Forget Nvidia: Jim Cramer Says This Company Could Be About to Cash In on Artificial Intelligence (AI) Data Centers

Data center services are witnessing outsized demand as the AI revolution unfolds.

One of the biggest investment areas among artificial intelligence (AI) opportunities is data centers. Applications in generative AI are fueling a new wave of demand for cloud storage, server racks, network infrastructure, and more.

While Nvidia is a major provider of data center services, other players are emerging with formidable solutions. Moreover, even big tech giants, such as Amazon, are investing significant sums into building their own data centers. Savvy investors understand that there are a host of opportunities making inroads in the growing data center realm — a market expected to reach nearly $440 billion by 2028, according to Statista.

Stock analyst and media personality Jim Cramer recently named Constellation Energy (CEG -1.49%) as a top pick for data center services. While this may seem a bit out of the ordinary, Constellation Energy is currently discussing some interesting partnerships and could very well emerge as a big winner of the AI data center boom.

Below is an exploration of how the company could play a major role in the data center arena and whether now is a good time to scoop up some shares.

Data centers use a lot of energy

Data centers act as storage units for IT architecture and network infrastructure. These buildings house larger server racks that are filled with hardware such as graphics processing units (GPUs), which are used for accelerated computing.

While data centers play an integral role in the AI ecosystem, there’s one big drawback: Data centers use a lot of electricity.

According to the Department of Energy, data centers use anywhere between 10 to 50 times more energy than a standard commercial office. This translates into roughly 2% of the total electricity consumption in the U.S.

Research from Goldman Sachs suggests that data center power demand will increase at a 15% compound annual growth rate (CAGR) through 2030 — at which point it would reach approximately 8% of total power demand in the U.S. by 2030.

Image source: Getty Images.

Constellation Energy offers a unique solution

Considering that the secular tailwinds fueling AI are directly correlated to rising energy consumption — electricity, in particular — data centers are in need of an alternative solution sooner rather than later. Constellation Energy might just have the answer.

The company operates across many aspects of the energy industry including solar, wind, and natural gas. But another solution Constellation Energy brings to the table is nuclear power. And the best part? Big tech is interested.

During Constellation Energy’s most recent earnings call, management alluded that the company is in discussions with “Magnificent Seven” members Microsoft and Alphabet about potentially partnering on nuclear-powered data centers.

Furthermore, Goldman affirmed rising interest in nuclear power, calling it “an attractive generation source for data centers given it is zero carbon and reliable.”

Is Constellation Energy stock a buy right now?

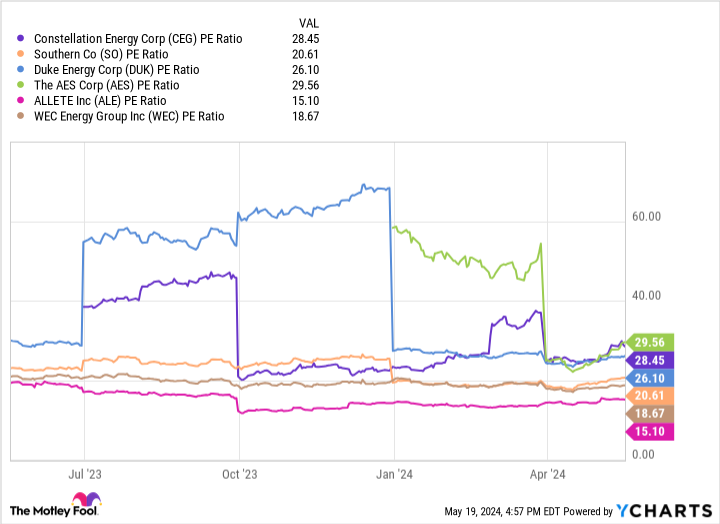

As of the time of this writing, Constellation Energy was trading at a price-to-earnings (P/E) ratio of 28.4 — well above the S&P 500‘s P/E of 24.8.

Furthermore, after benchmarking Constellation Energy against other regulated utilities, the company appears to be trading at a premium relative to some of its competitors.

CEG PE Ratio data by YCharts

While Constellation Energy might be pricey compared to other utilities, I see the company as an under-the-radar opportunity among AI investments. Although there will be obvious investment choices among big tech and peripheral competitors in IT infrastructure, energy stocks shouldn’t be forgotten when it comes to AI.

For this reason, Constellation Energy might be seen as a better value compared to many technology stocks which have seen valuation multiples expand dramatically over the last year as AI tailwinds have fueled buying activity.

Considering nuclear power is garnering the interest of the biggest AI enterprises, I wouldn’t overlook the energy sector, in general.

Given Constellation Energy’s relationship with big tech and its capabilities at the intersection of data center services and nuclear power, I see the stock as an attractive buying opportunity for long-term investors.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Constellation Energy, Goldman Sachs Group, Microsoft, and Nvidia. The Motley Fool recommends Duke Energy and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.