Fintech Fight Leads to Hundreds of Thousands of Frozen Accounts

One user said they had “over $60,000” tied up in an account that was unreachable. Another, a single mom, had just bought a home and couldn’t access the funds to make the first mortgage payment. A third had saved emergency funds for their family: “I feel powerless and unable to do anything. I’m so upset.”

These are just a few of at least hundreds of thousands of holders of online bank accounts with fintech companies like Yotta, Juno, and Copper, whose funds have been frozen for nearly two weeks amid a dispute involving a bankrupt middleman named Synapse Financial Technologies. The accounts were locked up May 11, when Evolve Bank and Trust, which provided banking services to the fintechs, lost access to a Synapse “dashboard” that details which accounts hold what amounts of money. Without the dashboard, the accounts cannot be processed.

Despite a bankruptcy judge in California ordering Synapse to restore full access to the dashboard, nothing has been resolved, leaving customers at the mercy of an increasingly ornery fight. A mediation session between Synapse and Evolve this week failed to yield a solution. Another hearing takes place on Friday.

Synapse CEO Sankaet Pathak said on X this week that “final ledger reports have been sent to all banks and fintechs,” and that he was working to resolve the problem. But he also conceded that “no progress was made with Evolve.”

In a bankruptcy filing, Synapse claimed that it works with ten million end users, but according to sources familiar with the situation, the number of active accounts affected is more like 200,000. That’s still a significant number, the biggest financial product disruption since the 2015 outage of RushCard, a prepaid debit card with 650,000 users. RushCard paid a $13 million fine and was eventually sold to rival Green Dot.

The problem appears to primarily involve customers with direct Synapse brokerage accounts, which they were involuntarily transferred into last year. Though Synapse has claimed these accounts are federally insured through partner banks, consumer advocates have warned that brokerage accounts aren’t meant to work this way.

Because so much fintech architecture is unregulated, federal officials have been unable to step in to extricate customers. In a statement read in bankruptcy court last week, the Federal Reserve pointedly refused to get involved. Only a settlement or court order would resolve the matter, and there’s no sign of that yet.

An email from the Prospect to Synapse did not get a response; an Evolve spokesperson referred back to a statement from last week. Both companies have been publicly lobbing charges and countercharges, while customers are caught in the crossfire.

The situation reveals the extreme reliance fintech startups have on technology and banking partners, which help them stand up apps quickly but add unnecessary risk when problems arise. “I think this is a watershed moment,” said Adam Rust, director of financial services at the Consumer Federation of America. “Do we need a system that makes it less capital-intensive to start a banking entity?”

Rise of the Neobanks

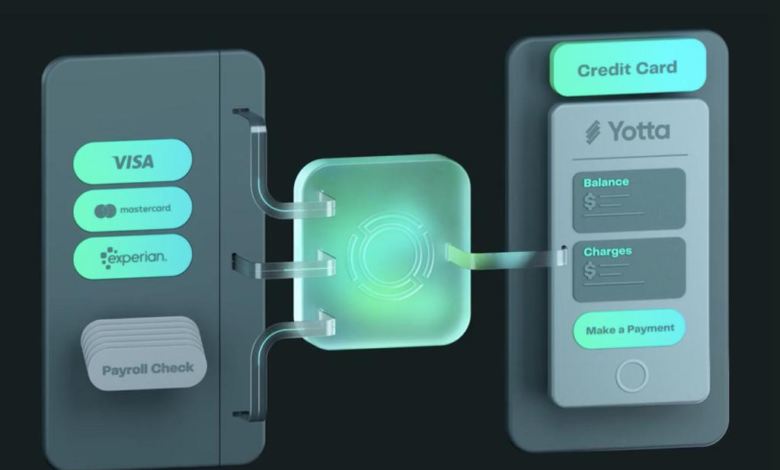

Synapse, established in 2014, was one of the first “banking-as-a-service” (BaaS) providers. For a startup, getting the necessary charters and permissions and building the systems to take deposits, make loans, and offer debit cards is an impossibly expensive and time-consuming enterprise. Banks didn’t initially find it easy to partner directly with fintech firms either, because of the technological complexities. Synapse arose as a kind of matchmaker to connect startups with willing sponsor banks like Evolve and others. Synapse sets up a “for benefit of” (FBO) account at the sponsor bank, which pools all the money customers deposit at the fintech. Then its various platform technologies can manage the individual customer accounts. No account holder sees Synapse’s handiwork; it operates in the background.

“Most of these middleware players, there is no direct regulation of them, there is no licensing scheme that oversees them,” said Jason Mikula of Fintech Business Weekly, one of the few reporters who has been following the Synapse story, despite being based in the Netherlands. (On Wednesday, CNBC and the Associated Press did issue reports.)

The BaaS relationship dramatically reduced barriers to entry and brought a host of new “neobanks” into the marketplace, which attempted to gain market share by offering perks like higher interest rates on deposits, lower fees, or investment options. Chime, a fee-free service focused on credit-building, is perhaps the most popular neobank.

Often the apps are targeted to particular communities. Hispanic customers are marketed Oportun, Comun, or Majority (which doesn’t require a Social Security number); Native Americans are pitched Totem; travelers can enjoy the lack of foreign transaction fees on Monzo; teenagers are encouraged to make their first bank account in Copper or Greenlight.

Yotta, one of the companies whose accounts are now frozen, enticed customers by gamifying bank accounts, offering depositors daily lottery tickets. Juno, another neobank, primarily serves cryptocurrency investors, promoting itself as the “the easiest way to go from cash to crypto with no holding period on withdrawals.”

As a BaaS pioneer, Synapse was able to acquire a lot of business, helped along by $51 million from two rounds of venture capital funding, including an investment by leading VC Andreessen Horowitz, which called Synapse “the Amazon Web Services of banking.” In 2019, Synapse’s valuation was $180 million, and at the end of 2022, it claimed to serve 18 million end users, with over 200 employees processing $76 billion in transaction volume. According to a filing in the bankruptcy, Synapse today works with roughly 100 companies.

But while Synapse grew quickly, it hadn’t reached profitability, and there were concerns raised about its hot-headed management going back to 2020, particularly Pathak, the Indian expat CEO known to fire engineers on the spot for not working more rapidly. Engineers complained of broken code and tangled customer databases. Neobanks would periodically ditch Synapse over the complications. “I had a Juno account, I couldn’t figure out how to make it work, which is another Synapse problem,” Rust said.

Hot Mess

In the summer of 2022, Evolve, a century-old bank based in Tennessee, announced its intention to break from Synapse as a sponsor bank, and withheld a $17 million payment to Synapse to cover what it called a $14 million “hole” in one of the FBO accounts. The process of separation was anything but quick and is still ongoing; Evolve chalks it up to Synapse’s inability to make the numbers on its account ledgers match. (This is literally the entire function of a bank, to reconcile ledgers; they don’t usually have to do it in conjunction with a partner that has a different set of numbers, under suspicious circumstances.)

Meanwhile, Synapse had another problem with its biggest customer, Mercury, a fintech bank account provider catering to small businesses with $3 billion in deposits. Mercury alleged that Synapse underpaid them for deposit “rebates” that it said should have been adjusted based on the rise in the federal funds rate. This is now the subject of ongoing lawsuits, with Mercury arguing in one filing that Synapse was insolvent, and its funds should be frozen so there would be money to collect if Mercury received a favorable judgment.

Simultaneously, Mercury decided to eliminate the middleman, entering into a direct relationship with Evolve without Synapse’s participation. This trend threatened the entire BaaS model, and that combined with the public allegations of insolvency sent Synapse into a tailspin.

Synapse shopped itself for a few months and finally found a deal with TabaPay, another financial services provider for fintech firms. To consummate the deal, Synapse entered into a Chapter 11 bankruptcy reorganization, and TabaPay planned to buy Synapse’s assets out of that for $9.7 million—significantly less than the VC funding Synapse took over the years. TabaPay hoped the process would leave it clear of any liabilities. (Hilariously, one of the biggest secured creditors in the bankruptcy, thanks in part to the use of fintech business banking apps by tech startups, is Silicon Valley Bank, which catastrophically failed last March.)

But once again, the dispute over Synapse’s FBO account at Evolve was a stumbling block.

TabaPay wanted Evolve to fully fund the FBO account, but Evolve and Synapse disagreed over who was responsible for certain shortfalls. Evolve’s lawyers then claimed that the FBO account was already fully funded, which Synapse disagreed with. Synapse then claimed that Mercury, the client which moved to a direct relationship with Evolve, had taken an extra $49.6 million in funds during the migration. Mercury, in keeping with the form here, disputed that.

With no end in sight, on May 8 TabaPay pulled out of the transaction. “Now you have Synapse in Chapter 11, a reorganization bankruptcy,” Mikula said. “But to quote one of the creditors, there is no prospect of the company continuing to operate.” According to Mikula, after multiple rounds of layoffs, Synapse let everyone but a few employees go this week.

Despite the lack of employees, Synapse remains the connective tissue for a lot of customer money. According to court testimony from a different sponsor bank called Lineage, Synapse has an FBO with them worth between $60 million and $80 million, to say nothing of the Evolve FBO and other bank relationships. Liquidating the company requires unwinding all these account relationships. Judge Martin Barash, who is overseeing the bankruptcy, has called the situation a “hot mess.”

After TabaPay canceled the purchase of Synapse, Lineage—which is actually under a federal consent order for its work with fintechs—immediately stopped conducting payment processing for customers of Synapse clients; some, like Juno, were switched to Evolve. Then on Saturday, May 11, the dashboard Synapse provides to Evolve to maintain customer accounts stopped working. All access to accounts at the affected fintech apps was abruptly shut off. All direct deposits or other transactions were returned to the originator.

The Brokerage Switch

Users on message boards and others to whom the Prospect has spoken have discussed the despair of not being able to get to their money. “I NEED TO PAY RENT AND MOVING EXPENSES, I HAD TO TAKE OUT A LOAN IN THE MEAN TIME!!!!” said one user; another said they only had $66 available outside the frozen account.

Nicholas Kennen, a Yotta user with a significant amount of money tied up, highlighted a strange situation that happened last fall. Users of Yotta, Juno, and Copper were told that their accounts were being transferred from a demand deposit account (DDA) at Evolve, which is insured through the Federal Deposit Insurance Corporation (FDIC), to a Synapse brokerage account. Users could opt out of the transfer, but information on how to do so was buried in the terms of service, and would have involved contacting Synapse, which most customers had never heard of.

Synapse set up the brokerage when they acquired an existing broker-dealer license a couple of years ago. Brokerage accounts normally involve trading stocks, but they include cash management services that can mimic a checking account. It’s unclear why the switch happened. Some argue Synapse wanted to preempt continued loss of business as a middleman by becoming a direct financial services provider; others say that it was a way for Evolve to limit their exposure as they tried to get out of business with Synapse.

Communications from the apps assured users that the funds would still be eligible for FDIC insurance. Copper promised “enhanced FDIC insurance coverage … up to $500,000,” as did Yotta, which said that the funds would be deposited “across a network of member FDIC banks.” Juno even listed the banks. But brokerage accounts are not intended to be used as bank accounts, much less sweep funds through depository institutions to capture FDIC insurance. In addition, if Synapse found itself locked in disputes with the new set of banks, the same freezes could ensue.

The users with the brokerage accounts they were pushed into are the ones who cannot access their money; Evolve has begun returning funds to users who were still in DDAs.

“I wish I had been more curious,” Kennen said. “A simple Google search in October would have revealed red flags with Synapse.”

The fintech companies, all of which were VC-funded in their own right, have managed the crisis in different ways. Copper, which had been transitioning away from banking products and into a “financial wellness” site that allows users to earn money through surveys and games, told users on May 12 that it would simply close down all of its debit cards and deposit accounts within 24 hours. As of last week, some users were still locked out and hadn’t gotten their money back.

Juno put a long statement on its website, explaining the Synapse outage. “This has been incredibly difficult and frustrating for us as well and the entire team who has been caught in the crosshair of an ongoing issue between Synapse and Evolve Bank & Trust,” the letter reads, explaining that Juno is not a bank and doesn’t hold custody of user funds, something users may have heard for the first time. Juno said that it was unable to shift to a new partner when Synapse was teetering because its relationship with crypto made other banks wary. Juno is working on developing a cash account to at least handle some limited transactions for users.

Yotta has no public statements at its website about the matter, though it has been communicating with users via email. A query to Yotta did not receive a response.

Regulatory Arbitrage

Last Friday’s five-hour bankruptcy hearing, where customers unable to access their accounts were heard, included a recommendation from the U.S. bankruptcy trustee to convert Synapse to a Chapter 7 liquidation or appoint a Chapter 11 trustee to take operations away from Synapse leadership, because of “gross mismanagement” and the unlikelihood of any reorganization.

Judge Barash did not do so, instead trying to solve the immediate problem of the frozen accounts. But a “meet and confer” between Synapse and Evolve didn’t make progress, and what Evolve believes to be the necessary records to accurately reconstruct the ledger haven’t been turned over.

Meanwhile, government regulators have been sidelined or inert. The banking institutions that work with fintech all maintain deposits below $10 billion, removing them from direct oversight from the Consumer Financial Protection Bureau. Evolve Bank is far from a failed institution, so the FDIC has no role to play. The primary regulator of Evolve is the Federal Reserve, and at last week’s bankruptcy hearing, a Justice Department attorney read out a letter from the Fed, where the central bank insisted it “does not … supervise or regulate fintech companies … nor does it mediate or have the authority to mediate disputes among commercial entities.”

Just about the only government regulatory agency that might have some direct oversight is California’s Department of Financial Protection and Innovation, which is where Synapse’s brokerage is registered. At last week’s bankruptcy hearing, DFPI would only say it was “monitoring” the situation.

Over time, if the fintechs or Synapse violated consumer protection laws, or if they misled consumers into believing that their deposits were safe, the CFPB could investigate and issue fines or even restitution. Last week, the bureau actually did sue a fintech, SoLo Funds, that used Synapse as a middleman. But those enforcement actions would come much later, far too late to deal with the here-and-now problem of people unable to access account funds.

The point is that the fintech/middleman/bank sponsor framework is almost perfectly calibrated to avoid regulatory oversight. In a situation where one link in the chain fails, that’s deadly for customers. Even if they get their money back, as they should if it was insured, it could take an indefinite amount of time to untangle, which is exactly what the FDIC was set up to prevent, by insuring deposits so customers would have perpetual access.

Banking-as-a-service seems to be on the way out as this regulatory arbitrage breaks down, with fintech firms opting for direct relationships with sponsor banks they effectively rent. But taking one link out of the chain doesn’t solve the problem of funds getting stuck through no fault of the customer.

“If this model is to continue, you have to have a fundamental restructuring,” said Rust, of the Consumer Federation of America. “I can see a system where there’s going to be a bank that is the bank partner, but the regulator has to be clear the entire way about the liabilities.”

The other option is that customers who need a bank account should use a bank. Most of the online services that fintechs provide are available at ordinary financial institutions, without the risk that faulty middleware or a pissing match between service providers can lock up your money.

“Most of the end users I’ve spoken to either believed these were banks,” Mikula said. “If they see ‘FDIC-insured’ they think they are safe. They don’t know Yotta is a fintech that works with Synapse that works with Evolve.”