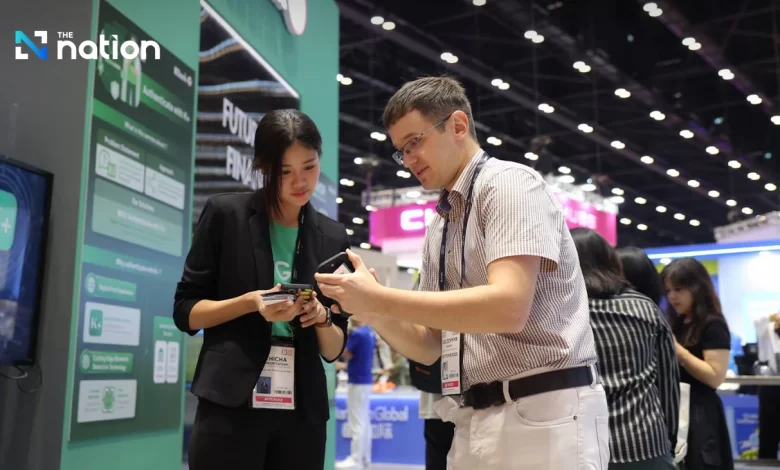

Fintech industry turns out for Asia Money 20/20

Aside from cross-border payments, she mentioned that open banking and better finance have been recurring themes throughout the show.

She also praised Thailand’s public sector, particularly the Bank of Thailand, for its proactive approach to fintech and other movements aimed at opening up the banking sector.

“When open banking becomes big, regulators get involved. Thailand is the leader in open banking and has been involved in many significant initiatives that have made data more easily accessible, which has benefited consumers,” she said.

Asia’s regulators are some of the most forward-thinking and collaborative, promoting cross-industry collaborations, harmonising cross-border regulations, and advancing fintech integration, Sieber added.

Citing recent Boston Consulting Group research indicating that Asia will be the world’s largest fintech market by 2030, Money 20/20’s global president Tracey Davies believes the show in Bangkok will bring tremendous tangible initiatives that will support Asia’s fintech industry, noting that financial inclusion, AI integration and security are among the hot issues being discussed at the event.

“We’ve seen many practical applications of AI among financial services,” she said.

Davies observed that differences in consumer behaviour, geography, and infrastructure set the region apart from Europe and the United States, making it even more active and creative. This has reinforced her belief that Money20/20 Asia will follow the two previous events in demonstrating how the region is fostering innovation and creating frameworks for growth in Asia and around the world.