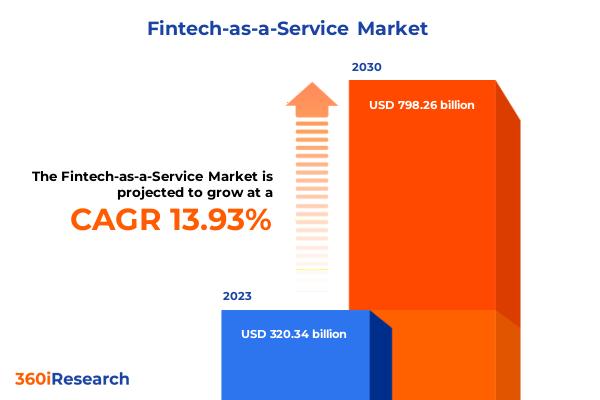

Fintech-as-a-Service Market worth $798.26 billion by 2030,

The “Fintech-as-a-Service Market by Type (Fund Transfer, Loan, Payment), Application (Compliance & Regulatory Support, Fraud Monitoring, KYC Verification), End-User – Global Forecast 2024-2030” report has been added to 360iResearch.com’s offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/fintech-as-a-service?utm_source=openpr&utm_medium=referral&utm_campaign=sample

“Key Drivers Fueling the Growth of Fintech-as-a-Service Market”

The Fintech-as-a-Service sector is experiencing rapid growth driven by escalating demand for integrated financial services, which streamline banking, payments, and financial management into a single efficient platform that reduces business costs. Improved regulatory policies advocating digital innovation and data security further accelerate this trend by easing market entry and enhancing stability. Significant traction from end-user segments like banking, retail, and e-commerce, which seek scalable digital financial solutions, and strategic partnerships between innovative fintech companies and established financial entities also contribute to the expansion. Entering underdeveloped markets and introducing versatile services that include payment processing, risk management, and compliance solutions allow Fintech-as-a-Service to provide economical alternatives to traditional financial systems, encouraging ongoing market penetration and growth. These multifaceted drivers collectively underpin the robust development and future prospects of the Fintech-as-a-Service industry.

“Key Challenges Hindering the Expansion of Fintech-as-a-Service Markets”

The Fintech-as-a-Service sector, while promising, is grappling with several growth constraints that warrant attention. High implementation costs create a substantial barrier, particularly for startups and small businesses. Coupled with a lack of standardized products, this results in compatibility issues, deterring potential users concerned with interoperability and quality assurance. The sector also faces stiff competition from alternative technologies, including sophisticated traditional banking systems and emerging decentralized finance platforms, which could divert investments. Moreover, regulatory challenges and the necessity for tailored solutions impede the commercialization and scalability of these platforms, confining their adoption to less regulated, niche markets. Additionally, the limited scope in certain product features compels users to seek supplementary services, further complicating deployment and elevating costs. Addressing these restraints collectively is pivotal for catalyzing the broader adoption and success of Fintech-as-a-Service solutions.

“Fintech-as-a-Service: Driving Innovation and Inclusion Through Emerging Market Dynamics”

Governments around the world are increasingly aligning with fintech advancements by enhancing regulatory measures that protect data and secure financial transactions. Initiatives like the EU’s Payment Services Directive (PSD2) have catalyzed a competitive and innovative financial landscape by welcoming new entrants. Additionally, a rising tide of venture capital demonstrates market confidence, empowering fintech startups to accelerate their technological innovations in payment systems, personal finance, and more. Strategic alliances between traditional banks and fintech firms are enhancing financial services that appeal to diverse consumer bases, bolstered by technological advancements in cloud computing and APIs that enable scaling without heavy infrastructure. Additionally, governmental support via special economic zones and innovation hubs amplifies research and development in fintech, while collaborations between public sectors and private fintech entities are pivotal in fostering financial inclusivity through innovative payment solutions and educational initiatives. These efforts collectively foster a robust, inclusive, and swiftly evolving fintech-as-a-service sector, poised to meet global financial service needs efficiently.

“Navigating Complexities in Fintech-as-a-Service: Key Challenges for Market Growth”

As the Fintech-as-a-Service (FaaS) sector evolves, it confronts several pivotal challenges that could impede its expansion and operational efficacy. Integrating innovative fintech solutions with traditional financial systems poses significant difficulties due to the varied nature of existing infrastructures and strict compliance requirements. Furthermore, there is a critical shortage of skilled professionals who can manage both the technological and regulatory demands of FaaS, complicating efforts to scale these solutions. Environmental concerns also come into play; despite fintech’s digital basis, its reliance on energy-intensive data centers and blockchain technology calls for urgent measures to reduce its carbon footprint. Additionally, the rapid pace of technological advancements in the field necessitates vigilance to guard against potential long-term risks like data security breaches, privacy issues, and systemic financial disturbances. Addressing these challenges is vital for sustaining growth and fostering innovation in the fintech industry.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/fintech-as-a-service?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Fintech-as-a-Service Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Type, market is studied across Fund Transfer, Loan, and Payment.

Based on Application, market is studied across Compliance & Regulatory Support, Fraud Monitoring, and KYC Verification.

Based on End-User, market is studied across Banks, Financial Lending Companies, and Insurance.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Key Company Profiles:

The report delves into recent significant developments in the Fintech-as-a-Service Market, highlighting leading vendors and their innovative profiles. These include Afterpay Limited, Betterment LLC, Early Warning Services, LLC, Envestnet Asset Management, Inc., Intuit Inc., Mastercard International Incorporated, Payoneer Inc., PayPal, Inc., Railsbank Technology Ltd., Rapyd Financial Network Ltd., Revolut Ltd., Robinhood Financial LLC, Solid Financial Technologies, Inc., Stripe, Inc., and Synctera.

Introducing ThinkMi Query: Revolutionizing Market Intelligence with AI-Powered Insights for the Fintech-as-a-Service Market

We proudly unveil ThinkMi Query, a cutting-edge AI product designed to transform how businesses interact with the Fintech-as-a-Service Market. ThinkMi Query stands out as your premier market intelligence partner, delivering unparalleled insights with the power of artificial intelligence. Whether deciphering market trends or offering actionable intelligence, ThinkMi Query is engineered to provide precise, relevant answers to your most critical business questions. This revolutionary tool is more than just an information source; it’s a strategic asset that empowers your decision-making with up-to-the-minute data, ensuring you stay ahead in the fiercely competitive Fintech-as-a-Service Market. Embrace the future of market analysis with ThinkMi Query, where informed decisions lead to remarkable growth.

Ask Question to ThinkMi Query @ https://www.360iresearch.com/library/intelligence/fintech-as-a-service?utm_source=openpr&utm_medium=referral&utm_campaign=query

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Fintech-as-a-Service Market, by Type

7. Fintech-as-a-Service Market, by Application

8. Fintech-as-a-Service Market, by End-User

9. Americas Fintech-as-a-Service Market

10. Asia-Pacific Fintech-as-a-Service Market

11. Europe, Middle East & Africa Fintech-as-a-Service Market

12. Competitive Landscape

13. Competitive Portfolio

Read More @ https://www.360iresearch.com/library/intelligence/fintech-as-a-service?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India – 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset – our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.