Footprint Pitch Deck That Helped the Fintech Raise $13 Million

A startup looking to be Wall Street’s one-stop shop for onboarding new customers just raised $13 million.

Footprint, which was featured on Business Insider’s up-and-coming fintechs list last year, announced its Series A on Tuesday. The round was led by QED Investors, and included investment from Index Ventures and Palm Tree Capital, among others.

The startup aims to streamline the identification process for businesses and consumers, which is a pain point felt across Wall Street thanks to regulations that require firms to know to whom they are providing services, such as Know Your Customer (KYC). The problem is that each firm does the same process differently, often relying on a host of software providers, according to Eli Wachs, Footprint’s CEO and cofounder. Footprint wants to change that by building a one-stop shop for banks and fintechs to merge KYC, authentication, and fraud mitigation into a single product.

“Historically, KYC was a back-end tool. It was a checkbox,” Wachs told BI. “We think it’s really difficult to catch fraud with a back-end API,” he added.

He compared the digital process to identification in real life. When a person presents their ID at a bank, Wachs said, the teller will check that the name and photo correspond to the person standing in front of them. He added the teller may also notice if that person is twitching, if they came in with three briefcases, or if six different people before them came in with the same ID.

But with many back-end KYC solutions, the parallel would have the teller in another room apart from the customer, with an intermediary who would relay the ID.

“That sounds silly,” Wachs said. “But that’s kind of what happens online with these back-end KYC tools,” he added.

How Footprint wants to build “portable identities”

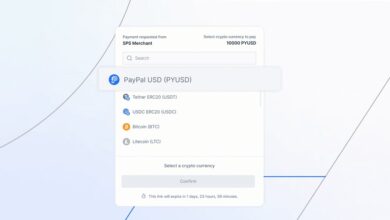

Footprint provides the online security for financial firms to ingest sensitive consumer information, like social security numbers, while verifying identity and automating compliance workflows. It was founded by Wachs, a former investor on General Atlantic’s technology team, and Alex Grinman, a security and cryptography expert.

To authenticate consumer identities, Footprint uses behavioral biometrics, which track a user’s physical behavior online to distinguish between criminal and legitimate activities. This technology can determine whether someone copy-and-pasted an SSN or if they typed it with ease. It also uses similar tech that Spotify and Netflix use to track the number of accounts and make sure every user in its database only has one identity.

The aim is to create a “portable identity” for consumers that Footprint owns. The portable ID would be shared between firms who require it, similar to how single sign-on authentication enables uers to log into multiple apps and websites with one set of credentials.

“Today, every company in a vacuum is looking for the needle in the haystack that is fraud. Footprint’s approach is to harvest the hay — we’re going to label good actors and make it very easy for them to get around, and more so we’re going to narrow the scope of possible bad actors,” Wachs said.

Sharing portable identities is something VCs are bullish on.

Wachs said he believes the technology is ready, but others have said the success of such a solution will come down to financial firms’ willingness to adopt such a fundamental change. The database of portable identities only works if there are enough entries.

According to Wachs, the number of companies buying into the idea is growing, especially among fintechs that cater to auto finance and real estate. By the end of the year, Footprint is slated to have more than 1.5 million portable identities, the company said. Some customers include Treasury Prime and Apiture, which facilitate digital banking for fintechs, banks, and credit unions.

The Series A brings Footprint’s total funding to $20 million. Wachs declined to disclose Footprint’s valuation. Wachs said he will use the capital to grow Footprint’s fraud and risk teams as it seeks to attract larger enterprise customers. The company will also use the capital to “productize” customer identities and automate compliance processes for financial institutions.