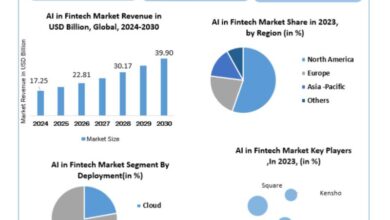

Fintech Market Size, Share Analysis and Forecasts: 2024-2029

The Fintech Industry Report is segmented by service proposition, including Money Transfer and Payments, Savings and Investments, Digital Lending and Lending Marketplaces, Online Insurance and Insurance Marketplaces, and Other Service Propositions. Additionally, it is segmented by geography, covering Europe, North America, Asia-Pacific, Latin America, and the Middle East and Africa regions.

The report by Mordor Intelligence provides market size and forecasts for the Fintech Market in terms of value (USD) for all the aforementioned segments.

Fintech Industry Overview

The fintech market is dynamic and continuously evolving, propelled by ongoing technological innovation, shifting consumer preferences, regulatory advancements, and strategic partnerships among various industry stakeholders. Key players in the market comprise Ant Financials, Atom Bank, SoFi, PayPal, and Coinbase.

Fintech Market Analysis

The global Fintech Market is estimated to be USD 312.92 billion in 2024, projected to reach USD 608.35 billion by 2029, with a CAGR- compound annual growth rate exceeding 14% during the forecast period (2024-2029). In the financial realm, Fintech denotes financial technology, encompassing automated and enhanced financial services provided by computer programs and other contemporary technologies. The Fintech sector has undergone significant evolution over time, fostering a more customer-centric approach among businesses. Consequently, navigating the vast array of global entities, ranging from startups to tech giants to established enterprises, presents a challenge. Fintech and financial service organizations have pursued disruptive and innovative concepts within an ever-evolving business landscape, either collaborating or competing with each other.

Several crises have acted as catalysts for the fintech industry’s growth. Fintech investments have surged since the global financial crisis, as weaknesses within the traditional financial services sector spurred a technological response, leading to its expansion. Similarly, the COVID-19 pandemic, which triggered a global economic downturn, accelerated the fintech industry’s development. In response to the pandemic, major financial institutions partnered with emerging tech firms to access new markets. Despite fintech firms seeking collaborations with large banks to broaden their clientele and offerings, the fintech industry continues to thrive.

In recent years, various fintech subtypes have emerged, including insurtech, regtech, payment services, and others, employing cutting-edge technologies tailored to specific industries or functions. As the fintech sector transcends mere trend status, the degree of execution in an organization’s strategy becomes increasingly significant. The technological aspect of the fintech industry is experiencing rapid growth, with increased adoption of technologies enhancing accuracy, efficiency, and agility, such as blockchain, process automation, application programming interfaces (APIs), robotics, and data analytics.

Fintech Market Trends

Rapid Uptake of Digital Payments Propels Market Growth

Money transfers and payments form the backbone of the fintech industry, serving as a catalyst for financial services innovation and digital metamorphosis. They enable access to financial services for underserved demographics, including the unbanked and underbanked. Fintech advancements in money transfers and payments enhance the overall customer experience by providing convenient, efficient, and user-friendly payment solutions.

Digital payments have revolutionized the fintech landscape by offering quicker, more efficient, and secure methods for money transfers and financial transactions. The proliferation of smartphones, the Internet, and other digital technologies has fueled the surge in digital payment usage. Digital payments serve as the cornerstone for numerous fintech innovations. Fintech enterprises leverage digital payment infrastructures to deliver various services such as peer-to-peer (P2P) transfers, online lending, robo-advisory, insurance, and more, thereby augmenting financial accessibility and inclusion through digital payment channels.

Digital payments offered by fintech entities often entail lower transaction fees compared to traditional banking methods, particularly for cross-border transactions. This cost-effectiveness benefits both consumers and businesses, alleviating financial barriers associated with transactions and driving the adoption of fintech payment solutions. Fintech firms prioritize security in digital payments through robust encryption, biometric authentication, and fraud detection mechanisms, enhancing the security of financial transactions and fostering user trust, thereby catalyzing broader adoption of digital payment solutions.