How fintechs can succeed on campus and grow with Generation Z

Fintechs are learning that college campuses and the Generation Z students on them are valuable markets with unique ecosystems. The paths of two, Transact Campus and Frich, are models for companies seeking to entrench themselves in academia.

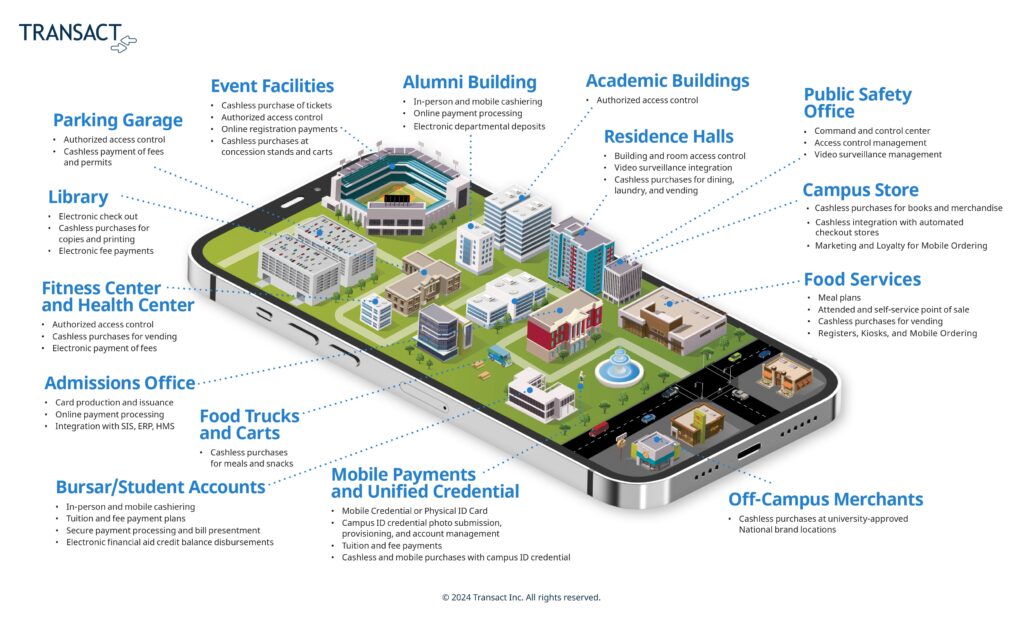

Unlike Frich, Transact Campus has been around for nearly 40 years. CEO Nancy Langer said Transact Campus has three lines, beginning with a payment platform that manages $53 billion annually in tuition and room and board payments. The second is identification software that organizes credentials for building access, meal management and other services. Transact Campus also operates a commerce system including mobile ordering, dining transactions and access for third-party brands. Roughly 1,500 of the company’s 2,000 are higher education institutions.

Leveraging campus-wide data to provide an optimal experience

Langer said Transact Campus’ value proposition is delivering an optimal student experience. That means mobile, real-time and text messages (no email) across most campus touchpoints.

“That’s the holy grail for our clients,” Langer said. “They want to, through a mobile experience delivered to students, provide everything they need, in a modern experience: efficient, real-time and convenient.”

Those many touchpoints generate 20 different data sources that Transact Campus uses to help institutions drive enrolment and retain students, a growing concern as population growth slows and registrations decline. It also shows what students want from their experience beyond post-graduate employment.

They want a connected experience, with easy communication in their preferred formats. They want to join groups. Payment options are an essential retention tool, with different plans available to help keep students in class.

Where it’s headed

Rapidly evolving technology means preferences change just as quickly. Whether they eat in the dining hall, students want mobile ordering. Transact Campus enhances the experience by integrating Amazon Walk Out.

“Where it’s moving is contactless,” Langer explained. “For the university, there’s less labor needed at the point of sale. It makes that a seamless experience for students who just order, pick up, and go. That goes to the efficiency (universities) need to drive their budgets as they continue to be cut or held firm.”

Financial institutions realize the treasure trove Transact Campus has on a key population segment on the verge of being an economic force. What are their payment preferences? Favorite activities? Langer’s marketing team helps fiservs reach Generation Z.

Marketing must be social yet personalized. Reach Generation Z with short videos that stick. Don’t inundate them with repeated pushes.

The economic benefits extend to the surrounding campus communities, which, in small towns, depend on students to survive. Transact Campus helps program partners market to those businesses so students can use stored value on their accounts to transact easily off campus.

Mobile credentials, proactively preventing dropouts – What’s next

Langer sees strong potential in mobile credentials, which are simpler to maintain than physical systems. The benefits extend to alumni, booster clubs and company-sponsored staff education plans.

“That’s historically been a very difficult process to manage, as it is not automated,” Langer explained. “We rolled out a platform for that and for the schools.

“Why that matters is driving higher enrolment, because many corporations and government entities get frustrated with that process. We also think that platform can be used for some private scholarships and things students use.”

The college experience is rapidly becoming a contactless and unattended one. Order your food on the way to the hall, grab it, and walk out. Transact Campus is integrating Amazon Walk Out and similar technologies. Langer says it’s the wave of the (near) future.

Beyond the payment convenience is the opportunity to learn what causes students to drop out and prevent it before it happens. Transact Campus works with institutions to interpret that data to reach students before they reach a crisis point. The system will be fully operational by the end of 2024. Dynamic menus where data is used to determine nutritional preferences are being studied.

Frich helps fiservs understand Generation Z

Katrin Kaurov got a crash course in personal financial management from a modelling career that saw her live and work in 20 countries between the ages of 14 and 22. She channelled that experience into Frich, a New York City-based fintech backed by Mastercard, Goodwater Capital, Financial Venture Studio and Antler.

Frich makes money a social topic. It allows Generation Z to anonymously compare themselves to their peers in all areas financial, helping them make quick decisions to improve their financial future. By assessing themselves against closely similar groups (Michigan State sophomores), Generation Z gets a clear picture of their financial health and takes steps to improve it. How much do they spend on social activities compared to their peers? Is their rent too high?

“There’s so little out there that understands how different Generation Z is from other generations,” Kaurov began.

They grew up through two financial crises and haven’t forgotten how banks pushed debt, even on campus. There’s no personalization – they’re simply commodities. Foreign-born Gen Z’ers, no matter their backgrounds, struggle even to get a credit card.

There’s a massive opportunity for credit unions and community banks. Kaurov said only 6% of Generation Z trusts traditional institutions. Her financial journey led her to credit unions and community banks, which she said are well-aligned to this emerging economic force.

“They’re vision- and mission-driven and personalized; they actually care about their members over profits,” Kaurov said. “Gen Z’ers don’t know anything about them, and the credit unions and community banks definitely don’t market to them.

“It’s for the benefit of the whole nation to make sure we’re supporting credit unions and community banks, and that’s the only way they can survive. Their average member age today is 54. They definitely must deal with this.

“We think of Frich as a bridge between Gen Z and those institutions.”

Frich does the legwork for credit unions and community banks by providing effective financial literacy and co-branded apps, giving them exclusive campus access through Frich.

How Generation Z is different

Generation Z is very social and compares themselves to their peers; money is behind every decision. Frich leverages that to deliver financial education.

“They’re very concerned if they’re better than others,” Kaurov said. “They’re worried if they’re behind their peers on campus, like ‘do other students have to have more savings than I do?’ ‘Is their credit score better?’ Leveraging what their peers are doing can be super helpful for banks to sign them up for products. Gen Z’ers want to be where their peers are, and that’s the most influential decision-making factor.”

Recruit Generation Z as customers by catching them at the right moment. If they’re comparing their finances to the average University of Michigan junior, that’s when you offer a savings account. Market it as a way to help them reach goals like a car or dream job.

“A lot of banks are missing out,” Kaurov said. “They’re so focused on showing what the product’s features are, trying to push the product at all costs, but they should be leading with the life goal, things that college students actually care about.”

Providing effective financial literacy

Financial literacy is a tough nut to crack for a generation with short attention spans. Kaurov said such education must be bite-sized and provide instant gratification.

“No one’s going to watch a module on financial literacy,” she said. “A student will never wake up on a Saturday morning and watch a video about building their credit. They’ll care about it when it matters to them, which is usually when they’re applying for a job. Then they’ll probably look for how to build their credit in five minutes.”

Money is stressful, so Frich eases Generation Z into it by beginning with simpler topics, stressing that personal finance is a tool to help them reach their dreams. Upon signing up, users enter their personal and basic financial information. They are regularly prompted to answer basic financial questions, with the payoff in showing them popular choices and how they compare to their peers.

Frich reaches critical mass by making a splash on every new campus. Crucial to that is its campus ambassador program, a staple also used by fintechs like Piere and Neu. Frich recruits popular leaders from campus groups, overachievers with busy social lives.

Kaurov has a plan to grow with Generation Z as they progress through life. One certainty she quickly learned is to get them before they graduate.

“We tried going after recent graduates too, but it’s much harder because all the banks are after them at that point, and people are no longer in communities,” she said. “It’s easiest to build loyalty while they’re still in college and becoming financially aware, to support them through that critical time and stay with them.”