FinTech Blockchain Market Size, Share, Growth Forecast

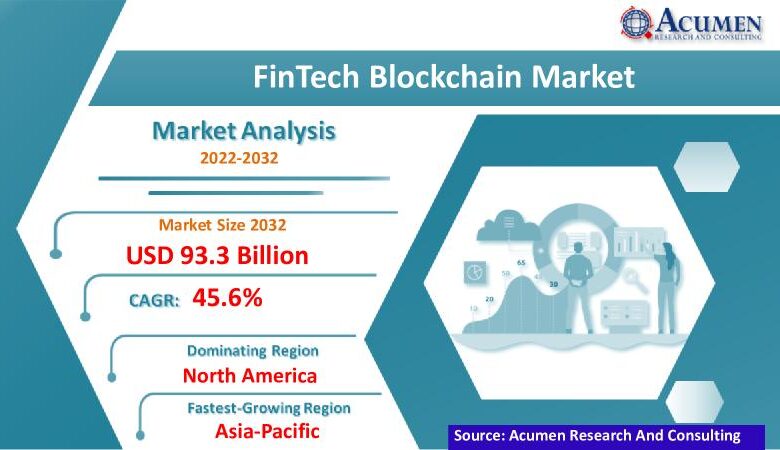

The FinTech blockchain market has emerged as a disruptive force in the financial landscape, revolutionizing traditional financial services with its decentralized and secure infrastructure. With a significant market size of USD 2.2 billion in 2022, and a projected exponential growth, reaching USD 93.3 billion by 2032 at a staggering CAGR of 45.6%, the sector showcases immense potential and opportunities. This article delves into the current trends, market drivers, restraints, opportunities, regional insights, competitive scenario, and the future growth prospects of the FinTech blockchain market.

Download Free FinTech Blockchain Market Sample Report Here: (Including Full TOC, List of Tables & Figures, Chart) https://www.acumenresearchandconsulting.com/request-sample/3447

Market Trends:

The FinTech blockchain market is witnessing several notable trends driving its growth trajectory. One prominent trend is the increasing adoption of blockchain technology by financial institutions to streamline operations, enhance security, and reduce costs. Additionally, the rise of decentralized finance (DeFi) platforms leveraging blockchain is reshaping the financial landscape by offering innovative solutions such as lending, borrowing, and trading without intermediaries.

Market Drivers:

Several factors are fueling the growth of the FinTech blockchain market. One of the primary drivers is the growing demand for secure and transparent transactions in the financial sector. Blockchain’s immutable ledger technology ensures trust and transparency, mitigating the risk of fraud and enhancing accountability. Moreover, the increasing digitization of financial services and the need for real-time payments are driving the adoption of blockchain technology to facilitate faster and more efficient transactions.

Market Restraints:

Despite the promising growth prospects, the FinTech blockchain market faces certain challenges that could hinder its expansion. Regulatory uncertainty and compliance issues pose significant hurdles for market players, particularly in navigating complex regulatory landscapes across different jurisdictions. Moreover, scalability and interoperability concerns remain key challenges for blockchain technology, limiting its widespread adoption in mainstream financial applications.

Opportunities:

Amidst the challenges, the FinTech blockchain market presents lucrative opportunities for innovation and growth. The integration of blockchain with emerging technologies such as artificial intelligence (AI) and Internet of Things (IoT) opens up new possibilities for developing advanced financial solutions. Furthermore, the rising demand for blockchain-based identity management, supply chain finance, and cross-border payments offers untapped opportunities for market players to capitalize on.

Competition Scenario:

The FinTech blockchain market is highly competitive, with a diverse ecosystem of startups, established financial institutions, and technology companies vying for market share. Key players such as IBM, Microsoft, Ripple, and Coinbase are leading the charge with innovative blockchain solutions tailored for the financial sector. Strategic partnerships, mergers, and acquisitions are common strategies employed by market players to gain a competitive edge and expand their market presence.

Future Market Growth Potential:

Looking ahead, the FinTech blockchain market is poised for exponential growth, driven by ongoing technological advancements, increasing digitalization, and evolving consumer preferences. The integration of blockchain technology into core financial processes, coupled with the proliferation of decentralized finance (DeFi) platforms, will fuel market expansion in the coming years. Moreover, growing investments in blockchain research and development, along with supportive regulatory frameworks, will further propel the market towards achieving its projected market size of USD 93.3 billion by 2032.

Table Of Content:

CHAPTER 1. Industry Overview of FinTech Blockchain Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Manufacturing Plant Analysis

CHAPTER 5. FinTech Blockchain Market By Provider

CHAPTER 6. FinTech Blockchain Market By Application

CHAPTER 7. FinTech Blockchain Market By Organization Size

CHAPTER 8. FinTech Blockchain Market By Verticals

CHAPTER 9. North America FinTech Blockchain Market By Country

CHAPTER 10. Europe FinTech Blockchain Market By Country

CHAPTER 11. Asia Pacific FinTech Blockchain Market By Country

CHAPTER 12. Latin America FinTech Blockchain Market By Country

CHAPTER 13. Middle East & Africa FinTech Blockchain Market By Country

CHAPTER 14. Player Analysis Of FinTech Blockchain Market

CHAPTER 15. Company Profile

FinTech Blockchain Market Segmentation:

The global FinTech Blockchain Market segmentation is based on provider, application, organization size, verticals, and geography.

FinTech Blockchain Market By Provider

Middleware Providers

Infrastructure and Protocol Providers

Application and Solution Providers

FinTech Blockchain Market By Application

Payments, Clearing, and Settlement

Smart Contract

Exchanges and Remittance

Compliance Management/ KYC

Identity Management

Other

FinTech Blockchain Market By Organization Size

Large Enterprises

SMEs

FinTech Blockchain Market By Verticals

Banking

Insurance

Non-Banking Financial Services

Regional Insights:

The FinTech blockchain market exhibits varied dynamics across different regions. North America dominates the market, driven by the presence of key market players, favorable regulatory frameworks, and significant investments in blockchain technology. Europe follows closely, with initiatives such as the European Blockchain Partnership fostering collaboration and innovation in the region. Meanwhile, Asia-Pacific is poised for substantial growth, fueled by increasing adoption in countries like China, Japan, and Singapore.

Buy the premium market research report here: https://www.acumenresearchandconsulting.com/buy-now/0/3447

Find more such market research reports on our website or contact us directly

Write to us at sales@acumenresearchandconsulting.com

Call us on +918983225533

or +13474743864

Browse for more Related Reports: https://www.acumenresearchandconsulting.com/industry-5-0-market

201, Vaidehi-Saaket, Baner – Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition.

This release was published on openPR.