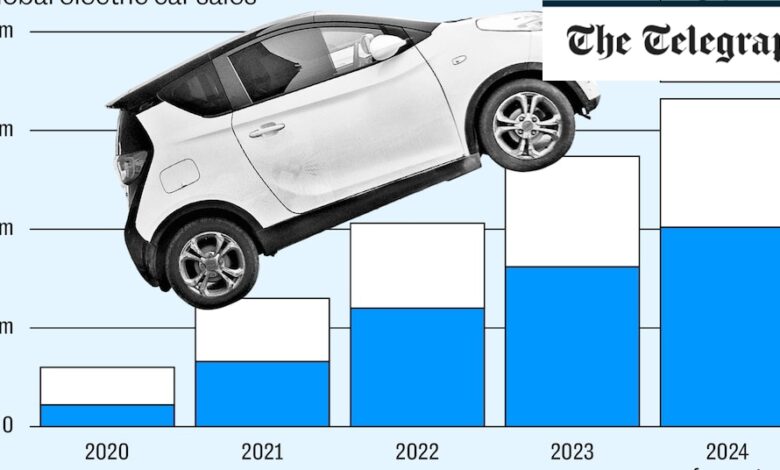

How China’s electric car invasion will reshape the West

China’s EV industry is benefiting from low labour costs, economies of scale from a large home market and a command economy that made battery and EV production a focus of China’s five-year plan introduced in 2021.

National champions are now beginning to build manufacturing bases overseas.

BYD, which last year briefly eclipsed Tesla as the world’s biggest EV maker, plans to start production in Thailand this year with an annual capacity of 150,000 vehicles.

Chinese companies already account for more than half of all EV sales in the country, the IEA says.

BYD is also planning to begin manufacturing in Brazil, investing $600m in its first EV plant outside Asia. Its rival Great Wall plans to open a factory in the South American country too, with access to local deposits of battery metals an added incentive.

The US remains resistant to encroachment.

The chair of the Senate Banking Committee this month urged President Joe Biden to block all Chinese-made cars, saying that a deluge of concealed subsidies represents “an existential threat to the American auto industry”. The president has said they pose a threat to national security.

Mexico is a test case of China’s ability to project its EV might on to the doorstep of the US. The country benefits from subsidies under the Inflation Reduction Act, and three Chinese manufacturers – BYD, Chery and SAIC – are considering expanding to Mexico to take advantage.

Elsewhere, the EU has opened an anti-dumping investigation into Chinese EVs, even as Chery begins selling its Omoda and Jaecoo brands in Italy, its second European market after Spain.

Sales in the UK are expected to begin before the end of the year.

The arrival of cheaper Chinese vehicles in Britain could rescue an EV market that’s stalled in recent years. However, the Transport Secretary has said Britain will use “robust” trade sanctions to prevent China from flooding the car market with artificially cheap EVs.

The next government, of whatever hue, will face tough decisions in seeking to promote the adoption of EVs without surrendering the UK market to Chinese manufacturers, though the IEA numbers suggest their advance is almost irresistible.

One of the most startling comparisons is just how cheap EVs are in China compared to the rest of the world.

The average electric vehicle cost 16pc more than a combustion-engine car in China in 2018. However, by 2022 EVs were selling for 14pc less than their petrol and diesel-powered rivals, data from the IEA shows. That was even before subsidies.