a 100 per cent growth of our generative AI business this year,” Xu told the South China Morning Post in an exclusive interview on Tuesday.

“But I think the actual growth of our generative AI business could be even higher, as this is a fast-growing sector,” said Xu, adding that many consumer generative AI applications were still in the investment phase last year, so the company is exploring potential business models.

SenseTime’s share price surged by over 30 per cent on April 24 when it released the latest iteration of SenseNova 5.0, which the company said was comparable with OpenAI’s GPT-Turbo model. Its generative AI business has become one of its core segments, accounting for 34.8 per cent of its total revenue.

Despite the strong performance of its generative AI business last year, the company has yet to turn a profit.

The 10-year-old AI company which was founded in Hong Kong reported a 10.6 per cent decrease in total revenue to 3.4 billion yuan last year. It recorded a loss of 6.49 billion yuan in 2023, the third consecutive year of losses since listing in Hong Kong in 2021.

“It is an inevitable phase of the cycle,” said Xu, who pointed out that many tech start-ups go through a long phase of losses due to heavy investment in research and development, and explore ways to commercialise and mass-produce their products.

He predicted that the generative AI business will become profitable within a year or two. SenseTime’s shares are about 76 per cent below their IPO price of HK$5.50 (US$0.70), trading at HK$1.31 on Tuesday.

“The stock price may not show the public perception of SenseTime, as there are many factors that contribute to it,” Xu said.

The company, known for its advanced facial recognition technology, was put on Washington’s Entity List in 2019 and slapped with a US investment ban in 2021, as part of sweeping sanctions targeting Chinese tech companies over national security and human rights concerns. The Entity List sanctions restrict SenseTime’s access to advanced US technology, while the ban on US investments in the firm initially delayed its IPO plans.

Amid the restrictions, SenseTime has explored opportunities outside its traditional AI business, including smart city and smart business solutions. In the consumer sector, it developed a chess-playing robot for family entertainment.

Xu said the company has developed the Model-as-a-Service (MaaS) business model to provide enterprise customers with generative AI applications without the need for them to build and manage the underlying infrastructure.

The MaaS business focuses on customising the company’s LLM for vertical industries, serving small and medium business owners who want to adopt cost-effective AI applications, according to Xu.

SenseTime’s generative AI services have been deployed in sectors ranging from telecommunications to financial institutions, with clients such as China Merchants Bank, Haitong Securities and China Telecom.

“In terms of infrastructure capabilities and industry-customisation of SenseTime’s LLMs, I think we have the opportunity [in future years] to become an AI infrastructure platform and find one or two vertical sectors that have strong profitability,” Xu said.

Tang had served as a member of the Hong Kong Chief Executive’s Council of Advisers (CECA), established in March 2023. At the time of his death, he was lauded by the government for providing “valuable advice in the area of innovation and entrepreneurship”.