From Artificial Intelligence (AI) to iPhones to China, This Chart Sums Up Apple’s Declining Business

The tech giant’s revenue has declined in five of the last six quarters, and the stock’s recent returns reflect poor investor sentiment.

Among the “Magnificent Seven” stocks, only two have produced negative returns so far in 2024: Tesla and Apple (AAPL 0.02%). Although Apple shares are only down a modest 1.5% as of this writing, the company’s latest earnings signal that further losses could be on the horizon.

Apple’s growing challenges

Apple is one of the most innovative companies of all time. From the iPad to the iPhone, it has put on a decades-long master class in developing hit consumer electronics.

However, in recent years, one of the biggest knocks against the company has been its lack of innovation. Although the company introduced its Vision Pro virtual reality headset earlier this year, demand has been uninspiring as consumers have less expensive alternatives — namely, from Meta Platforms.

For quite some time, Apple’s main source of growth stemmed from the iPhone as consumers opted to upgrade to the latest and greatest model. Unfortunately, this strategy hasn’t been working lately.

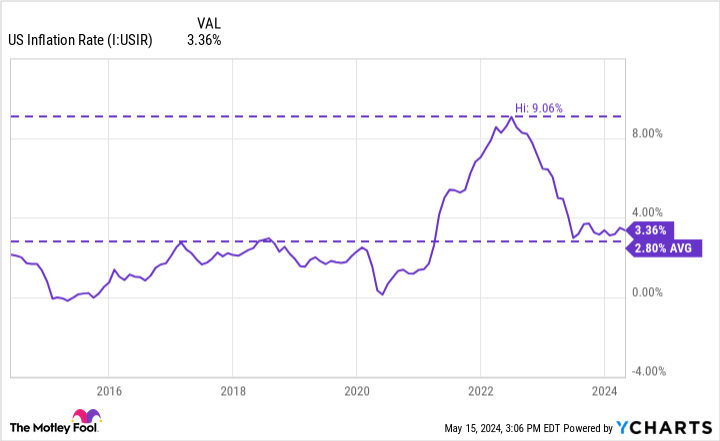

The economy has been plagued with high inflation and rising interest rates for the last 18 months. While the current inflation rate of 3.4% is much lower than the peak rates experienced in 2022, it remains much higher than the 10-year U.S. average and above the Federal Reserve‘s long-term target of 2%.

Data by YCharts.

The combination of lingering inflation and high borrowing costs has negatively impacted consumer purchasing power. This can be seen in Apple’s operating results, as customers aren’t upgrading their hardware devices.

Image source: Statista

The chart above illustrates that Apple’s main source of revenue — iPhone sales — is shrinking. To make matters worse, revenue in the important Chinese market fell 8% in the most recent quarter. Furthermore, sales of iPads and wearable hardware devices (such as the Apple Watch) were also down.

If this weren’t enough to raise concerns, Apple has been suspiciously quiet when it comes to an artificial intelligence (AI) roadmap. All of its mega-cap tech peers have already made inroads in the AI realm, with Apple seemingly left behind.

Given the combination of these bearish signals, I don’t see Apple as the best opportunity for growth investors right now.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Apple, Meta Platforms, and Tesla. The Motley Fool has positions in and recommends Apple, Meta Platforms, and Tesla. The Motley Fool has a disclosure policy.