Forget Nvidia: This Artificial Intelligence (AI) Stock Offers Stronger Growth Prospects

This player isn’t new to the tech world — but its growth just took off over the past few years.

You may think of Nvidia (NVDA 1.97%) as the ultimate artificial intelligence (AI) company thanks to its critical position in the deployment of this hot technology. Nvidia makes high-end chips that can provide the required level of computing power for the training and use of AI models, and it dominates that section of the chip market with more than 80% share. Its chips are the fastest and most powerful, and that has kept it on top — and its investment in research and development could keep the momentum going.

But there are other players in the AI environment worth your attention, and one in particular boasts earnings growth estimates that are even stronger than Nvidia’s. While Nvidia’s earnings per share are expected to grow at an annualized rate of 37.9% over the coming five years, this company’s annualized EPS growth forecast for that period is 48.2%. I’m talking about Super Micro Computer (SMCI 0.48%), a 30-year-old tech giant that just shifted into high-growth mode over the past few years thanks to its role in AI.

Image source: Getty Images.

A behind-the-scenes star

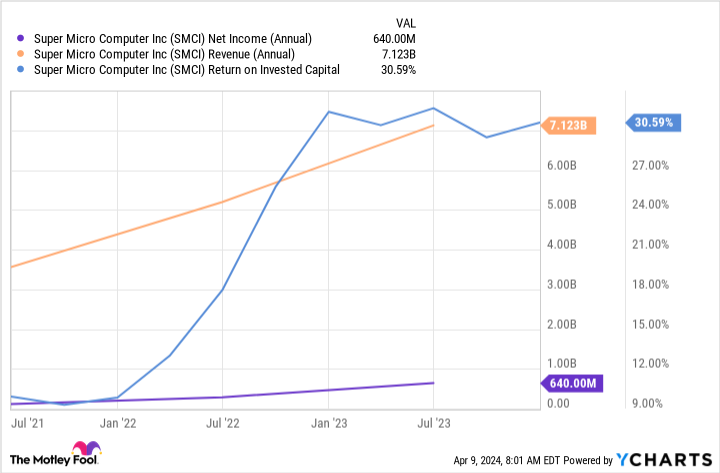

Supermicro is a behind-the-scenes superstar in the world of AI. It sells the servers, storage systems, rack-scale solutions, and other equipment needed to deploy the core hardware that powers AI platforms. This has translated into explosive earnings growth for the company over the past three years — and significant gains in return on invested capital.

SMCI Net Income (Annual) data by YCharts.

Supermicro has grown 5 times faster than its industry’s average over the past 12 months. The secrets to the company’s success? It offers customers a wide variety of customization possibilities, and since it uses a building-block approach, with common elements that serve multiple platforms, it can quickly build tailor-made systems to suit each client’s needs. Its ability to do that (and do it fast) has helped attract more and more customers.

But one other element has been playing an important role in this company’s speedy growth. Supermicro works closely with Nvidia, Intel, and other chip leaders, following their product developments and upcoming launches — that way, it can immediately integrate the latest chip innovations into its platforms.

Because of this, Supermicro should keep benefiting from general growth in the chip market. If Nvidia continues to win, great. But if another player emerges as a leader, Supermicro will benefit just as much thanks to its relationships with players across the industry.

We’ve already seen how these relationships are boosting Supermicro’s business. In the report for its fiscal 2024 second quarter (which ended Dec. 31), the company said it’s seeing continued record demand for AI systems at rack scale including Nvidia, Intel, and Advanced Micro Devices chips. It’s no surprise that Supermicro’s growth estimates are soaring.

A $3 billion quarter

That most recently reported period was also Supermicro’s first-ever $3 billion quarter. CEO Charles Liang said that given the demand for inferencing and computing system requirements, demand growth could continue for a number of years.

Supermicro also benefits from its liquid-cooling technology, which provides a solution to one of the biggest problems in AI hardware — the generation of heat that could hurt chip performance and lead to energy inefficiency within a data center.

All of these elements support the idea of more growth ahead for Supermicro. Today, the shares trade for 42 times forward earnings estimates, which may not look particularly cheap. But it’s important to remember that this measure is based on earnings estimates for the next year, so it isn’t particularly long term.

The AI revolution may just be getting started, in which case a player like Supermicro could also just be getting started when it comes to earnings growth. Estimates for the coming five years are positive, and even beat those for top player Nvidia. Considering all of this, Supermicro shares look reasonably priced today and could have plenty of room to run. That’s why you may want to forget Nvidia for now and instead add a few shares of Supermicro to your AI growth portfolio.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.