How do electric vehicles affect global oil demand?

In 1959, the oil giant Esso used the iconic slogan ‘put a tiger in your tank’ to promote its fuel energy. In the 2020s, this feline needs to find a new home because, increasingly, car tanks will be replaced by a charging port. What is the impact of the electrification of the transport sector on world gasoline consumption and global oil demand?

As the market penetration of electric vehicles (EVs) in new car sales has soared in several countries, peak oil demand – the point at which global demand for crude oil peaks – is now expected to occur at the end of this decade. However, passenger cars are not the only reason for the decline in petrol and diesel consumption. Rather unnoticed by the public, two- and three-wheelers are having a disproportionate impact on reducing the current displacement of petrol.

The International Energy Agency forecasts that oil consumption will peak in 2030

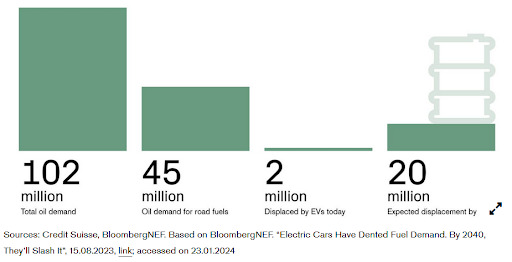

When the International Energy Agency (IEA) published its Energy Outlook 2023 in October last year, it forecast that oil demand would peak at 102 million barrels per day (mb/d) before 2030 rather than in the middle of that decade, as previously estimated. The IEA forecast contrasts with the World Oil 2023 outlook published at the same time by the Organisation of the Petroleum Exporting Countries (OPEC), which sees global oil demand at 116 mb/d in 2045. Although long-term forecasts are often difficult, recent voluntary cuts in oil production have hardly contributed to higher prices. Could the increase in the number of electric vehicles become the factor that displaces oil and also curbs potential oil price rises?

Transport sector accounts for the largest oil consumption

In 2023, global daily oil consumption reached 101.7 mb/d, of which more than 60% went to the transport sector. Within road transport, passenger cars consumed 24.3 mb/d in 2022, followed by commercial trucks (16.2 mb/d), while two- and three-wheelers consumed 2 mb/d. While chemicals, many manufacturing processes and aviation will continue to support oil demand, the decline in transport sector demand caused by electrification will ultimately have the greatest impact on global oil consumption in the coming years.

Figure 1: Oil consumption in the transportation sector

Electrification of two and three-wheel vehicles reduces overall oil consumption

Although the electrification debate focuses on passenger cars, the role of a global fleet of 1120 million two- and three-wheelers is increasingly important in reducing oil use. Although these two- and three-wheelers represent the smallest share of oil consumption in the transport sector, the rapid electrification of this segment has reduced global oil demand in 2023 by a staggering 1 mb/d. If electric and hydrogen buses are added to this, the reduction exceeds 1.3 mb/d of oil reduction in 2023 or 2% of the oil consumed by the transport sector in 2022.

The market for electric motorbikes and electric buses should remain relevant to this oil displacement process in the near term. The market for electric two-wheelers is expected to grow by 8.7% by 2029 to reach a total market value of USD 218 billion, and the conversion to electric buses is gaining momentum in many countries. China is currently leading the electrification trend in many areas. However, India’s giant fleet of two-wheelers and buses looks set to be the next to electrify. In August 2023, India announced the allocation of USD 2.4 billion in subsidies to deploy 10,000 electric buses in 169 Indian cities. The government now plans to replace up to 800,000 diesel buses with electric buses, including 200,000 electric buses for state transport companies, 550,000 for private operators and 50,000 dedicated to school and employee transport, by 2030. With a total fleet of 2.3 million buses in India, the potential for oil displacement due to electrification is considerable.

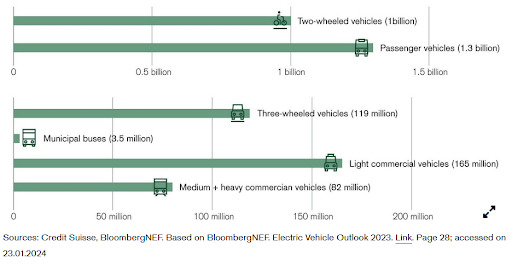

Figure 2: Road transport segment and overall fleet size

What percentage of global oil demand can electric vehicles eliminate?

Despite concerns about slowing demand for electric vehicles expressed by major automakers by the end of 2023, the structural argument in their favour remains intact. While reduced incentives for EVs in markets such as the US and Europe could weaken demand in the short term, sales are expected to reach a 20% market share of total new cars worldwide by 2024 as a result of new model launches and lower prices. As the electrification trend is expected to continue at least for the rest of this decade, the impact on reducing oil consumption is also likely to be more significant. According to the IEA’s latest projection, based on current market adoption trends, the replacement of oil by EVs could reach 5 mb/d by 2030. Beyond 2030, this trend should become more pronounced as EVs become a dominant part of the global fleet. By 2040, they could eliminate up to 20 million barrels per day, or around 20% of current oil demand, with far-reaching consequences for several sectors. With new developments in the field of synthetic fuels, biofuels and hydrogen for air and maritime transport and heavy-duty vehicles, this figure could be even higher.

Figure 3: Oil demand eliminated by EVs (barrels per day)

The impact of electric vehicles on oil demand is only just beginning to be realised

Electric vehicle adoption will reach 5% (share of new vehicle registrations) in more than 20 countries worldwide by 2023. While the transition to EVs is well underway in China and Western Europe, sales in countries such as India are just starting to take off. The availability of competitively priced EVs for around $10,000 caused sales to double in the nine months to September 2023. With lithium battery prices down 14% in 2023 versus 2022 – the biggest decline since 2018 – EVs are expected to become even more affordable.

Their impact on oil demand has only just begun. Motorbikes and electric scooters have a surprisingly large impact on the current displacement of oil consumption due to rapid electrification and the shorter lifespan of existing vehicles. As China’s oil demand growth is expected to slow in 2024 due to fading cumulative travel and consumption demand, the impact of electric vehicles on reducing oil consumption could be more pronounced.