How Technology is Reshaping the Financial Services Landscape

Fintech has been driving change across financial services for well over a decade, attracting many billions of dollars’ worth of investment along the way. Recent quarters have seen a slowing in the rate of deals being done but fintech innovation remains a

very powerful economic driver across the global economy.

Finding the right focus

Source: Pulse of Fintech, Biannual analysis of global fintech funding by KPMG

Despite some easing of the pace at which fintech investments are being made, there remains no shortage of investor optimism in the space and every reason to expect that fintech will continue to help define how the wider financial services sector evolves

across the current decade and beyond.

Notably, there is now enormous interest in the potential integration of AI and particularly generative AI technologies into financial service offerings across the board. Meanwhile, the transition towards ‘open banking’ and data sharing in the interest of

drastically improving consumer experiences continues to underpin tech-based evolutions of payment systems, savings apps and alternative lending solutions.

Ongoing impacts

The pace and manner in which fintech solutions are being integrated into financial services differs between regions and regulatory environments, with consumer demands, security concerns and data protection considerations impacting how specific markets take

shape. But with fintech’s capacity to improve everything from payment processing speeds to fraud detection standards, and to cut costs while bolstering customer experiences, the scope for impactful innovation in the space remains as vast as ever.

Challenges to be overcome

While fintech innovators are generally all about finding ways to offer solutions to problems, the space as a whole has been hit with some unavoidable headwinds of late. Indeed, KPMG, in its

look at the fintech landscape heading into 2024, describes the industry as facing “a storm of global challenges”. Those issues have generally been caused by macroeconomic factors such as stubbornly high inflation rates, in many parts of the world, along

with unhelpful increases in borrowing costs.

All eyes on AI

Source: AI in Banking: AI Will Be An Incremental Game Changer by S&P Global

Looking ahead, as inflation generally continues to fall across 2024, the environment for investors is expected to improve, with AI-driven technology a clear bright stop on the landscape. In fact, AI looks very much set to be a huge contributor to

the next wave of fintech developments. Certainly from an investment perspective, the financial services sector is backing AI in a big way, with

Juniper Research predicting that generative AI investments among banks will be worth $85 billion globally by 2030, up from the $6 billion expected to be allocated to those areas in 2024.

For now, the focus of AI investments in financial services is often about delivering easy wins through efficiency gains but with the technology evolving so quickly, more impactful innovations and changes to entire business models are also very much in the

offing. As IDC’s group vice president of worldwide research Rick Villars explains: “In 2024, the shift to AI everywhere will enter a critical buildout phase as enterprises make major new

investments with the goal of drastically reducing the time and costs associated with customer and employee productivity use cases. From there, the focus will shift to investments that boost revenue and business outcomes.”

Empowering inclusion

More broadly, the emergence of fintech into the very heart of the global financial services landscape has been one of the more impactful economic, social and technological evolutions of recent decades. By now, solutions underpinned by fintech are taken for

granted and are integral to the ways in which a myriad of banking-related activities are undertaken daily across the globe.

Coupled with the onset of the Covid-19 pandemic and the dramatic uptick in mobile phone use globally over the past decade, fintech innovation is empowering financial inclusion worldwide, particularly in developing countries where many millions of people

remain unbanked. According to the World Bank, those same forces and tech advancements have been helping to open up access to banking services across demographics in societies around the globe.

Emphasis on value creation

The explosion of fintech startups in the early phases of the industry’s evolution helped transform the financial service sector landscape and gave rise to what experts at McKinsey & Company describe as

“hypergrowth”. More recently, the industry has reportedly seen the collective market capitalisation value of publicly traded fintech firms double to $550 billion between 2019 and July 2023, according to the F-Prime fintech index. Within that same period,

the number of fintech unicorns worth over $1 billion exploded from 39 to 272, McKinsey analysis suggests.

Throwing forward, market expectations are that the focus for innovation among fintech firms will turn more towards sustainable value creation rather than experimentation or risk-taking. However, there is little doubt among analysts that fintech companies

and investors will continue to play a major role in shaping the financial services landscape, with digital banking adoption expected to continue growing rapidly, ecommerce services expanding and AI instigating all manner of advancements.

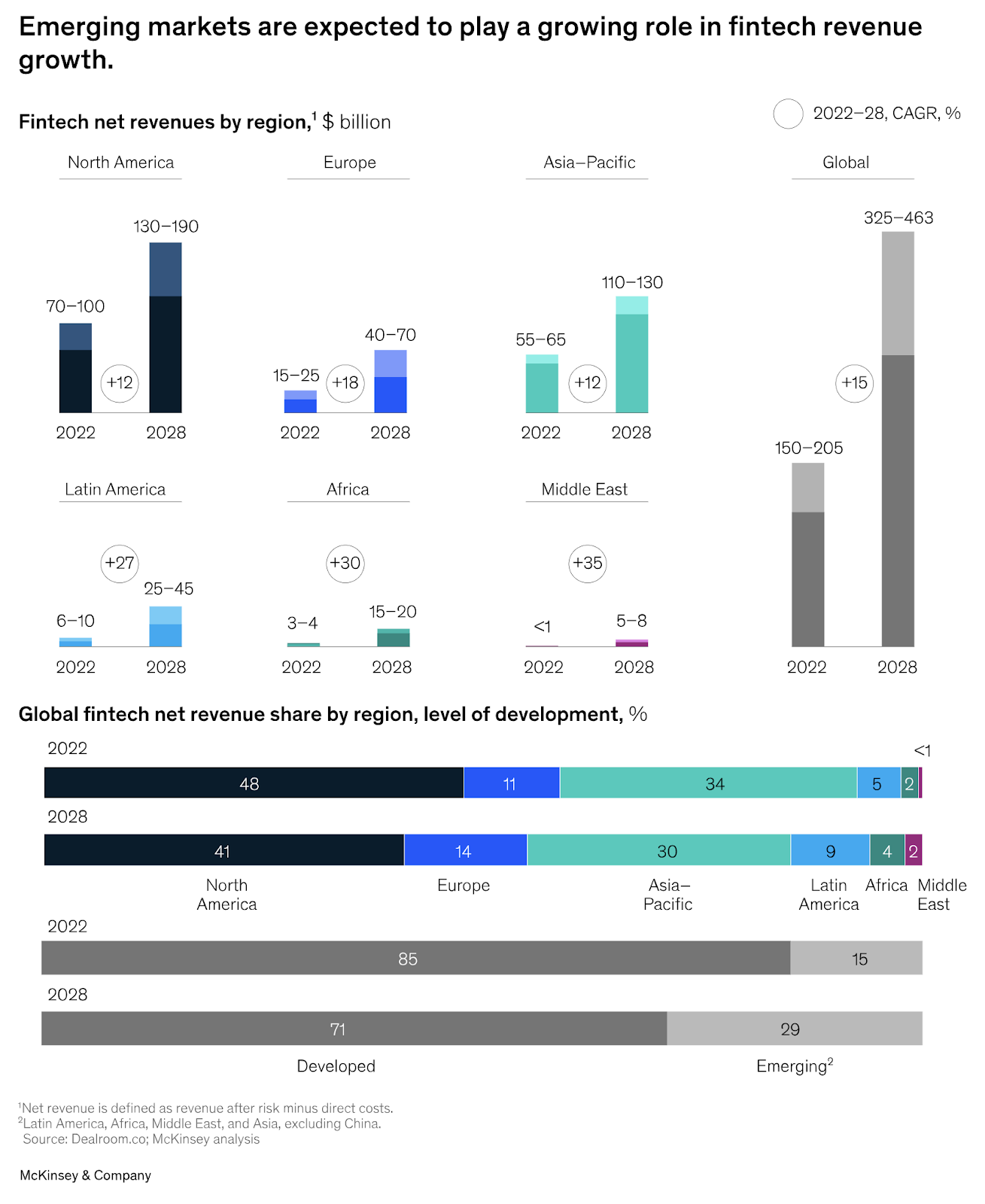

Notably, even while tech-led businesses focus more on sustainable value creation over instant-impact innovation, McKinsey experts estimate that revenues within the fintech industry will grow at almost three times the rate of those within the traditional

banking sector between 2023 and 2028.

Source: Fintechs: A new paradigm of growth by McKinsey & Company

Competition vs collaboration

The story of fintech has often been one of startups addressing consumer demands that more traditional banks have been unable to meet themselves. That dynamic has fed cycles of innovation and led to dramatic shifts across the financial services landscape,

with traditional banks eventually obliged to respond to protect their market share and keep their customers happy where they can.

By 2024, fintech firms are a fundamental part of the competitive parameters that all financial service activity happens within, with big banks often working alongside startups to upgrade their offerings, particularly with regard to

payment processing, and other times competing against them and seeking to maximise their own advantages.

But whether their efforts are geared towards working with established banking sector players or against them, there remains massive scope and potential for fintech companies to continue making waves across the wider industry and influencing fundamentally

the ways in which people bank across the world.