If the EV Market Has Slowed, Nobody Bothered to Tell Ford

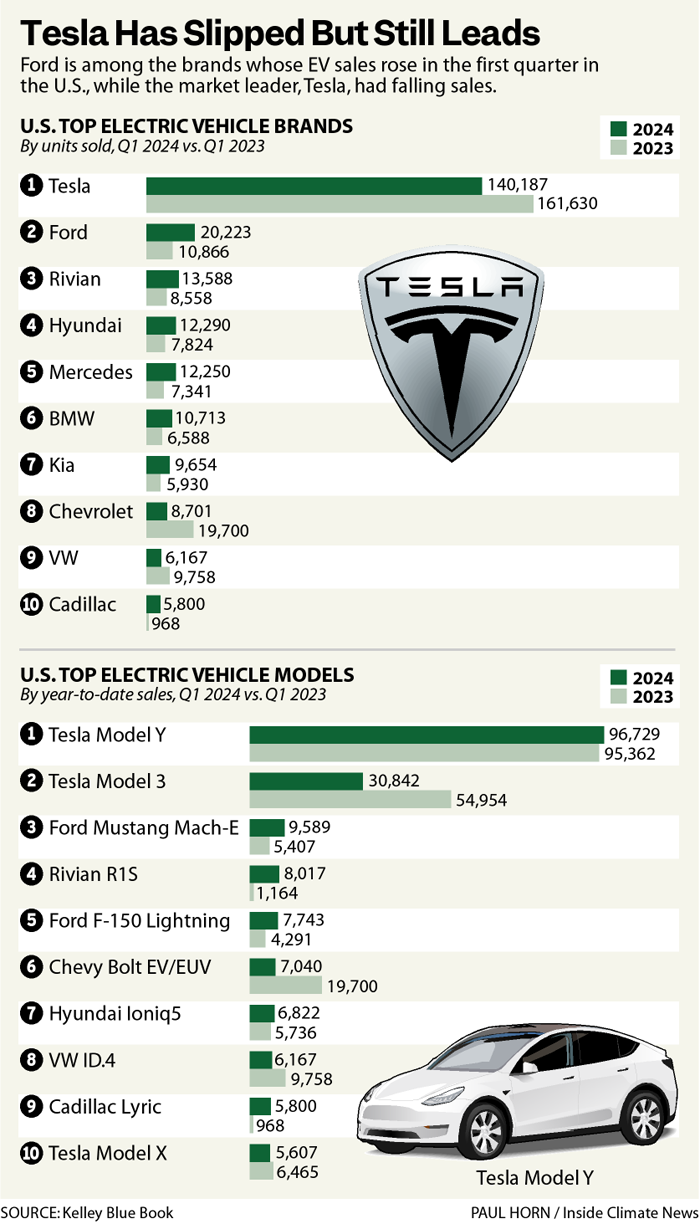

Tesla, you may have heard, is going through a rough patch, and the company represents a large enough share of U.S. electric vehicle sales that its problems could lead to a down year for the entire market.

But that hasn’t happened—at least not yet—partly because several other brands’ EV sales have risen to take the sting out of Tesla’s decline.

Ford is looking especially good, with year-to-date sales through April of 28,252 EVs, an increase of 97 percent from the same period last year. That makes Ford the country’s second-leading EV brand, although Tesla still outsells Ford’s EVs at a rate of about seven to one.

Ford’s shift to an electric future is far from a smooth ride. The company’s EV division posted a $1.3 billion loss in the first quarter, and has a long way to go before this part of the business is profitable. It’s a familiar situation for legacy automakers who must invest billions of dollars for research and development and to retool factories and sometimes need years to see an adequate return on those investments.

Ford’s EV sales surge is being led by the Mustang Mach-E, a crossover SUV, of which 14,482 were sold, an increase of 107 percent, as of April, compared to the prior-year period. The F-150 Lightning pickup also gained momentum with sales of 9,833, an increase of 75 percent. Ford’s other EV, the E-Transit van, had sales of 3,927, an increase of 128 percent.

A lot of the company’s sales gains can be attributed to a price cut for the Mach-E that Ford announced in February. After cuts of $3,100 to $8,100, the model’s prices range from $39,895 to $57,395. (The Mach-E is not eligible for the federal tax credit of up to $7,500 because the model is assembled at a plant in Mexico.)

“The bottom line is that we’re more competitive and doing well in the marketplace,” said John Lawler, Ford’s chief financial officer, speaking about EV sales in an April 24 conference call with analysts.

Ford also is emphasizing gas-electric hybrids as an option for customers. The company sold 56,418 hybrid vehicles as of April, an increase of 47 percent.

Still, Ford has pushed back some timetables related to EV rollouts and production. For example, Ford said last month that it is delaying the market launch of a planned three-row electric SUV from 2025 to 2027. The model is set to be assembled at a plant in Oakville, Ontario.

To get a better sense of what’s happening with Ford’s EV sales, I spoke with Camron Savarani, general manager of Walnut Creek Ford in the East Bay area of greater San Francisco. His store is one of Ford’s best in the country for EVs, with electric models making up about half of sales.

He has observed the way EV sales gain a self-perpetuating momentum.

“It’s really just a factor of time as more people decide that they’re ready” to buy an EV, he said. “There continues to be more charging infrastructure; more people have friends and family members driving them; and that just continues to increase the growth rate.”

California has the highest EV market share in the country due to consumer preferences and a history of state laws that support EVs. His store’s experience may give a sense of what it will be like when other regions reach a similar level.

“It becomes less novel and less complicated or scary,” he said.

The Mach-E is his top model, and the price cut helped to boost sales, he said.

EV prices have fallen across brands, with an average transaction price of $54,021 in March, down about 10 percent from a year ago, according to Kelley Blue Book, a website for auto buyers. But even with the decrease, EV are more expensive than the average for all light vehicles, which was $47,218 in March, down 1 percent from a year ago.

Savarani views the prices of EVs as one of the main factors that hinder the growth of sales. This underscores why the Mach-E price cut was so important.

“As we continue to have EVs that are more and more affordable, that’s a huge step in the right direction,” he said.

EV sales in the United States rose 2.6 percent in the first quarter of this year compared to the first quarter of the prior year, but they were down 15.2 percent compared to the fourth quarter of the prior year, according to Kelley Blue Book. (Above, I cited year-to-date sales through April for Ford, which includes one more month than the Kelley Blue Book report on the first quarter, which is the basis for this chart.)

For the overall vehicle market, it’s normal for first quarter sales to be the lowest of the year and fall behind fourth quarter sales. But this hasn’t been the case for EVs, sales of which have grown every quarter since mid-2020.

The main reason for the sluggish 2024 growth was that Tesla, the market leader for EVs, posted a 13 percent decrease in sales for the quarter.

Since Tesla sells about half of the EVs in the country, its struggles reverberate across the market. Tesla has faced an array of challenges, including a lackluster rollout for the Cybertruck and few substantial updates for its top-sellers, the Model Y and Model 3.

On Wednesday, Reuters reported that federal prosecutors are looking at whether Tesla committed fraud by misleading investors and consumers about the effectiveness of its vehicles’ self-driving systems. This would be one more in a bunch of legal and regulatory challenges for the company.

Sean Tucker, a senior editor at Kelley Blue Book, said EV sales remain strong despite challenges like those being experienced by Tesla. His company continues to project that EV sales will grow this year to reach 10 percent of overall new car sales, which would be up from 7.6 percent in 2023.

“Slow growth is still growth,” he said. “We saw exponential growth for a couple of years in the EV market and everybody got very used to that, and now we saw one quarter of relatively slow growth, and we’re getting all of these panic stories: ‘Oh, my god, the rush is over.’”

He is referring to some of the media coverage of EV sales, which sometimes highlight any signs that the shift to clean transportation is sputtering.

This story is funded by readers like you.

Our nonprofit newsroom provides award-winning climate coverage free of charge and advertising. We rely on donations from readers like you to keep going. Please donate now to support our work.

But the reality is that sales continue to rise at the same time that some automakers struggle to make a profit on EVs.

While I’ve focused on Ford, it’s far from alone among brands that have a combination of at least 5,000 EVs sold and substantial percentage increases in sales. The others include BMW, Cadillac, Hyundai, Kia, Mercedes-Benz and Rivian.

Looking at the numbers, I don’t see an EV market that is collapsing.

Other stories about the energy transition to take note of this week:

Spending on Biden’s Big Climate and Infrastructure Laws Has Been Slow to Ramp Up: Programs funded by the Inflation Reduction Act and the Bipartisan Infrastructure Law have spent only $125 billion of the $1.1 trillion available,as Jessie Blaeser, Benjamin Storrow, Kelsey Tamborrino, Zack Colman and David Ferris report for Politico. The slow start to spending on parts of the two laws means that the administration is less able to show results for its main accomplishments, at the same time that political opponents attack the spending.

Interior Department Proposes First Gulf of Maine and Oregon Offshore Wind Auctions: The U.S. Department of the Interior said it will hold auctions in which companies can bid for the right to develop offshore wind in the Gulf of Maine and off of Oregon, the first such auctions in those two places, as Diana DiGangi reports for Utility Dive. If developed, the two areas have the potential for up to 18 gigawatts of generating capacity, the agency said. The agency is now seeking feedback on the proposals before moving on to the next step of scheduling auctions.

Why Is Oil Demand Still Climbing, Even as EV Sales Are Taking Off? This year will likely bring two seemingly incongruous milestones as global sales of electric vehicles will hit an all-time high at the same time that global oil consumption also will hit an all-time high. My colleague Nicholas Kusnetz reports on the factors driving oil demand and some of the challenges in figuring out how much the rise of EVs will cut into that demand. The story is part of the Politically Charged series that looks at how political polarization threatens the shifts to cleaner transportation.

Giant Batteries Are Transforming the Way the U.S. Uses Electricity: Power companies are increasingly using giant batteries to provide electricity at times when wind and solar power are not available. The results are becoming clear in states with the most batteries, such as California, as Brad Plumer and Nadja Popovich report for The New York Times. California has used its batteries to handle the period in the early evenings when demand is high but solar power production has fallen. The state also expects the batteries to be a major asset for dealing with the strains that heat waves and wildfires place on the electricity grid.

Climate Change to Drive Value of Rooftop Solar: University of Michigan researchers are projecting that the value of rooftop solar will increase because of climate change, as Patrick Jowett reports for PV Magazine. The recently published paper says the value of rooftop solar will rise by 5 percent to 15 percent by mid-century. This is because climate change will lead to an increase in solar radiation, which will boost electricity production of solar panels, and climate change also will lead to an increase in temperatures, which will lead to higher utility bills and greater savings for consumers who can offset their bills by using solar.

Inside Clean Energy is ICN’s weekly bulletin of news and analysis about the energy transition. Send news tips and questions to [email protected].