How AI may become the new offshoring

Stay informed with free updates

Simply sign up to the Artificial intelligence myFT Digest — delivered directly to your inbox.

It took 72 years for the number of US households with a telephone to rise from 10 per cent to 90 per cent. It took 19 years for adoption of the television to follow the same arc. But the speed of take-up for our latest technologies, such as generative AI, is stunning. Within 15 months of launch, 23 per cent of American adults had used OpenAI’s ChatGPT chatbot.

The reasons for this acceleration are not hard to fathom. Rather than being a discrete, relatively expensive, physical object, like a telephone or television, generative AI is (mostly) free software that augments existing services.

Colossal global digital platforms can deliver this technology almost instantly at mass scale. This week, Apple announced it would be rolling out “Apple Intelligence” to more than 2bn device users.

But the availability of a new technology does not mean it will instantly be put to quick and productive use. It can take years, if not decades, before general purpose technologies transform economies.

International donors have long argued that the benefits of foreign aid are limited by the “absorptive capacity” of any recipient country. In other words, does a country have the institutions and knowhow to invest the money wisely? Something similar may be true with generative AI.

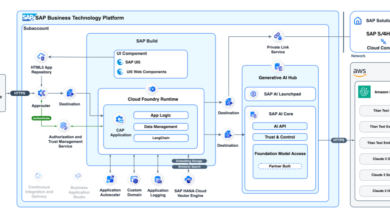

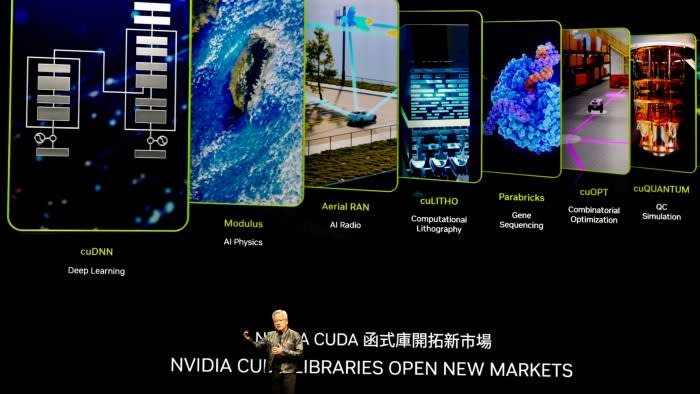

To listen to the evangelists, AI is going to upend everything, everywhere all at once. According to stock market investors, the clear winners are the Magnificent Seven US tech companies, led by Microsoft, Nvidia, Apple, Alphabet and Amazon, which account for about half the $30tn market value of the world’s 960 largest listed tech stocks. They are providing the models, cloud computing infrastructure and silicon chips that run AI.

One big institutional investor told a Founders Forum event in London this week that it was “just incredible” to hear the leaders of these AI companies talk about the speed of development.

“It has dramatic implications. The top seven companies in 2018 were 10 per cent of the [US] market index. Now 30 per cent. There is a concentration risk that is higher than ever before,” the investor said.

The Magnificent Seven are all hyper-ambitious and intent on using AI to boil the ocean. Many other companies want to use AI to switch on a kettle. For established companies, there are two main uses: to do things more efficiently and to do what could not be done before.

More intriguingly, a small army of start-ups is exploring the possibilities of using the technology to invent wholly new business models. But the key will be to focus on specific enough use cases to build sustainable and defensible companies.

Established companies in most industries, which have their own proprietary data, entrenched brands and deep relationships with their customers, are in a great position to exploit the generative AI tools offered by the big tech companies. Previously, only the chief technology officer of most companies could deliver AI services. But the accessibility of generative AI models now enables all other C-suite functions, from finance to operations to marketing, to deploy them, too.

However, one former founder of a west coast AI start-up who has spent years working with public and private sector organisations to implement AI solutions, tells me the main constraint on using the technology remains institutional resistance, especially in the defence and healthcare sectors.

There are, as the saying goes, nine penpushers to every trigger-puller in the US military. That organisational inertia, the entrepreneur says, is true in many private sector organisations, too. To put it another way, they lack absorptive capacity. It will take five to 10 years to make the most of existing AI models, let alone the more powerful models to come.

For that reason, we might see the emergence of alternative business models that can accelerate the process.

For the past few decades, private equity companies have followed a lucrative, if somewhat brutal, playbook of buying companies, firing employees and offshoring operations to China. That game may now be ending given the geopolitical tensions between the US and China and the renewed focus on the resilience of supply chains. Maybe AI will be deployed to transform corporate cost structures instead.

“Could a PE firm buy up the fourth-biggest company in an industry, deploy AI and turn them into the number one?” the entrepreneur asks. It’s a good question and one that will entice some PE managers as much as it unnerves many employees.