Here Is My Top Artificial Intelligence (AI) ETF to Buy Right Now

If you don’t have hours to dedicate to researching stocks, ETFs are a terrific solution.

Between work, family, hobbies, and other commitments, most people don’t have hours to devote to stock research. Plus, let’s face it. Picking individual stocks is more difficult and riskier than buying a basket of companies. This makes exchange-traded funds, or ETFs, an attractive vehicle. ETFs trade just like stocks, but the funds hold dozens of stocks linked by a specific theme. Several ETFs cater to the market’s hottest sector: artificial intelligence (AI).

There is a lot of hype around AI, and the enthusiasm is warranted. Companies are spending billions of dollars researching real-world solutions and bringing them to market, and organizations in many industries are already integrating generative AI and large language models (LLMs) into workflows. The efficiencies these tools provide and our ultra-competitive business world will encourage more companies to adopt them.

One estimate forecasts that the global market size will approach $2 trillion by the end of this decade, as shown below.

Image source: Statista.

What are the best artificial intelligence ETFs?

Not all ETFs are created equal. Factors like diversification, assets under management, historical performance, and the expense ratio are important. The Global X Robotics & Artificial Intelligence ETF (BOTZ 0.13%) is a popular AI fund. It has $2.8 billion in assets under management and an expense ratio of 0.68%, which is competitive. Its portfolio currently holds 43 companies, focusing on those that will “benefit from increased adoption and utilization of robotics and artificial intelligence.”

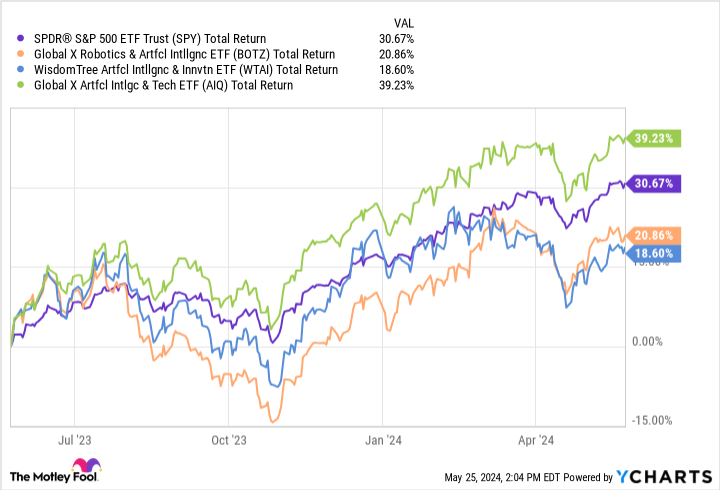

BOTZ is heavily weighted toward its top holdings. Nvidia (NASDAQ: NVDA) makes up more than 10% of the fund, and its top four holdings account for more than 35%. The fund has underperformed the SPDR S&P 500 ETF (NYSEMKT: SPY) over the past year, despite Nvidia gaining 248%.

Besides the reliance on a few top holdings, another potential drawback is its lack of big tech holdings. BOTZ investors miss out on Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), Meta (NASDAQ), and Microsoft (NASDAQ: MSFT), and even one of my personal favorites, Arm Holdings (NASDAQ: ARM).

BOTZ is most appropriate for investors seeking a well-managed portfolio featuring a few stocks with a focus outside big tech.

Global X also manages the Artificial Intelligence & Technology ETF (AIQ -0.21%). AIQ holds positions in 84 companies, has a 0.68% expense ratio, and has crushed the S&P 500 over the past year, as you can see below.

SPY Total Return Level data by YCharts

The Artificial Intelligence & Technology ETF has positions in all of the stocks above except for Arm Holdings. Its top stock is also Nvidia, but it accounts for only 5% of the total. AIQ is best for those who seek a diversified portfolio with an emphasis on big tech. AIQ is an excellent choice with a tremendous recent track record.

Here’s my favorite

However, my favorite AI ETF is the WisdomTree Artificial Intelligence and Innovation Fund (WTAI -1.11%). WTAI is the worst-performing fund in the chart above, but this doesn’t mean it won’t outperform moving forward. Nvidia and Microsoft account for almost 13% of the S&P 500 and 8% of AIQ but under 5% of WTAI, which explains the underperformance. These stocks exploded last year, but they could soon hit fair value and level off.

The WisdomTree Artificial Intelligence and Innovation Fund is the most diversified of the three funds I’ve chosen, with no company making up more than 3% of assets. It currently holds 75 stocks, including big tech names. It also has the lowest expense ratio at 0.45%. Its most significant investments are in semiconductors (33%) and AI software (24%), thriving industries with serious room for growth as AI ramps up. Its recent underperformance could change quickly, since the semiconductor industry is cyclical and appears headed for another up cycle after a difficult 2022 and 2023.

WTAI is a terrific pick for those who want significant diversification, a low expense ratio, and exposure to the industry’s biggest names.

You don’t have to be a brilliant stock picker to capitalize on a rising industry like AI. Sometimes, it’s best to let those with more time to dedicated to following stocks choose. ETFs offer broad exposure with less risk and volatility. There are tons of options; perhaps one mentioned above is right for you.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Alphabet, Amazon, Arm Holdings, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.