IHAK: Buy The Dip In Cybersecurity Stocks, But Risk Management Urged (NYSEARCA:IHAK)

Maskot

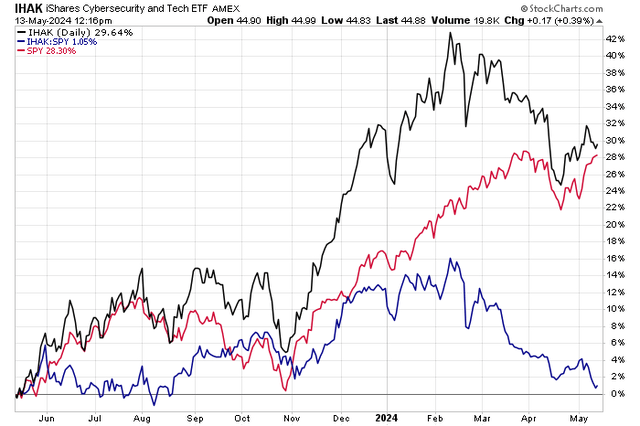

Cybersecurity stocks have lost some of their luster this year. It was a hot space for much of 2023, particularly during the final 10 weeks of the year, when shares of companies such as CrowdStrike (CRWD) lifted off. While tech attacks have been intermittent over the last several months, the cybersecurity theme has taken a breather at the very least. Given the pullback, I think there is an opportunity today.

I reiterate a buy rating on the iShares Cybersecurity and Tech ETF (NYSEARCA:IHAK). I was bullish on the space in Q3 2022, and while a churn in the fund’s price ensued through early 2023, IHAK was a great spot to be overweight through its run-up to the February 2024 all-time high.

Cybersecurity Equities Stumble, About Flat vs SPX YoY

StockCharts.com

According to the issuer, IHAK seeks to track the investment results of an index composed of developed and emerging market companies involved in cybersecurity and technology, including cybersecurity hardware, software, products, and services. It offers investors exposure to companies at the forefront of cybersecurity innovation both at home and abroad, primarily in the Information Technology sector.

IHAK is a relatively small-sized ETF with just $801 million in assets under management as of May 10, 2024. The fund has lost its luster in terms of share-price momentum, now a weaker C+ rating compared to an A+ ETF Grade by Seeking Alpha just three months ago. IHAK sports a moderate 0.47% annual expense ratio, and the trailing 12-month dividend yield is very low at just 0.13%.

It’s also a risky portfolio given the historical standard deviation and somewhat concentrated allocation. Still, liquidity is decent, a B rating, given average daily volume of just under 100,000 shares, but a lofty median 30-day bid/ask spread of seven basis points is a concern. So, using limit orders is encouraged.

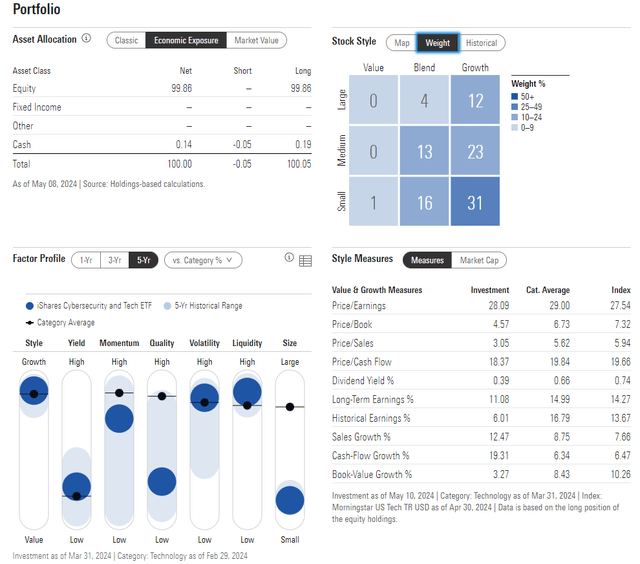

The 3-star, Gold-rated ETF by Morningstar features some diversification across the style box, but a significant bent to the small-cap growth size and style is partly what makes this fund more for aggressive investors. Just 16% of IHAK is considered large cap, while a scant 1% is in the value style. And while the price-to-earnings ratio is above 28, investors capture high long-term earnings growth near 11%.

IHAK: Portfolio & Factor Profiles

Morningstar

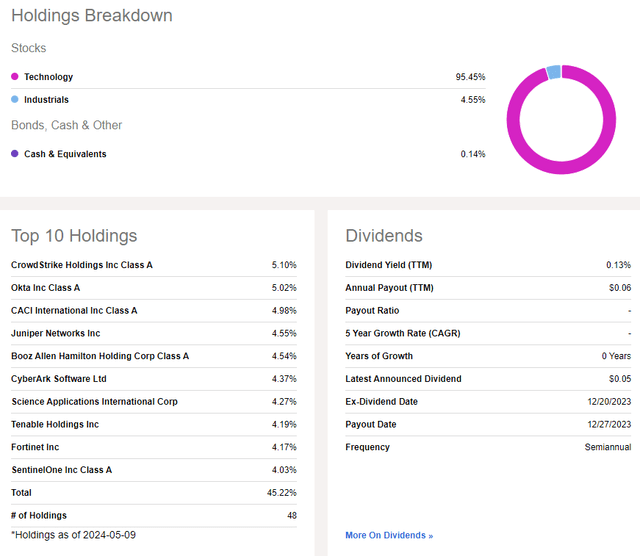

As the ETF’s name suggests, IHAK is primarily a tech fund. Just 5% of the portfolio is invested in the Industrials sector, and there is no access to any other market sectors. What’s more, there is concentrated risk considering that the top 10 holdings comprise nearly half of the ETF.

IHAK: Holdings & Dividend Information

Seeking Alpha

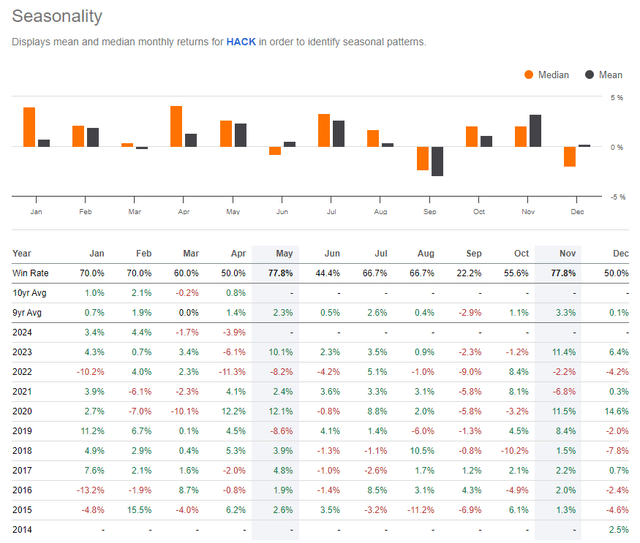

Seasonally, we are in a rather bullish time of year for the cybersecurity space. I took a look at the longer-lived Amplify Cybersecurity ETF (HACK) to get a gauge on seasonal tendencies. May and July are some of the best months of the year in history going back to 2015, though June has featured more lackluster returns.

Cybersecurity Stocks: Bullish May and July Trends, Weaker June

Seeking Alpha

The Technical Take

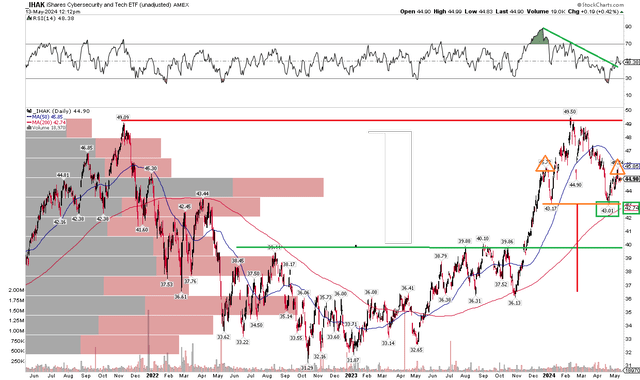

After a material pullback, IHAK held support at the rising 200-day moving average just a few weeks ago. Notice in the chart below that shares tested the all-time high, and actually briefly climbed above the $49.09 late 2022 peak, before retreating by more than 10% to a low near $43 in April. What I like about the technicals today is that the RSI momentum oscillator has broken the downtrend off the high hit way back in December, well before price rose to near $50 (that was a bearish divergence, by the way). It’s though that momentum often leads price, so I would not be surprised to see IHAK rally through its falling short-term 50-day moving average.

The $43 low from earlier in the quarter was also a successful test of the nadir from early in 2024. Of course, the setup also has the hallmarks of a bearish head and shoulders topping pattern. If the share price falls under $43, then a downside measure move price objective to about $36 would be in play. That is a key feature to monitor in the weeks and months ahead.

Overall, the technicals are a mixed bag, but given the retreat, I think now is a fine time to be long the ETF.

IHAK: $49 Resistance, Key Support at $43, RSI Breakout

StockCharts.com

The Bottom Line

I reiterate a buy rating on IHAK. The cybersecurity fund is off its highs, and while there is EPS growth in the industry, the chart does bear watching.