Fight Against Inflation, Market Correction At Heart Of VC Slowdown

Iconic Sand Hill Road sign against a blue sky, on Sand Hill Road in the Silicon Valley town of Menlo … [+]

The venture capital data out of Q1 affirmed the slowdown felt by investors and entrepreneurs: a 7-year-low funding slide, a frosty exit landscape pummeling private market valuations and the fintech sector hitting the skids. But VC is a game of exceptions and exceptional outcomes. A review of past corrections’ data reminds us how bear markets produce generational companies, even amid investor cautiousness. VC has become an established asset class. It might shrink for a while, going back to its roots as a smaller cottage industry and becoming less attractive to recent college grads. But it will continue to produce the tech companies that drive the public markets.

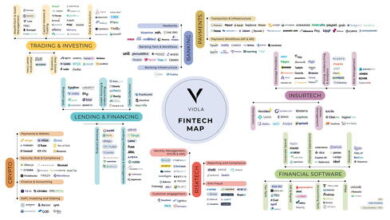

Despite some notable exceptions to the startup investment dip (generative AI and robotics gained), fintech funding fell 16% quarter-over-quarter. This cooling is rooted in the macro economy: high interest rates designed to curb inflation, higher cost of capital and worsening geopolitical tensions. However, after years of a pandemic capital-fueled boom cycle, this moment in fintech is probably best interpreted as a normalization, with deployment returning to pre-COVID-19 levels.

All indications show that the US economy is growing (thanks to low unemployment, rising wages and strong consumer spending), but the macro horizon feels unpredictable. Consequently, investors are cautious. As VC-backed projects experience valuation corrections, VC fundraising slows because the data points to lower risk return on investment. It can feel like a death spiral.

Meanwhile, although funding is down overall, blockbuster mega-rounds, a frequently cited bright spot across Q1 reporting (growing 30% QoQ), mostly kept concentrations with the largest managers and closed-end funds, pointing to private market consolidation rather than buoyancy. It begs a series of questions about risk assets in general: is VC a canary in a coal mine or just a retreat from risk assets as a result of federal bank tightening? Even among the Magnificent 7, there appears to be evidence of bifurcation.

Tech companies, public or private, are ultimately risk assets, so the fate of an awful lot of invested capital may mirror the ups and downs of venture. During market corrections, investors search for the bottom. The price discovery process slows the whole market down, perhaps the simplest explanation of the Q1 data. Consolidation also feels like a pattern familiar to the last two major fundraising downturns.

Central banks will not ignore persistent inflation. The promised three rate cuts this year look increasingly unlikely. If the Fed does its job right, it will continue to tamp down on the irrational exuberance that powers venture buoyancy. As venture valuations come in line with boring, old public markets multiples, investors will simply be unable to justify the funding environment that has prevailed since COVID.

But the innovation economy has always been driven by high risk, high growth bets and VC is an efficient and storied way to fund them. Exuberant markets are great places to exit venture-backed business, but they are expensive places to build them. In bubbles, talent is pricey, competition is fierce and customer acquisition is costly. Many of our favorite tech businesses were built during market troughs, not bull markets. In fintech, the funding data coming out of Q1 asserts that today’s challenging operating environment requires new priorities: a healthier mix of growth, profitability and utility. Investors will retrench geographically and thematically, while founders look for sharper wedges to create outliers. As always, value plays out in time.