HP Inc.: Here Comes The Generative AI Supercycle (NYSE:HPQ)

manaemedia

HP Inc. (NYSE:HPQ) reported earnings on Wednesday after the close. I was disappointed to see another quarter of just modest PC revenue growth, coupled with continued pressures in the printing business. The company continues to be a cash cow and leverage is modest. The stock is not terribly expensive at 10x earnings, but clearly investor enthusiasm centers around the potential growth from generative AI computers. I expect the upcoming quarters to reflect vastly different financial results than the start of this fiscal year, as generative AI computer products appear set to be shipped as early as next month. I reiterate my buy rating for the stock, as consensus estimates do not appear to be factoring in this potential supercycle.

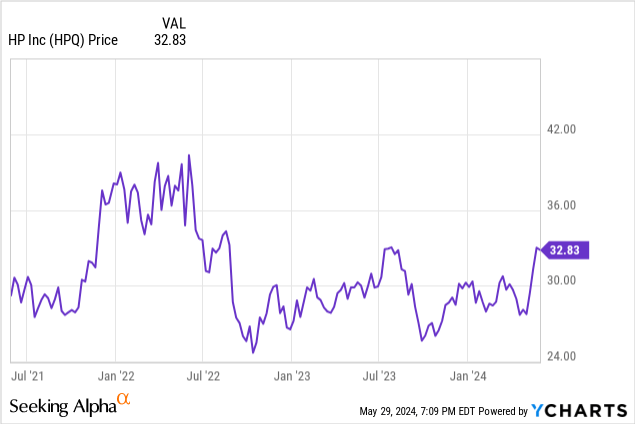

HP Inc. Stock Price

I last covered HPQ in February, where I rated the stock a buy on account of the low valuation and potential for a generative AI supercycle in the personal computers market. The stock has performed well since then, but has underperformed the broader market since my initial bullish call.

The anticipated supercycle might begin quite soon once the company begins shipments of its generative AI products.

HPQ Stock Key Metrics

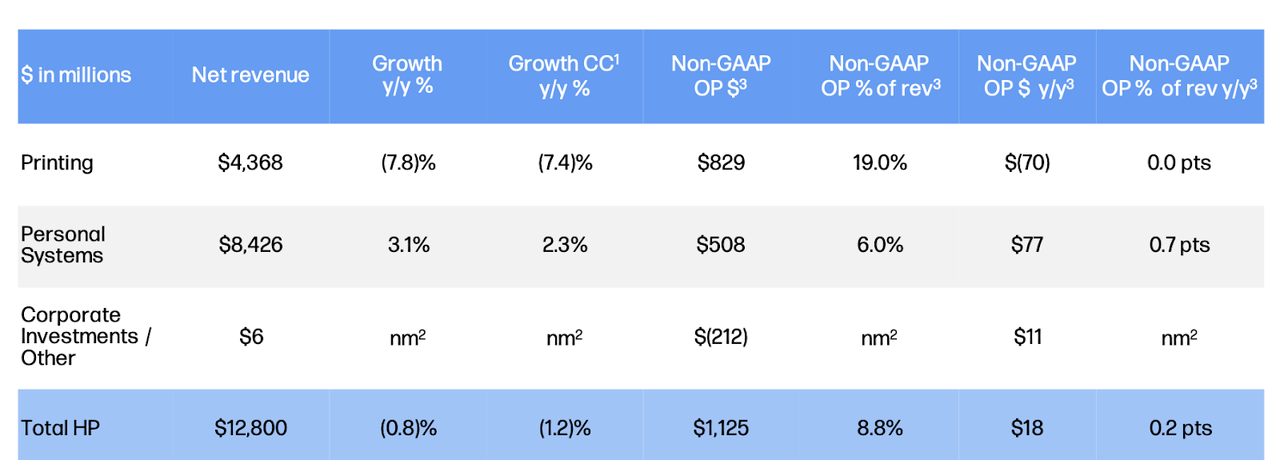

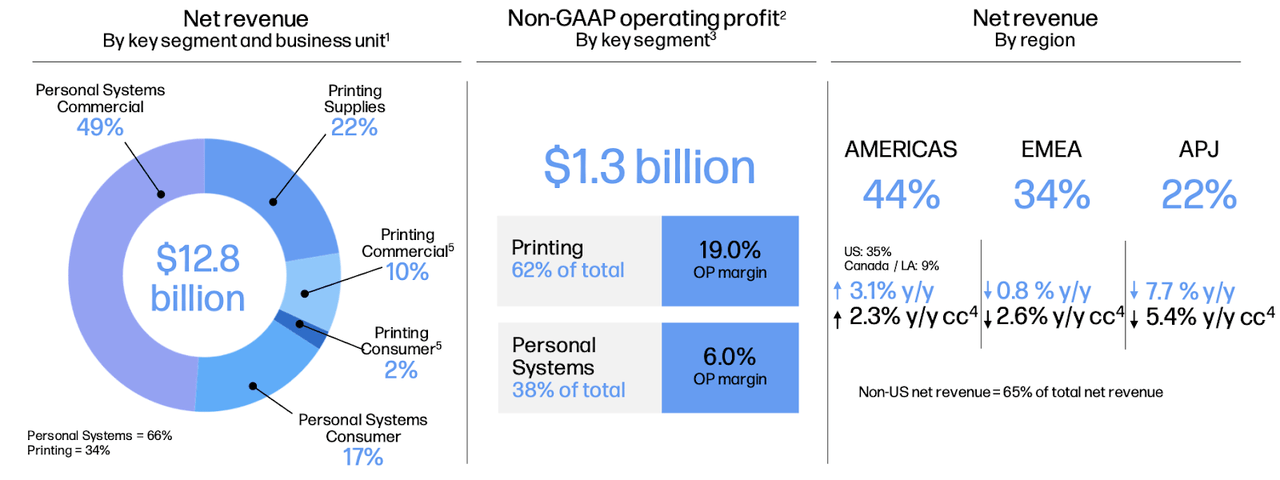

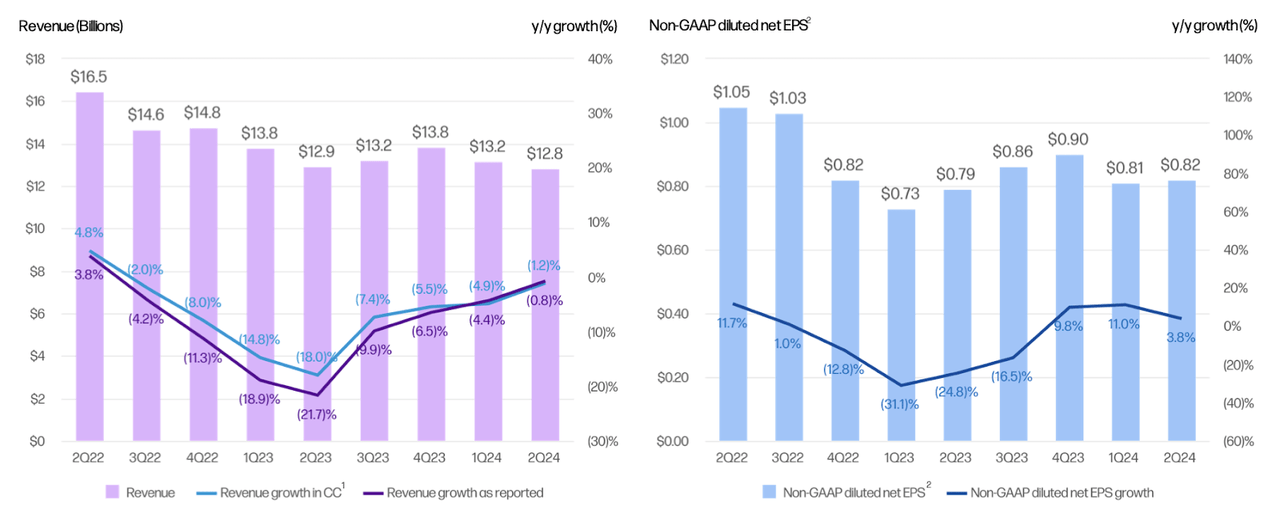

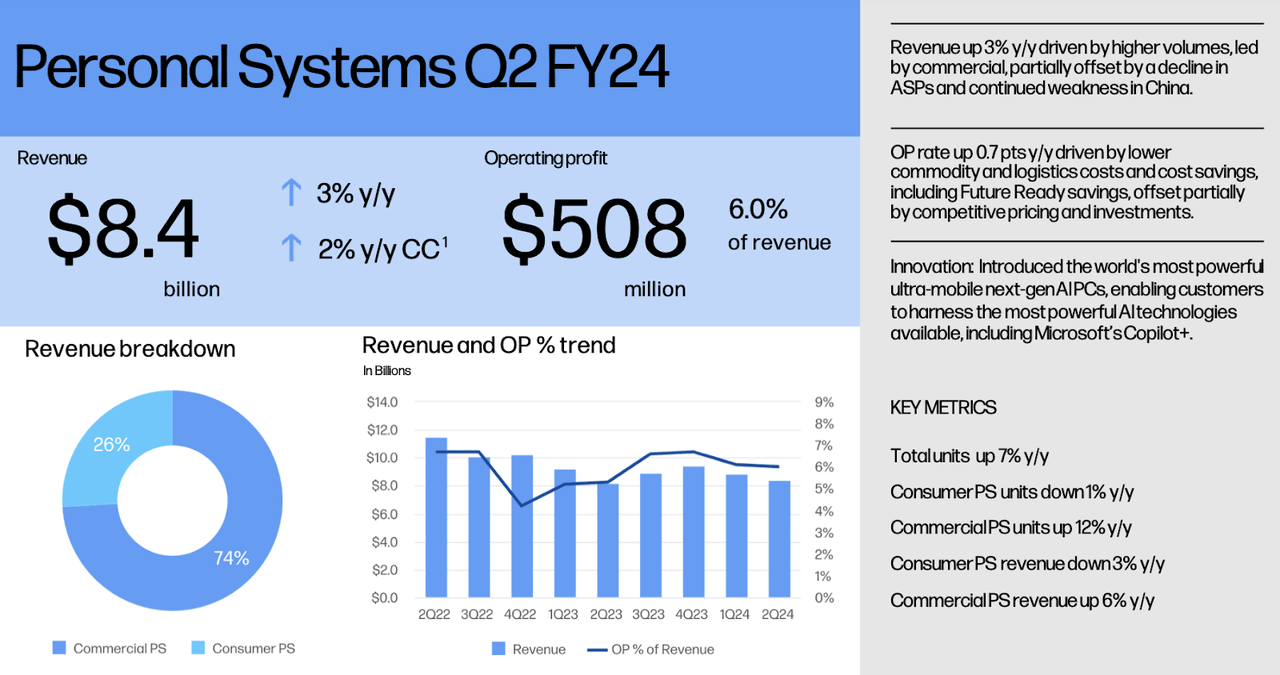

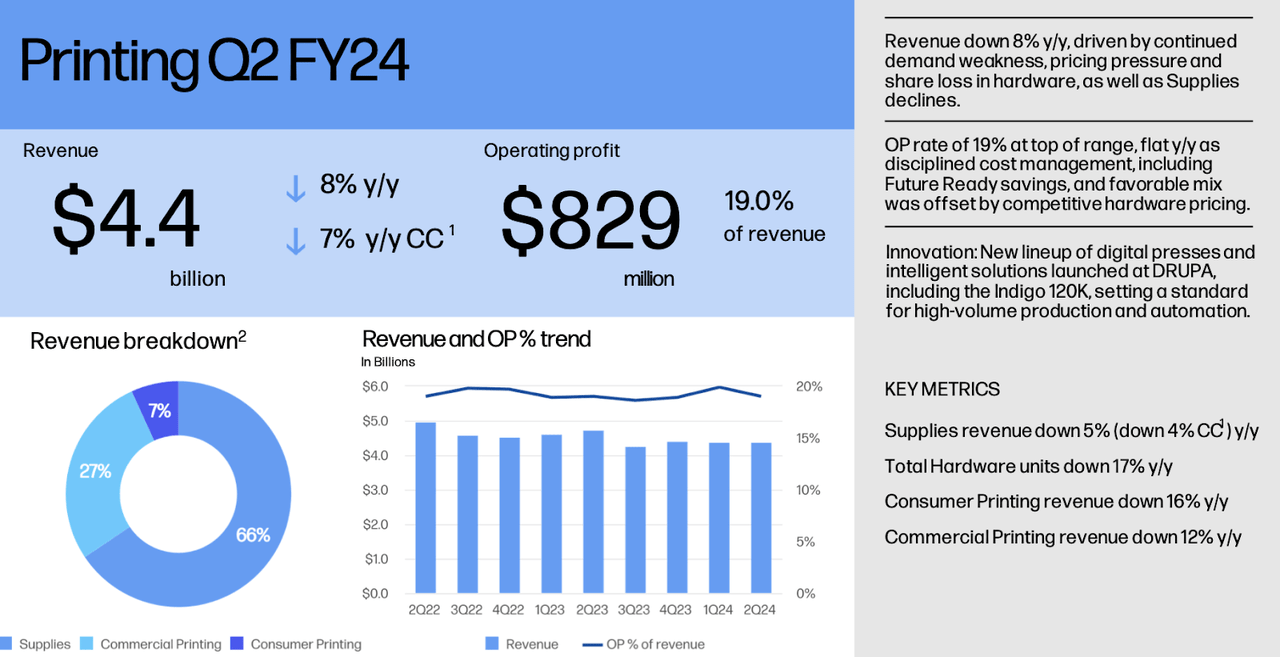

In its most recent quarter, HPQ saw revenues decline 0.8% YoY on a consolidated basis, highlighted by 3.1% YoY growth in personal systems and 7.8% YoY declines in printing.

While personal systems revenues make up 66% of overall sales, printing makes up 62% of total operating profits due to having higher margins.

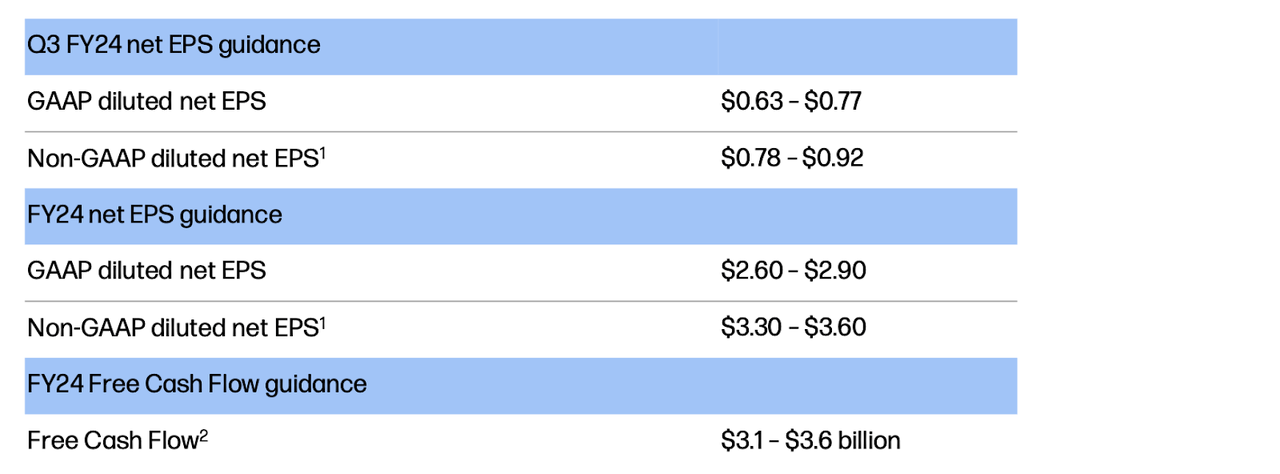

The company ended up delivering 3.8% YoY non-GAAP EPS growth to $0.82, coming faster than revenue growth due to share repurchases. That was squarely within management guidance of between $0.76 and $0.86.

HPQ saw a slight uptick in personal systems volumes, but the margin gains were mainly driven by operational efficiencies as these were offset by a competitive pricing environment. It is possible that many consumers may be waiting to purchase new computer equipment only after the release of generative AI models.

Meanwhile, HPQ saw printing revenues plummet 8% YoY due to both pricing pressures as well as market share loss.

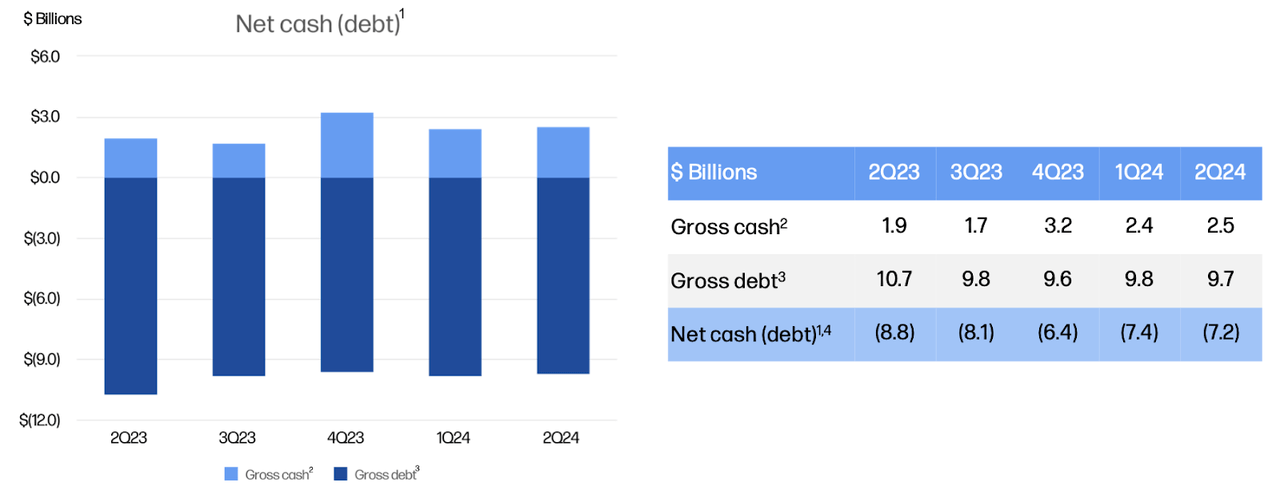

The company ended the quarter with $7.2 billion in net debt, a slight reduction from the first quarter. I consider the roughly 1.2x debt to EBITDA ratio to be appropriate for this kind of business.

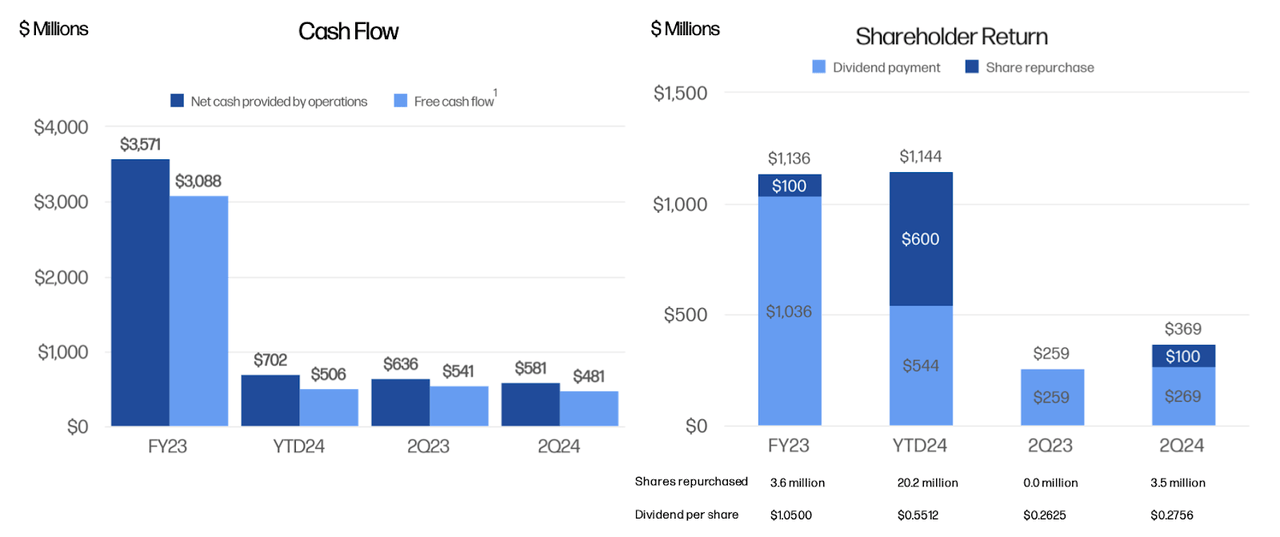

That improvement in net debt can be directly tied to the fact that the company returned only $369 million to shareholders through share repurchases and dividends, despite generating $481 million in free cash flow.

Looking ahead, management has guided for the third quarter to see around $0.85 in non-GAAP EPS at the midpoint, which would represent a very slight decline YoY. Management also tightened its earnings guidance range for the full-year.

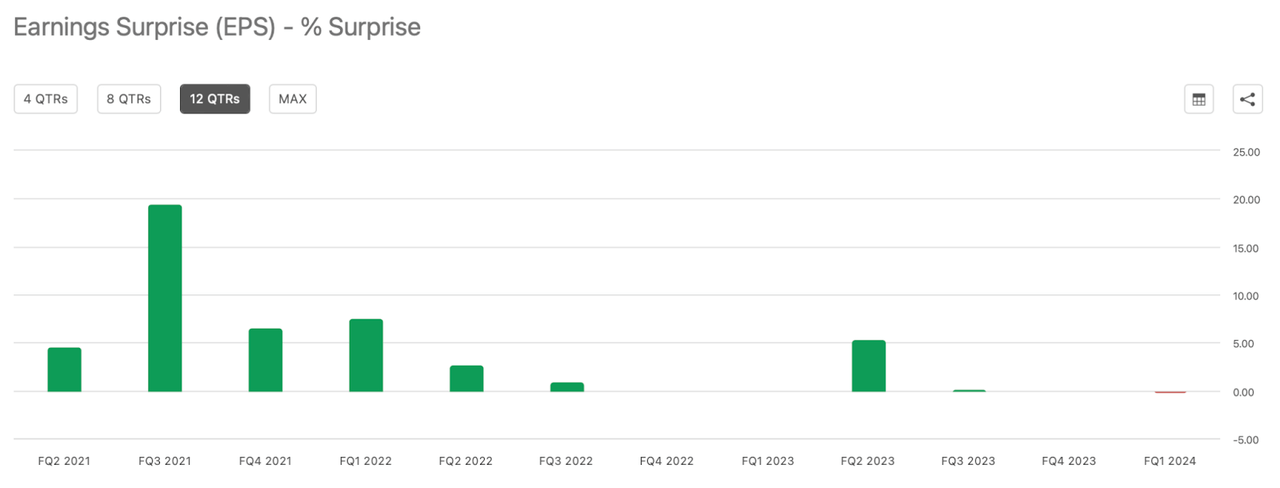

This is a company which has seen results come in right around expectations over the past many quarters.

Is HPQ Stock A Buy, Sell, or Hold?

My last several quarters of owning HPQ stock have centered around the potential for it to benefit from a generative AI-induced upgrade cycle for PCs. HPQ, along with competitors, is set to begin selling generative AI PCs on June 18th. This is notable given that management has issued guidance while having only seen pre-order data for these products.

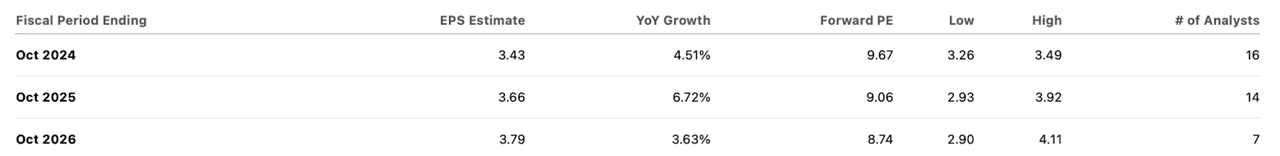

I find it curious that the stock still trades at under 10x earnings, despite these generative AI products likely carrying a higher average selling price than prior models (I made that assessment based on cursory analysis of the company’s currently offered products).

Between the likelihood of solid growth in units sold as well as a rise in average selling prices, I find it likely for revenues to surpass consensus estimates for 0.28% YoY growth.

It is difficult to estimate exactly what kind of numbers HPQ will present, but with the stock trading at 10x earnings and management returning cash to shareholders through dividends and share repurchases, one could argue that this supercycle optionality is coming at the right price. I am targeting 25% to 50% potential upside, representing around 12x to 15x normalized earnings or a stock price of $40 to $48 per share.

HPQ Stock Risks

It is possible that my expected supercycle never takes place. Perhaps the presence of competition crashes the party. It is also possible that the stock has already priced in a supercycle, and the stock re-rates downwards to its 8.5x 5-year historical P/E multiple. The problem here is that longer term, HPQ appears to be facing great competitive risks that may manifest in pricing pressures in both its printing and personal systems businesses. That outlook lends itself to lower long-term valuation multiples, though the company’s conservative balance sheet and committed shareholder capital return program help to somewhat offset such headwinds.

HPQ Stock Conclusion

I can understand if investors are getting impatient waiting for a generative AI payoff, but with June 18th coming up soon, HPQ investors may finally see the fruits of their patience. I continue to find the 10x earnings multiple to be worth the price of betting on a generative AI upgrade supercycle, and the next two quarters should indicate the validity of my beliefs. I reiterate my buy rating for the stock, but of course note the importance of the upcoming quarters.