How can fintechs ensure further profitability amid macro-economic challenges?

Funding for startups and fintech has fallen to a low point since its peak in 2021. Yet, many companies with a more solid base are looking at how they can expand further and create more profitability in a challenging macroeconomic environment.

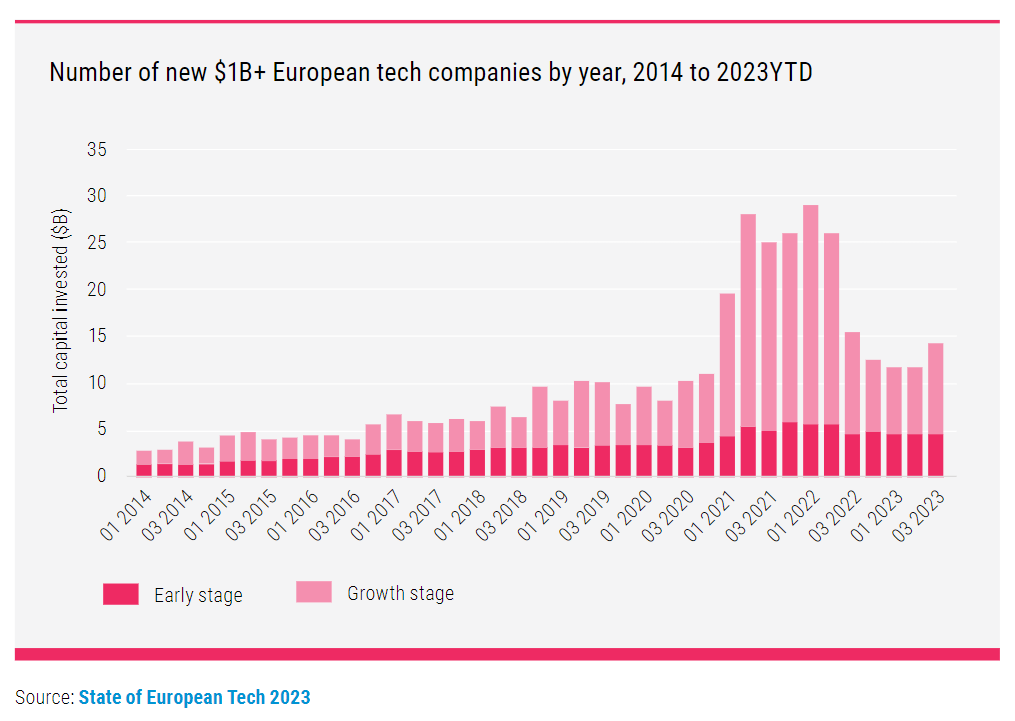

Q1 2024 saw only 904 deals and $7.3 billion in fintech funding, which was the worst performing quarter since the beginning of 2020. Billion-dollar companies have seen a major drop in valuation, in 2023 the lowest number of billion-dollar companies emerged

in the last decade, as seen in the figure below.

What macro-challenges are European start-ups facing?

There have been an array of factors impacting the status of European start-ups in 2023 and the first half of 2024, with major contributors including geopolitical instability, such as the conflict in Ukraine and war on Gaza that has had international repercussions

on policies and the economy.

Other challenges that have led to the investment downturn in Europe has been the lack of funding in the sector, risk aversion due to funding slowdown, recession, inflation, talent shortages and an unstable job market, and the threat of the climate crisis

looming on the horizon. In countries like the UK specifically, the cost-of-living crisis has impacted the economy significantly, along with making the job prospects slim and soaring housing prices.

Francesco Simoneschi, CEO of TrueLayer, stated: “Over the past eighteen months start-ups have faced major headwinds on a macroeconomic level – like many other parts of the economy. The environment for fast-growth technology firms is transformed. Where previously

all incentives were aligned towards fundraising and scaling as quickly as possible. The increased cost of capital has turned this situation on its head. As a result, we have seen a 180-degree shift in operating models as companies target profitable growth

and make efficiencies wherever they can.

“While these macro conditions have inevitably led to firms being run in a different way, we must not lose sight of the bigger, foundational shifts in technology and consumer behaviour taking place beneath our feet. These trends will enable a new generation

of category-defining companies to thrive.”

With lowered investment in fintech, how can we ensure innovation continues?

Global fintech investment has been swerving downwards since 2022, and so Europe is not alone in the market reset seen in 2023. In fact, Europe is still ahead of the US when it comes to tech growth in the last 18 months.

Tech investments in 2023 were half of that in 2022, due to an influx of issues impacting the startup economy, having reduced to $45 billion from $82 billion.

According to the State of European Tech report, there was significant amount of investment in the sector between 2021 and the first half of 2022, but that has decreased in 2023. The report also surveyed stakeholders

According to the State of European Tech report, there was significant amount of investment in the sector between 2021 and the first half of 2022, but that has decreased in 2023. The report also surveyed stakeholders

in the industry and found that 45% expressed optimism on the prospects of the sector.

Simoneschi noted: “We are seeing more sustained examples of fintechs and established financial players – in particular banks – working together closely to deliver innovation. VRP are a great example of this: TrueLayer has formally partnered with NatWest,

to make a wide set of VRP use cases available to its customers. At the same time, we are working with a wide range of stakeholders to address shared challenges as VRP scales, for example on setting up dispute mechanisms.”

What are incoming trends for start-up growth?

Out of 26 European tech deals worth over $100 million in 2023, 11 were AI companies; AI has seen large amounts of investment recently and will likely see even more as this year progresses. Other sectors where start-ups are more likely to see growth and investment

going further into 2024 are cross-border

payments, DLT solutions, and ESG fintech providers.

Simoneschi said: “At TrueLayer, we have continued scaling by bringing new products and services to the market which address the pain points experienced by our customers. Last year, we launched Signup+ which combines account creation with payments to streamline

sign-up processes, speeding up Know Your Customer onboarding. This is a stage of the customer journey where merchants often lose business: research by YouGov and TrueLayer found that 4 in 10 people in the UK start creating an online account but do not complete

it, with clunky, manual processes causing delay. Fintech succeeds where it brings innovation to bear to solve problems in this way and make customer processes smoother and more painless.”

Cross-border payments are maturing as interconnectedness has become a new essential in the digital payments space. Companies developing cross-border transaction capabilities in 2024 are expected to maintain a standard of speed, efficiency, and security.

Digital assets are expected to see considerable investment in 2024 after the cryptocurrency slump in 2022 and 2023, with stablecoins recovering the market and tokenisation on the rise. January 2024 saw the arrival of Sport BTC ETFs and SEC approval of 11

application including BlackRock and Fidelity.

As for AI technology, there are a great deal of AI-focused initiatives underway in major financial institutions, as well as nonbank financial service providers. PayPal has announced AI-focused initiatives, along with JP Morgan, Klarna, Visa, and numerous

others.

The next steps for start-ups are to engage in collaboration, monetising sustainability, and generating consistent revenue streams. Maintaining sustainable operating practices will see success in the long-term.

How can fintechs move towards further profitability in 2024?

As fintech funding picks up speed, financial service providers need to focus on innovation, adapting to the new regulatory environment, and leveraging modern technologies to bolster growth and increase profitability.

The European ecosystem has proven its resilience, but there is more that it can do to embrace innovation and entrepreneurship. Big tech offering digital financial services and leveraging AI solutions is driving the financial ecosystem forward. Giants such

as Google and Apple that offer online payments methods have hit the mainstream and increased competition.

Stew Cofer, EMEA head of payment specialists and embedded banking solutions at J.P. Morgan, commented: “The clients we are supporting in this sector are focused on scaling and growth, which inevitably means payments. In payments and any business, growth

and resiliency live in constant balance, and scaling responsibly is so critical as start-ups define their market identity.”

Incoming regulation in Europe will shape the payments sector, such as DORA that will establish a framework to prevent cyber-threats and standardise security, PSD2 open banking legislation, the European Commission’s Instant Payment Regulation, the proposed European

Digital Identity Regulation, and the European Payment Council’s SEPA Payment Account Access Scheme (SPAA) that will introduce a commercial system for premium APIs. All these new developments will define how established financial organisations will approach

advancement and growth in the coming years.

Simoneschi explained: “The regulatory environment plays an important role. Later this year, all Eurozone banks will start being required to send and receive instant payments, while at the same time policy developments in the UK, EU and beyond continue to

open up competition further.”