How generative AI is used in underwriting

The role of the underwriter is changing. Challenges like shifting employer expectations and static underwriting operations in an industry facing rapid digital acceleration are adding pressure to underwriters across all insurance lines.

Forty-five percent of commercial and personal underwriters struggle to meet broker and customer expectations, according to CapGemini’s

Within the next decade, insurance will face a talent crisis that can only add to the mounding challenges underwriters face in their roles.

In Send’s webinar,

The panelists shared best practices for recruiting, training and retaining high quality underwriting talent: a diverse and inclusive workforce, improved employee benefits, innovative skill development offers and advanced technology like generative AI (gen AI) for improved productivity and process efficiency.

Caroline Bedford, chief executive at EDII (Educate, Develop, Innovate, Inspire) explained that the skills and competencies of underwriters are evolving in parallel with digital acceleration at a rapid pace.

“In our community, we know that the best underwriting talent wants to ensure that they’re joining a company that’s future-focused, using the latest technology, working with the best partners and is able to provide all the tools and techniques that they’re going to need,” said Bedford.

More CapGemini research from “

CapGemini data also shows that organizations that implemented automated and data-driven underwriting decision-making show significant gains in speed, reduced expenses and improved target achievement when compared to other insurers. These insurers also see improvement in fraud detection and managing loss costs.

“…to ensure that you can compete to attract that talent, you have to be able to demonstrate that not only are you as an organization prioritizing the right projects, partnerships and transformation, but you are also prioritizing the continued development of the underwriters that you want to bring on board so they can continue to stay at the top of their game,” Bedford stated.

Talent transition post-Covid presents a major challenge as many experienced underwriters work remotely, noted Georgi Munger, global head of MidCorp casualty and underwriting practices at Allianz. This creates a deep learning gap for new underwriters who need hands-on training and experience.

Munger explained, “About 70% of our underwriters are fully remote. Zero, however, of our associate grads are remote. The number of associate grads paired up with an experienced underwriter who actually comes to the same office is the challenge.”

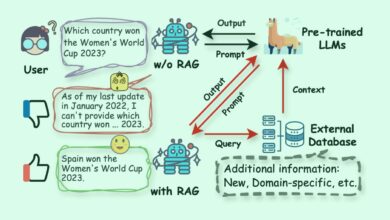

The Send webinar highlighted that tech like gen AI can not only streamline operational efficiency, but also empower the onboarding and training of new talent. AI-driven large language models can aid in managing policy information, data retrieval and underwriting rules for new hires, overall improving their data fluency and data literacy.

“One of the things that technology like artificial intelligence is doing is democratizing some of this knowledge. Clearly, human skills, emotional intelligence and face-to-face relationships are indispensable. Absolutely. But we now have really great language models that can be specific to your organization, that can share knowledge with graduates or with people who are building experience,” said Bedford.

AI models can also benefit more experienced underwriters: “Not only is artificial intelligence technology able to provide some of that knowledge as a basis for us, but also, the type of insurance models that we are providing our customers are evolving significantly,” Bedford explained. “Some of those more experienced underwriters may not even be familiar with parametric, embedded or usage-based [insurance]. We’ve got an opportunity now where we’re attracting that analytical talent, data natives, coming into the market to allow them to help us shape that from scratch.

“The insurance industry is not alone. There is a huge talent crisis across sectors today. From the offset, there is a lot we can share and learn from each other in handling the situation. We must look at this as an opportunity to involve seniors in our succession plans and streamline fresh talent to thrive in the next decade,” said Pat Caldwell, chief people officer at Send, during the webinar.