Fintech Startup iBind Systems Collaborates with Google Cloud to Redefine Corporate Banking

Fintech startup iBind Systems has something better to offer. It has partnered with Google Cloud to revolutionize the corporate banking segment. The primary focus is to improve the way banks and financial institutions handle their corporate customers in today’s system.

iBind is known for its advanced software and Google Cloud has a powerful infrastructure as well as cutting-edge AI technology. The two jointly are promising to make banking faster and easier for businesses.

iBind Systems has lately come up with a new product called the Entity Digital Locker. It is a part of their Corporate Identity Platform (CIP). The solution simultaneously simplifies corporate onboarding as well as includes processes like Know Your Customer (KYC), Anti-Money Laundering (AML) checks, credit assessments and digital signatures. The primary goal of the partnership is to create a secure and user-friendly system for sharing data. It will make easier for businesses to access financial services.

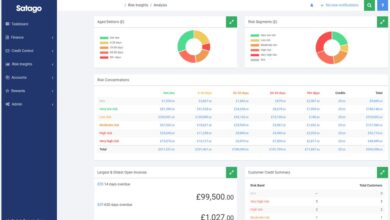

The partnership will also simultaneously enhance the risk assessment platform of iBind. The platform will generate detailed risk profiles for corporations with the help of AI. This will help banks understand and manage potential risks better.

iBind has plans to use AI to offer personalized advertising for corporate customers. It will be something like a virtual Relationship Manager. The specialized AI models will enable banks to quickly and accurately analyze financial data as well as improve risk and credit assessments.

The collaboration is learned to be driving innovation in the fintech segment. Google Cloud will support iBind to develop secure and advanced financial solutions. The partnership will further allow iBind to continue creating more improved products for the corporate banking.

iBind Systems co-founders Santu Maity and Sanat Bhat expressed excitement about the partnership.