Fintech Software Market size is set to grow by USD 22.65 billion from 2024-2028, Need to improve business efficiency boost the market, Technavio

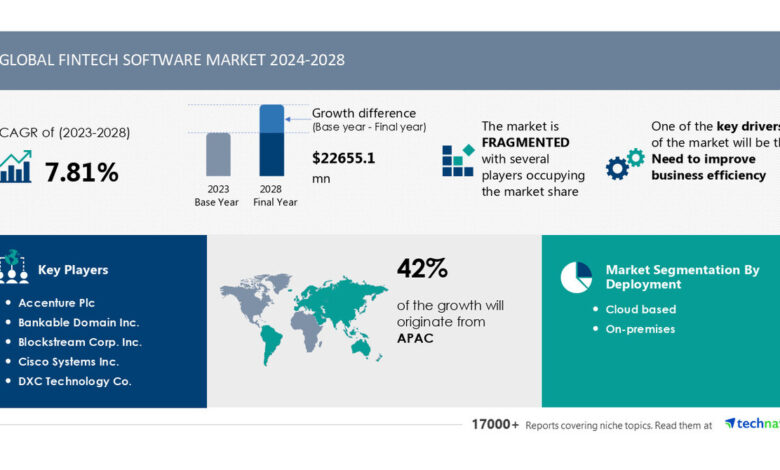

NEW YORK, June 12, 2024 /PRNewswire/ — The global fintech software market size is estimated to grow by USD 22.65 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 7.81% during the forecast period. Need to improve business efficiency is driving market growth, with a trend towards rising demand for data integration and visual analytics. However, data privacy and security concerns poses a challenge. Key market players include Accenture Plc, Bankable Domain Inc., Blockstream Corp. Inc., Cisco Systems Inc., DXC Technology Co., Fingent, Hewlett Packard Enterprise Co., Infosys Ltd., Intel Corp., Intellectsoft LLC, International Business Machines Corp., iTechArt Group Inc., LeewayHertz, Microsoft Corp., Oracle Corp., Praxent LLC, Red Hat Inc., SAP SE, SAS Institute Inc., and Serokell OU.

Get a detailed analysis on regions, market segments, customer landscape, and companies- View the snapshot of this report

|

Fintech Software Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2023 |

|

Historic period |

2018 – 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.81% |

|

Market growth 2024-2028 |

USD 22655.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023 (%) |

7.24 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 42% |

|

Key countries |

US, China, Japan, UK, and France |

|

Key companies profiled |

Accenture Plc, Bankable Domain Inc., Blockstream Corp. Inc., Cisco Systems Inc., DXC Technology Co., Fingent, Hewlett Packard Enterprise Co., Infosys Ltd., Intel Corp., Intellectsoft LLC, International Business Machines Corp., iTechArt Group Inc., LeewayHertz, Microsoft Corp., Oracle Corp., Praxent LLC, Red Hat Inc., SAP SE, SAS Institute Inc., and Serokell OU |

Market Driver

Fintech software plays a crucial role in enabling enterprises to integrate and analyze vast amounts of data from various sources for informed decision-making. Its real-time capabilities facilitate the monitoring, transformation, and delivery of data, bridging the gap between businesses and IT. With the increasing globalization, fintech software helps connect people and systems around the world.

Companies integrate fintech with business analytics software and visual analytics tools for dynamic data representation, highlighting key metrics through charts and graphs. These factors contribute significantly to the growth of the fintech software market.

The Fintech software market is experiencing significant growth with various technologies and regulations shaping its landscape. Regtech technology is a key trend, focusing on regulatory compliance through automation and artificial intelligence. Securitization is another trend, with companies using technology to create and trade financial securities. Blockchain technology is also transforming the industry, providing secure and transparent transactions.

Programming languages like R and Python are widely used for Fintech development. Venture capital funding is fueling innovation in areas like artificial intelligence, capitals, and fintech infrastructure. Overall, the Fintech software market is dynamic and innovative, driven by technology and regulatory trends.

Research report provides comprehensive data on impact of trend. For more details- Download a Sample Report

Market Challenges

- Fintech software adoption in organizations faces challenges due to data privacy and security risks. Big data and AI capabilities allow tracking, retrieval, and analysis of data from connected servers, while altering server algorithms.

- Unauthorized access to IT infrastructure and system flaws from open-source code pose risks. Cloud infrastructure, with its multitenant architecture and shared resources, is particularly vulnerable to hacking and data breaches. These concerns may limit fintech software market growth.

- The Fintech software market is experiencing significant growth, with various solutions and programs coming to the fore. However, this growth brings challenges. Companies face integration issues when implementing new technologies. Consumer privacy and security are major concerns.

- Additionally, regulations like GDPR and CCPA add complexity. Older systems may not be compatible with new technologies, making modernization a challenge. Furthermore, maintaining and updating Fintech systems can be costly and time-consuming. Lastly, ensuring scalability and adaptability to changing market conditions is essential. Addressing these challenges requires a strategic approach and continuous innovation.

For more insights on driver and challenges – Request a sample report!

Segment Overview

- Deployment

- 1.1 Cloud based

- 1.2 On-premises

- End-user

- 2.1 Banking

- 2.2 Insurance

- 2.3 Securities

- Geography

- 3.1 North America

- 3.2 APAC

- 3.3 Europe

- 3.4 South America

- 3.5 Middle East and Africa

1.1 Cloud based- The cloud-based fintech software market is projected to expand significantly during the forecast period. Key drivers include cost savings, scalability, and data security innovations. Cloud solutions enable financial companies to store critical data on-premises and infrequently used data on public servers, optimizing costs. Additionally, cloud-based software offers flexibility to scale resources as needed, making it an attractive option for organizations. These advantages are expected to fuel the growth of the cloud-based segment in the fintech software market.

For more information on market segmentation with geographical analysis including forecast (2024-2028) and historic data (2017-2021) – Download a Sample Report

Research Analysis

The Fintech software market is experiencing significant growth, driven by the integration of modern technologies such as Artificial Intelligence (AI), Blockchain, and Cloud-based Solutions in the Financial Sector. Application Programming Interfaces (APIs) play a crucial role in enabling seamless communication between various financial applications and services. Financial Institutions, including Insurance Companies and Banks, are leveraging Fintech software to enhance their service proposition, offering consumers innovative solutions for Savings and Investments and other service propositions.

E-commerce Sites and Mobile Banking Apps are also integrating Fintech software to streamline transactions and improve customer experience. Regulatory Standards set by National Regulators and the World Bank ensure the secure and ethical implementation of Fintech solutions in the Financial Technology landscape. Computer Programs and Fintech Software are transforming the way consumers manage their financial needs, making financial services more accessible and convenient.

Market Research Overview

The Fintech software market is a dynamic and innovative industry that focuses on leveraging technology to improve and automate financial services. This sector encompasses various applications such as digital payments, lending, wealth management, and insurance. The market is driven by factors like increasing smartphone usage, growing internet penetration, and the need for efficient financial solutions. Programming languages like Python and Java are commonly used in Fintech software development.

Security is a top priority in this industry, with encryption and biometric authentication being essential features. Additionally, regulatory compliance and data privacy are significant concerns. The market is segmented based on application areas and geographies. It is expected to grow significantly in the coming years due to the increasing adoption of digital financial services.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Deployment

- End-user

- Banking

- Insurance

- Securities

- Geography

- North America

- APAC

- Europe

- South America

- Middle East And Africa

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

SOURCE Technavio