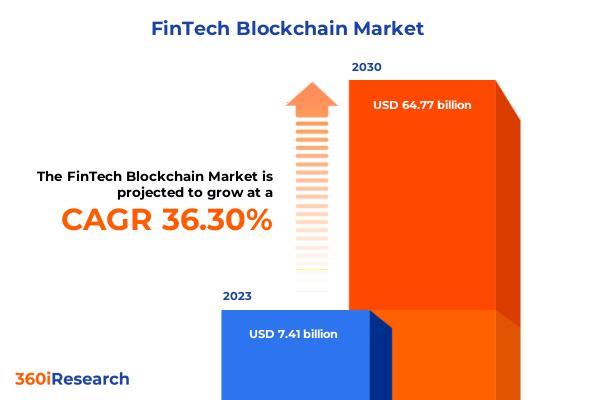

FinTech Blockchain Market worth $64.77 billion by 2030, growing

The “FinTech Blockchain Market by Provider (Application & Solution Providers, Infrastructure & Base Protocol Providers, Middleware & Service Providers), Organization Size (Large Enterprises, Small & Medium Enterprises), Application, Vertical – Global Forecast 2024-2030” report has been added to 360iResearch.com’s offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/fintech-blockchain?utm_source=openpr&utm_medium=referral&utm_campaign=sample

“Key Drivers Propelling the Growth of Blockchain in Financial Technology”

The surge in digital transactions globally necessitates secure and efficient processing solutions, with blockchain emerging as a shield against fraud while streamlining operations. Endorsements from regulatory bodies worldwide are also pivotal, crafting a conducive landscape for blockchain adoption in financial systems. Top financial entities are integrating blockchain for functions like secure payments, swiftly processing real-time settlements, and executing smart contracts-making operations more cost-effective. Furthermore, strategic collaborations between blockchain providers and financial corporations tailor blockchain innovations to specific needs, enhancing technology adaptation. The technology’s uptake in emerging markets is driven by its potential to democratize access to financial services, offering economical alternatives for microfinancing and small transactions crucial in areas with sparse banking frameworks. Technology advancements are continuously refining blockchain’s compatibility with existing financial infrastructure, enhancing its scalability and interoperability-key aspects that underpin the vigorous growth of the FinTech blockchain domain. These advancements ensure that blockchain technology not only supports a broader adoption but also augments the efficiency and security of global financial services.

“Navigating Challenges in Blockchain Adoption for Financial Technologies”

The adoption of blockchain technology in the financial sector, while promising, is hindered by several significant challenges. High initial and maintenance costs make it difficult for small to medium-sized enterprises to implement blockchain systems, which also require consistent updates and integration with existing financial frameworks. Additionally, the diversity of blockchain platforms lacks standardization, complicating interoperability and efficient data exchanges across different systems. Furthermore, simpler and less costly alternative technologies often seem more appealing to companies seeking similar benefits without the complexities of blockchain. The intricate nature of blockchain technology itself poses a substantial barrier, particularly for those without a technical background, compounded by a shortage of skilled professionals capable of managing these systems. Finally, issues of compatibility and integration with established financial systems and regulations can introduce substantial delays and additional costs, discouraging some institutions from transitioning to blockchain solutions. These factors collectively present formidable obstacles to the widespread acceptance and implementation of blockchain in FinTech.

“Empowering FinTech: The Pivotal Role of Blockchain in Catalyzing Secure, Rapid Growth Across Financial Technologies”

In light of the increasing reliance on digital transactions, the integration of blockchain technology into mobile payment systems is set to significantly bolster security, reduce fraud, and expedite processing times, thereby enhancing transaction transparency and fostering trust across various market segments. Simultaneously, governmental bodies worldwide are crafting supportive policies to nurture innovation in the blockchain space, creating a conducive environment for burgeoning start-ups. Furthermore, collaborations with established financial and technological entities are proving instrumental in accelerating blockchain product development and market integration, specifically tailored to meet distinct financial needs. Innovations aimed at overcoming scalability and speed challenges in blockchain are making this technology increasingly viable for enterprises handling high-volume transactions. Additionally, initiatives to elevate blockchain education and workforce proficiency are essential to sustaining industry growth. Public-private partnerships are essential in driving national and international blockchain agendas, blending financial motivation with strategic resource sharing to lower barriers to innovation. Finally, adopting blockchain for identity verification and anti-money laundering processes not only fortifies security but also aligns with regulatory compliance, potentially unlocking new markets in sectors managing sensitive data. These strategic moves are crucial for leveraging blockchain technology to ensure sustainable and comprehensive growth within the FinTech sector.

“Key Challenges Facing Blockchain Adoption in the Financial Sector”

Integrating blockchain with old financial systems remains a complex task, often requiring significant investment and time, possibly disrupting ongoing operations. There’s also a notable deficit of skilled blockchain professionals, which could delay development and inflate costs. Regulatory challenges are prominent since blockchain must comply with diverse financial laws across different regions, potentially stalling adoption rates. Environmental concerns associated with blockchain’s energy usage also present significant hurdles, as stakeholders increasingly prioritize sustainability. Additionally, the rise of sophisticated cybersecurity threats poses risks to blockchain’s integrity, emphasizing the need for advanced security measures. Identifying and addressing these issues is essential for the effective integration and growth of blockchain technology in the financial sector.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/fintech-blockchain?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the FinTech Blockchain Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Provider, market is studied across Application & Solution Providers, Infrastructure & Base Protocol Providers, and Middleware & Service Providers.

Based on Organization Size, market is studied across Large Enterprises and Small & Medium Enterprises.

Based on Application, market is studied across Compliance Management & Know Your Customers, Cross-Border Payment and Exchanges & Remittance, Identity Management, Payment, Clearing & Settlement, and Smart Contract.

Based on Vertical, market is studied across Banking, Insurance, and Non-Banking Financial Services.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Key Company Profiles:

The report delves into recent developments in the FinTech Blockchain Market, highlighting leading vendors and their innovative profiles. These include AlphaPoint, Amazon Web Services, Inc., Anchorage Digital, Applied Blockchain Ltd., Auxesis Group, Bitfury Group Limited, BitGo Holdings, Inc., BitPay, Inc., Blockchain.com, Inc., Chain Global Ltd., Chainalysis Inc., Circle Internet Financial, LLC, Coinbase Global, Inc., Consensys Software Inc., Digital Asset Holdings, LLC, Factom, Gemini Trust Company, LLC, GuardTime OÜ,, International Business Machines Corporation, JPMorgan Chase & Co., Kraken by Payward, Inc., Microsoft Corporation, Morgan Stanley, Oracle Corporation, R3 HoldCo LLC, Ripple Labs Inc., Stellar Development Foundation, Tata Consultancy Services, and Wipro.

Introducing ThinkMi Query: Revolutionizing Market Intelligence with AI-Powered Insights for the FinTech Blockchain Market

We proudly unveil ThinkMi Query, a cutting-edge AI product designed to transform how businesses interact with the FinTech Blockchain Market. ThinkMi Query stands out as your premier market intelligence partner, delivering unparalleled insights with the power of artificial intelligence. Whether deciphering market trends or offering actionable intelligence, ThinkMi Query is engineered to provide precise, relevant answers to your most critical business questions. This revolutionary tool is more than just an information source; it’s a strategic asset that empowers your decision-making with up-to-the-minute data, ensuring you stay ahead in the fiercely competitive FinTech Blockchain Market. Embrace the future of market analysis with ThinkMi Query, where informed decisions lead to remarkable growth.

Ask Question to ThinkMi Query @ https://www.360iresearch.com/library/intelligence/fintech-blockchain?utm_source=openpr&utm_medium=referral&utm_campaign=query

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. FinTech Blockchain Market, by Provider

7. FinTech Blockchain Market, by Organization Size

8. FinTech Blockchain Market, by Application

9. FinTech Blockchain Market, by Vertical

10. Americas FinTech Blockchain Market

11. Asia-Pacific FinTech Blockchain Market

12. Europe, Middle East & Africa FinTech Blockchain Market

13. Competitive Landscape

14. Competitive Portfolio

Read More @ https://www.360iresearch.com/library/intelligence/fintech-blockchain?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India – 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset – our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.